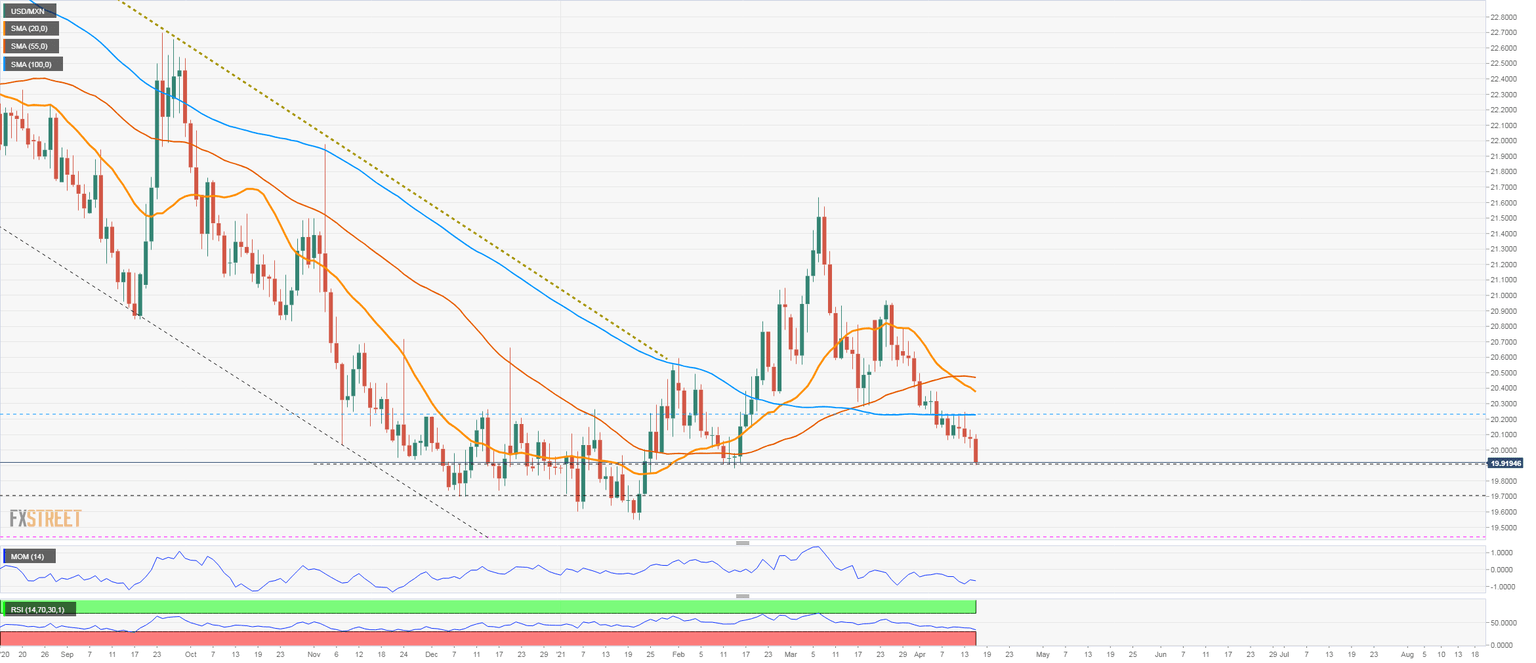

USD/MXN Price Analysis: Mexican peso strengthens after breaking under 20.00

- USD/MXN drops below 20.00, fall to lowest in two months.

- Outlook point to further gains for the MXN, targeting 19.70/75.

The USD/MXN is falling sharply on Thruways. The decline accelerated after breaking under the 20.00 area. It bottomed so far at 19.89, the lowest level since mid-February. The pair is testing the support at 19.90, and a firm break lower would see the lowest leave since late January.

The outlook continues to favor more losses, with the next target seen at 19.70/75. A recovery back above 20.00 would alleviate the bearish pressure. Above, the next resistance stands at 20.30.

Technical indicators show there is still room for more losses. The RSI is not yet at extreme levels, and neither Momentum. Below 19.70, the YTD low at 19.55 would be exposed.

USD/MXN daily chart

Author

Matías Salord

FXStreet

Matías started in financial markets in 2008, after graduating in Economics. He was trained in chart analysis and then became an educator. He also studied Journalism. He started writing analyses for specialized websites before joining FXStreet.