USD/TRY offered, approaches the 200-day SMA near 7.85

- USD/TRY extends the leg lower to the vicinity of 7.85.

- The CBRT left the One-Week Repo Rate unchanged at 17.00%.

- The CBRT highlights the strong course of the economic activity.

The Turkish lira keeps the firm note unchanged for yet another session and drags USD/TRY to new lows in the proximity of the 7.85 area on Thursday.

USD/TRY weaker post-CBRT

USD/TRY sheds ground for the third consecutive session so far on Thursday on the back of the renewed selling bias in the greenback and broad-based fresh inflows into the EM FX.

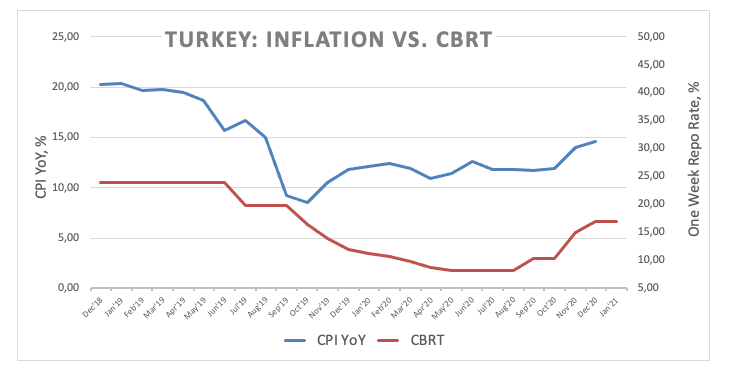

Also supporting the lira, the Turkish central bank (CBRT) left the One-Week Repo Rate unchanged at 17.00% at its meeting on Thursday, matching the generalized consensus.

The central bank noted the solid pace of the economic recovery in the country, although still remains concerned over the high inflation and inflation expectations. Furthermore, the CBRT pledged to keep the tight monetary policy stance in order to achieve price, macroeconomic and financial stability.

Earlier in the session, Turkey’s Consumer Confidence improved to 83.3 for the month of January.

USD/TRY key levels

At the moment the pair is losing 0.35% at 7.3786 and a drop below 7.3485 (200-day SMA) would expose 7.2391 (2021 low Jan.7) and then 7.2019 (low Aug.21). On the flip side, the next resistance emerges at 7.5415 (2021 high Jan.18) followed by 7.6884 (55-day SMA) and finally 8.0250 (monthly high Dec.11).

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.