- USD/JPY reversed its intraday losses and bounced above the 108.00 figure.

- 108.60 is the level to beat for bulls.

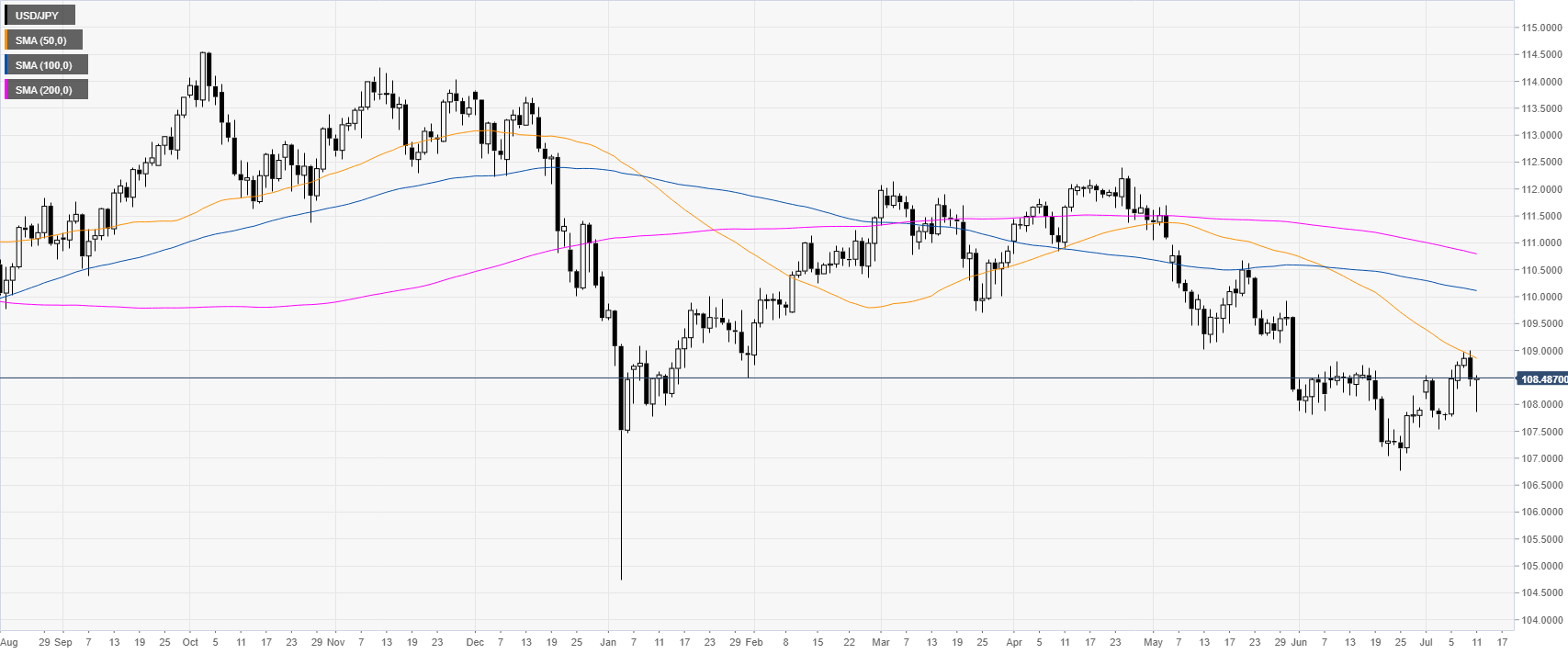

USD/JPY daily chart

USD/JPY is trading in a bull leg below the main daily simple moving average (DSMA). The market is rebounding from the 108.00 figure.

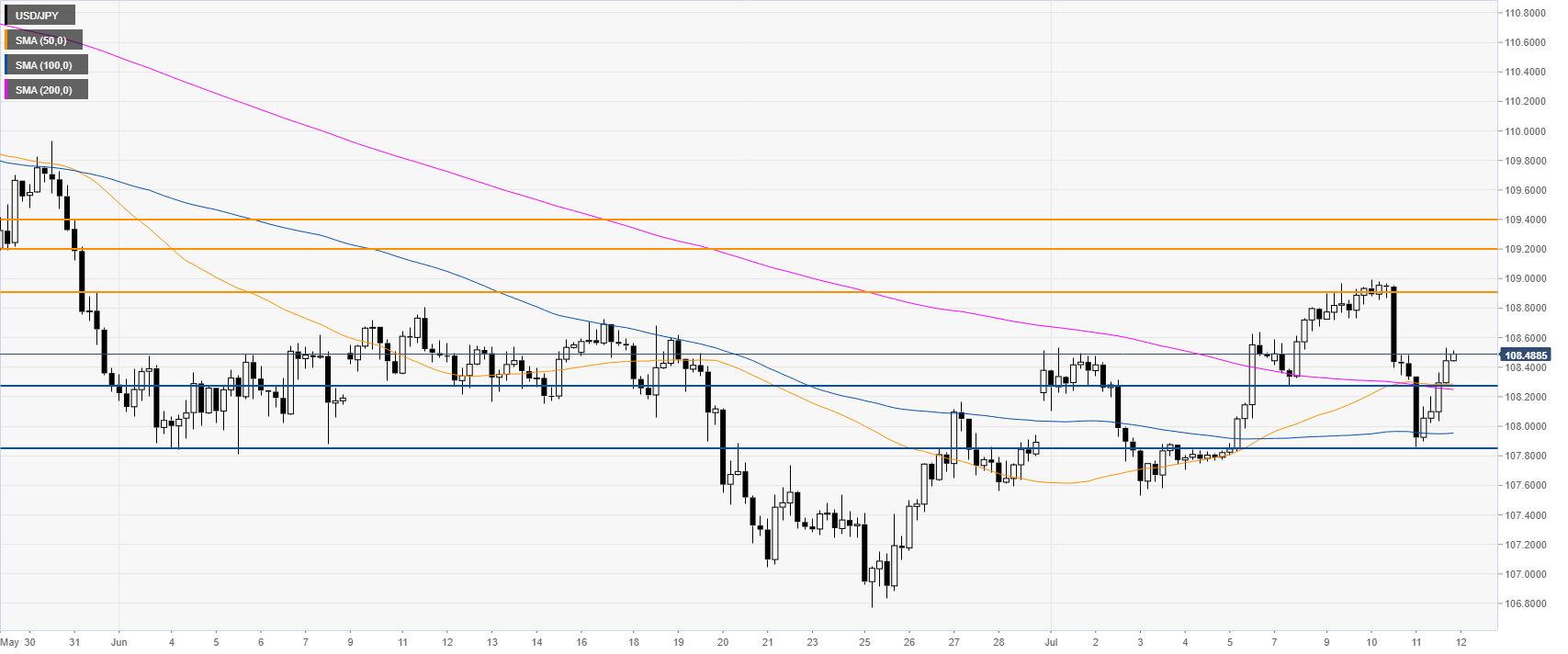

USD/JPY 4-hour chart

The market is trading above its main SMAs suggesting bullish momentum. Bulls need to break above 108.60 to reach 108.90 on the way up, according to the Technical Confluences Indicator.

USD/JPY 30-minute chart

USD/JPY is trading between the 50 and 100 SMAs suggesting a consolidation in the near term.

Immediate support can be seen at 108.28 and 107.85, according to the Technical Confluences Indicator.

Additional key levels

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

Bank of Japan holds interest rate in September, as expected

The Bank of Japan announced on Friday that it maintained the short-term rate target in the range of 0.15%-0.25%, following the conclusion of its two-day monetary policy review meeting. The decision aligned with the market expectations.

AUD/USD bears attack 0.6800 amid PBOC's status-quo, cautious mood

AUD/USD attacks 0.6800 in Friday's Asian trading, extending its gradual retreat after the PBOC unexpectedly left mortgage lending rates unchanged in September. A cautious market mood also adds to the weight on the Aussie. Fedspeak eyed.

Gold consolidates near record high, bullish potential seems intact

Gold price regained positive traction on Thursday and rallied back closer to the all-time peak touched the previous day in reaction to the Federal Reserve's decision to start the policy easing cycle with an oversized rate cut.

Ethereum rallies over 6% following decision to split Pectra upgrade into two phases

In its Consensus Layer Call on Thursday, Ethereum developers decided to split the upcoming Pectra upgrade into two batches. The decision follows concerns about potential risks in shipping the previously approved series of Ethereum improvement proposals.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.