- USD/RUB extends losses to the 73.50 region.

- The Russian central bank (CBR) raised rates by 100bps.

- The CBR justified its move by rising inflationary concerns.

The Russian ruble gathers further traction and forces USD/RUB to ease to new 2-week lows in the mid-73.00s on Friday.

USD/RUB weaker on hawkish CBR

USD/RUB loses ground since Tuesday and navigates the area of multi-day lows near 73.50 after the CBR hiked the key rate by 100bps to 6.50% at its event earlier on Friday.

Higher-than-projected inflation and persistent high inflation expectations seems to have convinced the central bank to tight its monetary policy further, delivering a larger-than-forecast rate hike.

In fact, the central bank now sees inflation struggling to return to the bank’s target of around 4% in the second half of the next year and now projects the CPI to be within the 5.7%-6.2% range by year-end (from 4.7%-5.2%).

When comes to interest rates, the CBR now sees the policy rate to be between 6.5%-7.1% (from 4.8%-5.4%) by end of this year and within the 5.3%-6.3% band in 2022.

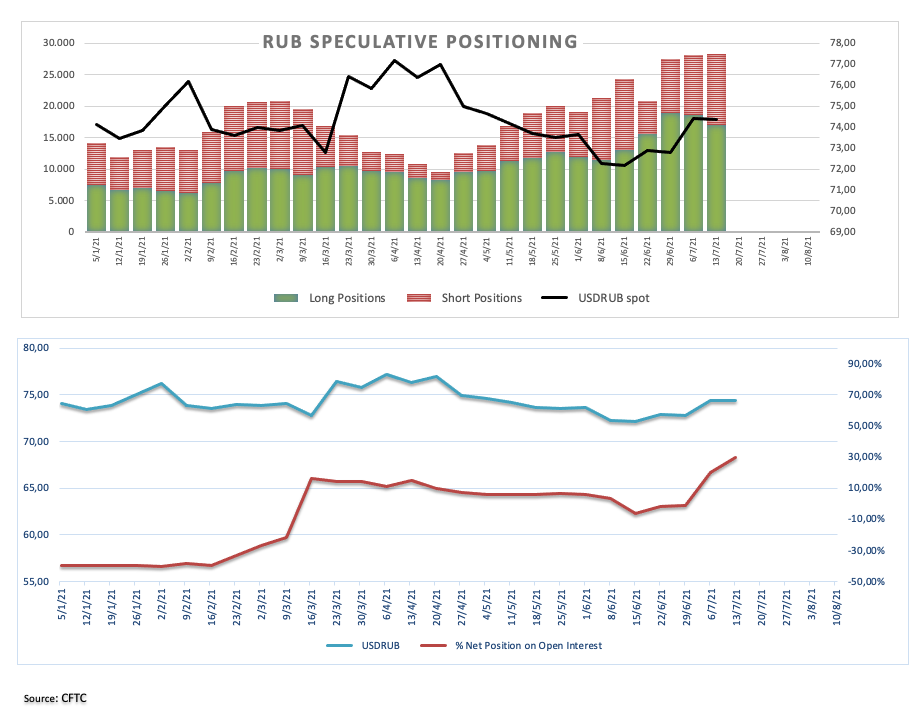

On another front, speculators trimmed their gross longs in RUB for the second session in a row, taking net longs to 4-week lows on the week ended on July 13. The Russian currency has appreciated since this week’s cut-off date (July 20) and ahead of today’s decision by the CBR, so it will be interesting to see if expectations of further tightening appears in the next CFTC report.

USD/RUB levels to watch

At the moment the pair is losing 0.27% at 73.58 and a breach of 73.35 (50-day SMA) would aim for 72.03 (low Jun.25) and finally 71.55 (2021 low Jun.11). On the flip side, the next up barrier emerges at 74.30 (100-day SMA) followed by 74.74 (200-day SMA) and then 75.35 (monthly high Jul.8).

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of US jobs report

EUR/USD stays in a consolidation phase above 1.0700 after closing the previous two days in positive territory. Investors eagerly await April jobs report from the US, which will include Nonfarm Payrolls and Unemployment Rate readings.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2550 amid the softer US Dollar on Friday. Market participants refrain from taking large positions as focus shifts to April Nonfarm Payrolls and ISM Services PMI data from the US.

Gold remains stuck near $2,300 ahead of US NFP

Gold price struggles to gain any meaningful traction and trades in a tight channel near $2,300. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support to XAU/USD ahead of the key US NFP data.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.