- USD/TRY moves lower to the 5.78 level on Wednesday.

- The Turkish central bank (CBRT) left rates on hold today.

- Attention remains on potential US sanctions over S-400.

The Turkish Lira is now picking up pace and drags USD/TRY to fresh daily lows in the 5.7800 region.

USD/TRY lower on steady CBRT

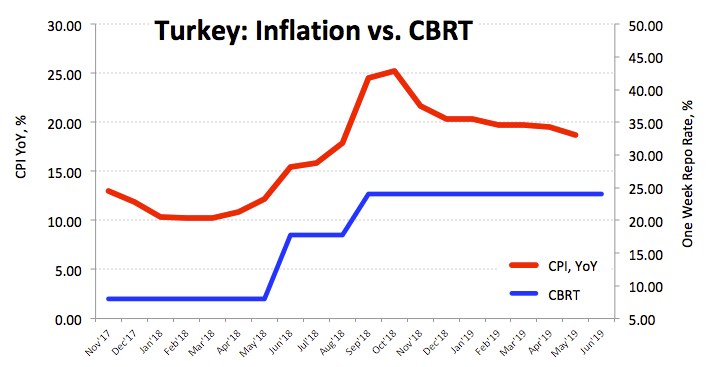

TRY gained extra steam and forced spot to visit lower levels after the Turkish central bank (CBRT) left the One-Week Repo Rate unchanged at 24.0% at today’s meeting, matching the broad sentiment.

From the statement, the CBRT sees the economy running at a slow pace amidst tight monetary conditions, while the current account balance should keep improving. Regarding inflation, the central bank considers appropriate the current tight conditions in order to support disinflation.

On the not-so-bright side, US sanctions over the purchase of the Russian S-400 defence system looms larger, as well as the likeliness of further pressure on the Lira.

What to look for around TRY

The Turkish Lira is attempting a sideline theme so far this week, regaining ground lost after testing weekly lows above 5.84 vs. the buck. As usual, trade effervescence should remain as key driver in the EM FX space, while frictions between the AKP and its main opposition party in the run up to the municipal elections in Istanbul are also emerging as another source for Lira volatility. Further out, potential US-Turkey effervescence and its negative impact on TRY remains well in place involving the Russian S-400 missile system and US F-35 jets. Additionally, the independence and credibility of the CBRT should remain under the microscope against the omnipresent conflict between the government and the bank’s authorities.

USD/TRY key levels

At the moment the pair is losing 0.04% at 5.7964 and a breach of 5.6560 (low Jun.5) would open the door to 5.6306 (200-day SMA) and then 5.5743 (61.8% Fibo retracement of the 2019 rally). On the flip side, the next up barrier emerges at 5.8687 (55-day SMA) followed by 5.9308 (21-day SMA) and finally 6.1516 (high May 23).

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD alternates gains with losses near 1.0720 post-US PCE

The bullish tone in the Greenback motivates EUR/USD to maintain its daily range in the low 1.070s in the wake of firmer-than-estimated US inflation data measured by the PCE.

GBP/USD clings to gains just above 1.2500 on US PCE

GBP/USD keeps its uptrend unchanged and navigates the area beyond 1.2500 the figure amidst slight gains in the US Dollar following the release of US inflation tracked by the PCE.

Gold keeps its daily gains near $2,350 following US inflation

Gold prices maintain their constructive bias around $2,350 after US inflation data gauged by the PCE surpassed consensus in March and US yields trade with slight losses following recent peaks.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.