USD/MXN dives to new lows below 18.50, despite a strong USD

- US Pending Home Sales improved, but investors are focused on core PCE figures on Friday.

- Banxico’s monetary policy decision loom, with analysts expecting a 25 bps rate hike.

- USD/MXN Price Analysis: Further downside is estimated, but Banxico’s decision could spur a leg-up.

The USD/MXN continues its free-fall during the week, down 1.45% since Monday, registering five days of consecutive losses. Sentiment improvement, and a strong US Dollar (USD), have not stopped the appreciation of the Mexican currency. At the time of writing, the USD/MXN is trading at 18.1060, down 0.69% in the day.

The Mexican Peso at the mercy of Banxico’s policy decision

A risk on impulse underpinned the Mexican Peso (MXN), which continues to drag the USD/MXN exchange rate, further below the psychological 18.50 barrier, eyeing to test 18.00. Investors’ appetite for risk improved on news that Alibaba will split into six business groups seeking Initial Public Offerings (IPOs). Therefore, Wall Street portrays an optimistic sentiment after a “short-lived” banking crisis.

A light economic calendar in the United States (US) featured that Pending Home Sales for February grew at a 0.8% MoM and exceeded estimates for a plunge of 0.3%, though on an annual basis, decreased by 21.1%, less than the 29.4% plunge foreseen.

Market participants ignored US data as they shifted to the US Federal Reserve’s (Fed) preferred gauge for inflation, the Core Personal Consumption Expenditure (PCE) for February, estimated at 0.4% MoM and 4.7%, annually based.

Additionally, Thursday’s calendar will be packed, with Initial Jobless Claims for the last week, and the Gross Domestic Product (GDP) for Q4

In the meantime, US Treasury bond yields are retreating, with 2s and 10s, each at 4.05% and 3.56%, respectively. The greenback climbs 0.27%, as shown by the US Dollar Index, up at 102.704.

On the Mexican front, the Bank of Mexico (Banxico) will unveil its interest rate decision on Thursday. Analysts foresee a 25 bps rate hike by Banxico. Expectations lie around a possible pause in the hiking cycle, which, although it favors the Mexican Peso (MXN) due to its interest rate differential, could trigger some profit-taking. Therefore, further upside in the USD/MXN could be possible.

USD/MXN Technical analysis

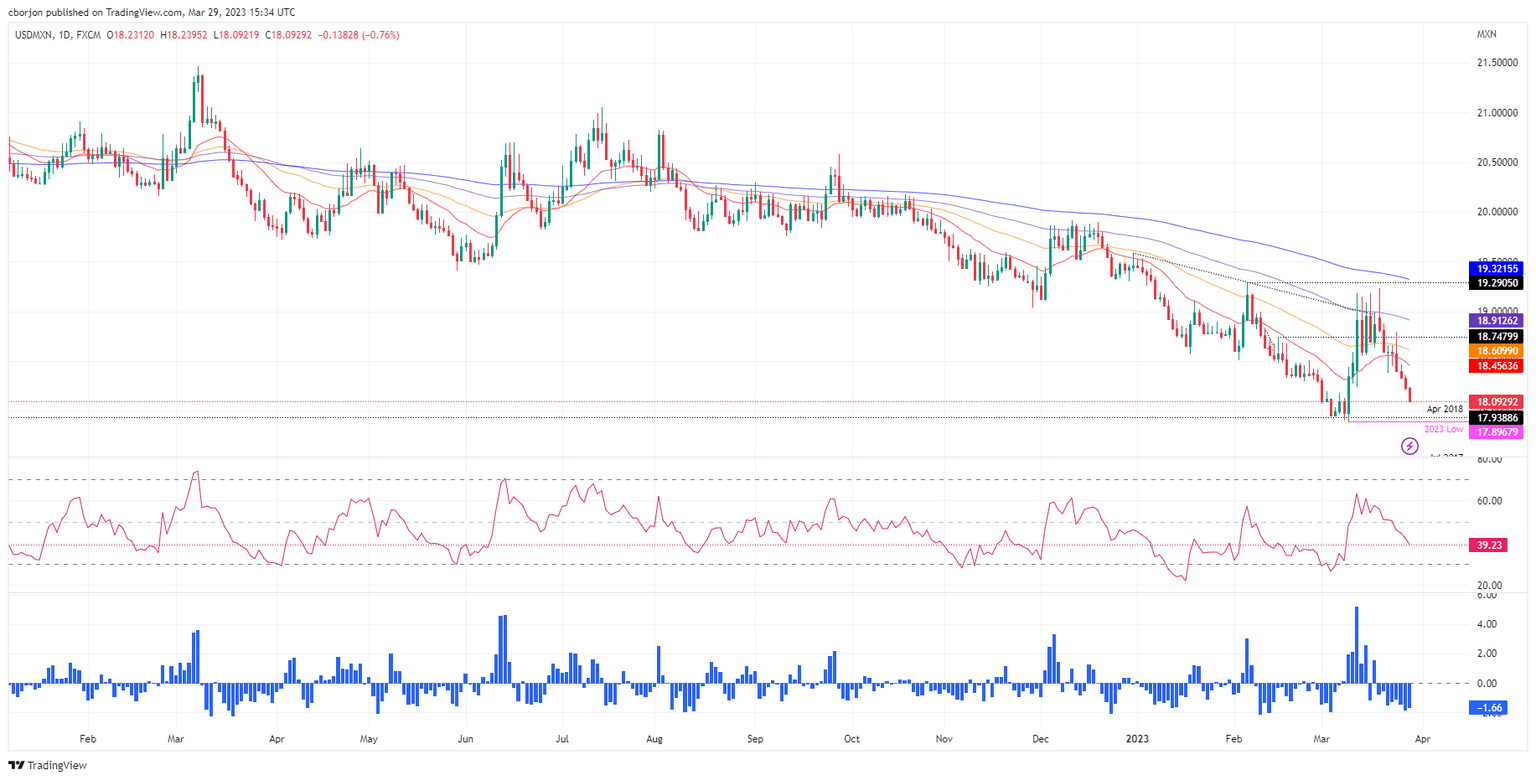

From a daily chart perspective, the USD/MXN is downward biased, eyeing a renewed test of YTD lows at 17.8968. But, the USD/MXN pair needs to clear some hurdles on its way south, like the 18.00 figure, followed by the March 7 low of 17.9664, before challenging the YTD low. If that price level is cleared, the next support would be July 2017 low at 17.4498.

Conversely, the USD/MXN’s first resistance would be the 20-day Exponential Moving Average (EMA) at 18.4607. But oscillators staying at bearish territory suggest the least resistance path is downwards.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.