USD/TRY climbs to 5-week highs above 8.6000

- USD/TRY extends the upside and breaks above 8.6000.

- Turkey’s End of Year CPI Forecast came in at 16.74%.

- The lira losses further ground ahead of the CBRT event.

The Turkish lira depreciates further and pushes USD/TRY to new 5-week highs past the 8.6000 yardstick on Friday.

USD/TRY targets YTD highs around 8.8000

TRY rapidly losses ground and motivates USD/TRY to advance for the second session in a row and break above the consolidative theme that prevailed earlier in the week. The pair’s upside gathered extra pace after spot surpassed the 55- and 100-day SMAs around 8.5000.

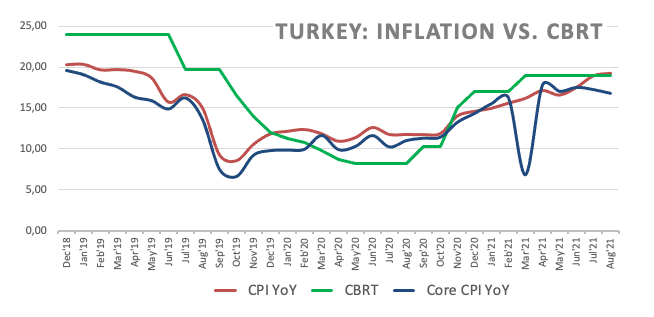

The lira has been accelerating its losses vs. the dollar pari passu with rising investors’ cautiousness ahead of the next monetary policy meeting by the Turkish central bank (CBRT) due next week. Indeed, fears of the start of the easing cycle much sooner than anticipated (and needed) by the CBRT have been exacerbated after the central bank announced last week that the core inflation will now be the anchor to set the policy rate (instead of the headline CPI).

It is worth recalling that the headline CPI rose above the 19.0% level in August – and above the bank’s One-Week Repo Rate - and that the government now sees the inflation heading lower to 16.2% by year-end and 9.8% by end of 2022.

USD/TRY key levels

So far, the pair is gaining 0.76% at 8.5919 and a drop below 8.4013 (low Sep.10) would aim for 8.3905 (20-day SMA) and finally 8.2590 (monthly low Sep.6). On the other hand, the next up barrier lines up at 8.6806 (monthly high Aug.11) followed by 8.7303 (high Jul.8) and then 8.7974 (2021 high Jun.25).

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.