- The US Dollar fails to capitalize on a risk-off mood, blamed on falling US bond yields.

- Recently released US economic data would keep the Federal Reserve tightening monetary policy.

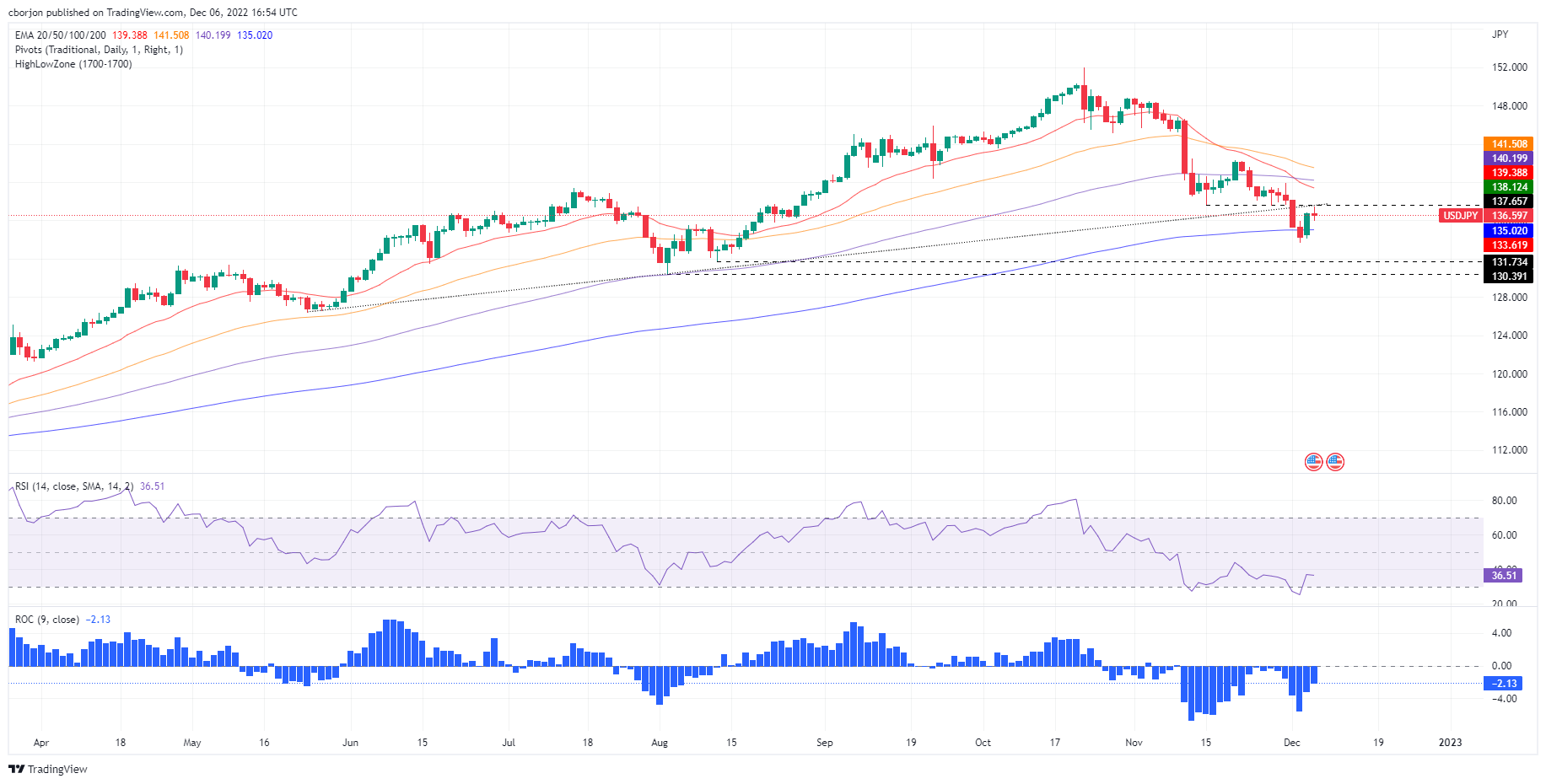

- USD/JPY Price Analysis: Upward biased, but might consolidate around 135.00/136.00.

The USD/JPY remains pressured in the North American session, spurred by dented risk appetite produced by the last three days’ economic data from the United States (US) suggesting further tightening needs by the Federal Reserve (Fed). Nonetheless, the USD/JPY edges lower, trading at 136.61, partly due to falling US Treasury yields.

Before Wall Street opened, the US Department of Commerce (DoC) revealed that Trade Balance in the United States widened to $-78.2B compared to September’s $-74.1B, beneath estimates of $-80B. Delving into the data, the Exports rose by $256.6B below September’s data, while Imports jumped $334.8B above the previous month’s $332.6B.

Meanwhile, data revealed since last Friday portrays that the labor market in the US remains tight, while Average Hourly Earnings jimping 5.1% YoY added to inflationary pressures. Aside from employment data, the US Institute for Supply Management (ISM) revealed that the Service PMI Index rose 56.6, better than the 53.3 expected.

Elsewhere, investors’ sentiment has dampened since the beginning of the week due to their assessment of the Federal Reserve’s (Fed) reaction to data. Wednesday’s speech by the Federal Reserve Chair Jerome Powell, pivoting towards less aggressive rate hikes in the 50 bps size, spurred a rally in risk-perceived assets. However, last week’s data put Powell at a crossroads, with the Producer Price Index (PPI) to be released on Thursday, followed by the University of Michigan (UoM) Consumer Sentiment and next week’s Consumer Price Index (CPI) before December’s meeting. Any hints that inflation remains high could put an aggressive 75 bps hike back into play.

Hence, the USD/JPY failed to sustain the rally on Tuesday due to the US bond yields falling. The US 10-year Treasury yield creeps down two and a half bps, at 3.550%.

USD/JPY Price Analysis: Technical outlook

From the daily chart perspective, the USD/JPY is neutral-upward biased. Since last Friday’s breach of the 200-day Exponential Moving Average (EMA), the major recovered some ground, though it’s testing the bottom trendline of a previous upslope support trendline at around 137.40s. The USD/JPY key support levels lie at 136.00, followed by the December 2 daily high of 135.98, followed by the 200-day EMA at 135.01. On the other hand, the USD/JPY first resistance would be the psychological 137.00 mark. Break above will expose the upslope trendline drawn since August 2022 at around 137.40, followed by the December 1 daily high of 138.12.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD falls amid highs US yields, Fed’s tough stance

The Australian Dollar posted losses of 0.23% against the US Dollar on Thursday amid higher US yields that underpinned the Greenback during the day. Wall Street hit new all-time highs but retreated afterward, ending the session with losses. As Friday’s Asian session begins, the AUD/USD trades at 0.6678.

EUR/USD slipped on Thursday after Greenback pares some losses

EUR/USD eased slightly on Thursday, falling back below 1.0880 as the Greenback broadly recovers losses from earlier in the week. The pair remains notably up for the trading week, but a late break for the US Dollar is on the cards as investors second-guess the Fed's stance on rate cuts.

Gold loses its bright and tumbles on firm US Dollar, Fed hawkish comments

Gold prices fell in the mid-North American session on Thursday, below $2,390, as US Treasury yields recovered and underpinned the Greenback. Wednesday’s inflation report in the United States sponsored the golden metal rally, but Thursday’s data was a mixed bag, which could likely trigger some profit-taking ahead of the weekend.

Bitcoin price holds above $65.5K threshold as world’s largest futures exchange plans to launch BTC trading

Bitcoin’s (BTC) price rally on Wednesday was shocking, steered by the April Consumer Price Index (CPI) data release in the US. Speculation and market sentiment inspired the surge as traders and investors interpreted the news of softened inflation as a signal that central banks may maintain loose monetary policy.

April CPI: Worst good news ever

The monthly rise in prices based on the Consumer Price Index (CPI) came in slightly lower than projected, sending a wave of euphoria across the financial landscape. The consensus is cooling inflation puts Federal Reserve interest rate cuts back on the table.