USD/THB advances as US economy signals strength

- The USD/THB bulls gain momentum, with the pair showing a 0.56% spike.

- Favorable PMI data and stable unemployment figures, coupled with the Federal Reserve's unwavering stance favor the USD.

- Markets are giving up their hopes of a cut in September by the Fed.

The USD/THB pair is gaining strength rising to 36.60 on Thursday due to the Federal Reserve's (Fed) persistent hawkish stance on maintaining high interest rates. This is backed by better-than-expected Manufacturing PMI data and low unemployment claims in the US, providing a favorable economic environment.

The latest US data showed a robust PMI reading for May, exceeding expectations with manufacturing PMI at 50.9, up from April's 50.0, and outpacing the forecast of 50.0. The Services PMI also saw an impressive surge, reaching 54.8 from April’s figure of 51.3, significantly beating a 51.3 forecast.

In addition, the US Labor Department declared a smaller-than-anticipated rise in unemployment benefits, which marked another positive note for the US economy. All these factors, combined with the Federal Reserve's steadfast commitment to high interest rates, benefited the Greenback against its peers on Thursday. In that sense, according to the CME FedWatch tool, markets have practically given up the hopes of a cut by the Fed until September. In that month’s meeting, investors now see just a 40% chance of the easing cycle starting.

USD/THB technical analysis

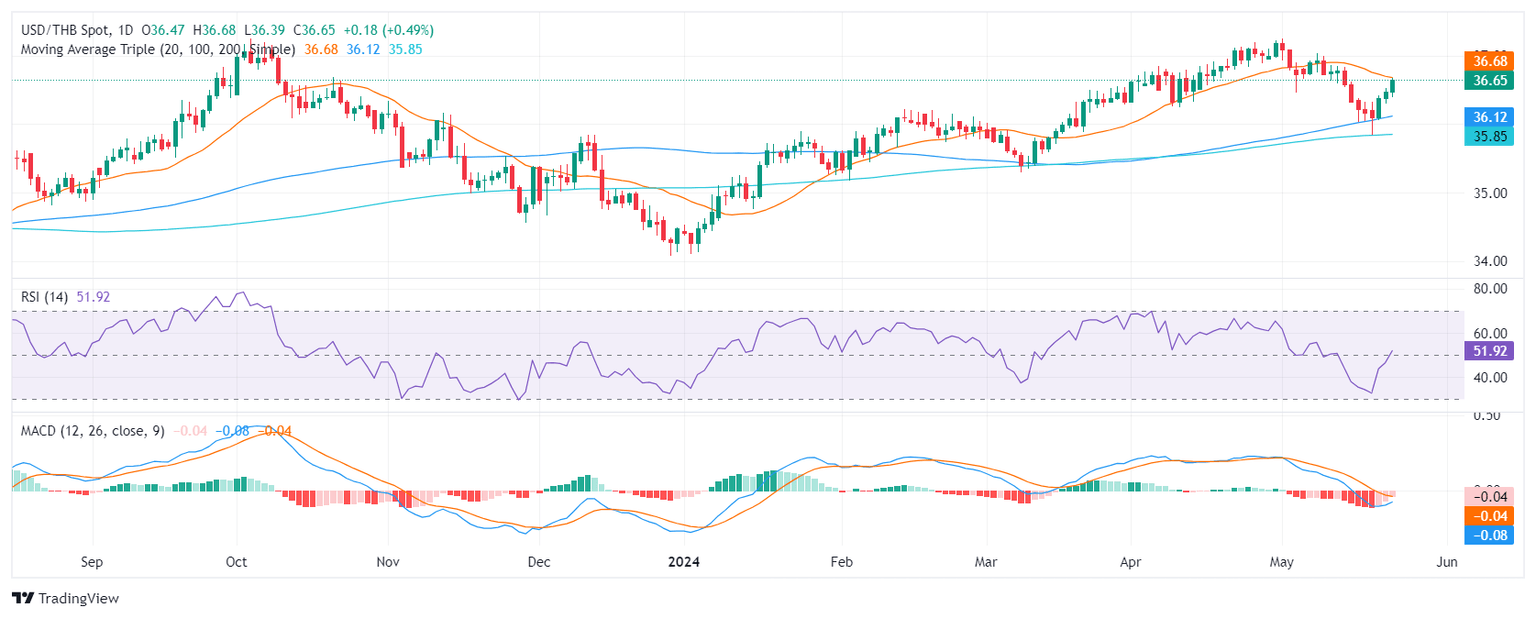

Within the daily view, the Relative Strength Index (RSI) shows a transition from negative to positive territory. The market dynamics quickly flipped from an oversold to a positive trend with the latest RSI reading standing above the mid-line. The buyers appear to have gained control, offsetting prior losses and establishing a more optimistic outlook.

Supporting this is the trend witnessed in the Moving Average Convergence Divergence (MACD) histogram, which displays declining red bars. This indicates a diminishing negative momentum, aligning with the bullish context presented by the RSI above.

USD/THB daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.