USD/JPY refreshes 34-year highs above 153.00 following US PPI data

- USD/JPY edges up to 153.22, lifted by inflation reports and rising DXY.

- US PPI data indicates slower inflation growth yet fails to dampen the bullish momentum for the US Dollar.

- Fed officials express disappointment in inflation trends, highlighting ongoing economic challenges.

The USD/JPY climbed during the North American session and remains above the 153.00 figure despite Japanese authorities jawboning on excessive Japanese Yen (JPY) movements. Further data from the United States (US) depicts inflation is stickier than expected, putting pressure on the Federal Reserve. At the time of writing, the major trade at 153.22, up 0.05%.

Despite Japanese interventions warnings, USD/JPY edges higher as stickier US inflation data fuels USD strength

The Greenback is strengthening across the board, as the US Dollar Index (DXY) rises to its highest level since November 2023. The DXY is up at 105.51, shy of testing the next resistance seen at 106.06. Wednesday’s inflation report sponsored the buck’s reaction. Meanwhile, the recently revealed Producer Price Index (PPI) was softer compared to CPI, though it failed to weigh on the US Dollar.

The US Department of Labor revealed that PPI in March slowed more than expected, coming at 0.2% MoM, below estimates of 0.3%. Annually-based figures witnessed the PPI rising by 2.1%, lower than projected by surpassing February’s 1.6%, while the core PPI stood at 2.4%, also above estimates and the previous month's data.

Given that US economic data suggests that the Federal Reserve’s job is not done, further US Dollar strength is seen, in the near term. Also, US Treasury yields on Wednesday, climbed more than 20 basis points along the whole yield curve, boosting the prospects of the American currency.

In the meantime, Federal Reserve officials continued to cross the wires. New York Fed President John Williams commented that recent inflation data has been disappointing, adding that the economic outlook is uncertain. Recently, Richmond’s Fed Thomas Barkin added that the latest inflation data does not increase confidence that disinflation is spreading in the economy, raising the question of whether we (the Fed) are seeing a shift.

On the Japanese front, Finance Minister Suzuki said that authorities wouldn’t rule out any steps to deal with excessive volatility in the Yen. He added, “We are looking with a high sense of urgency.”

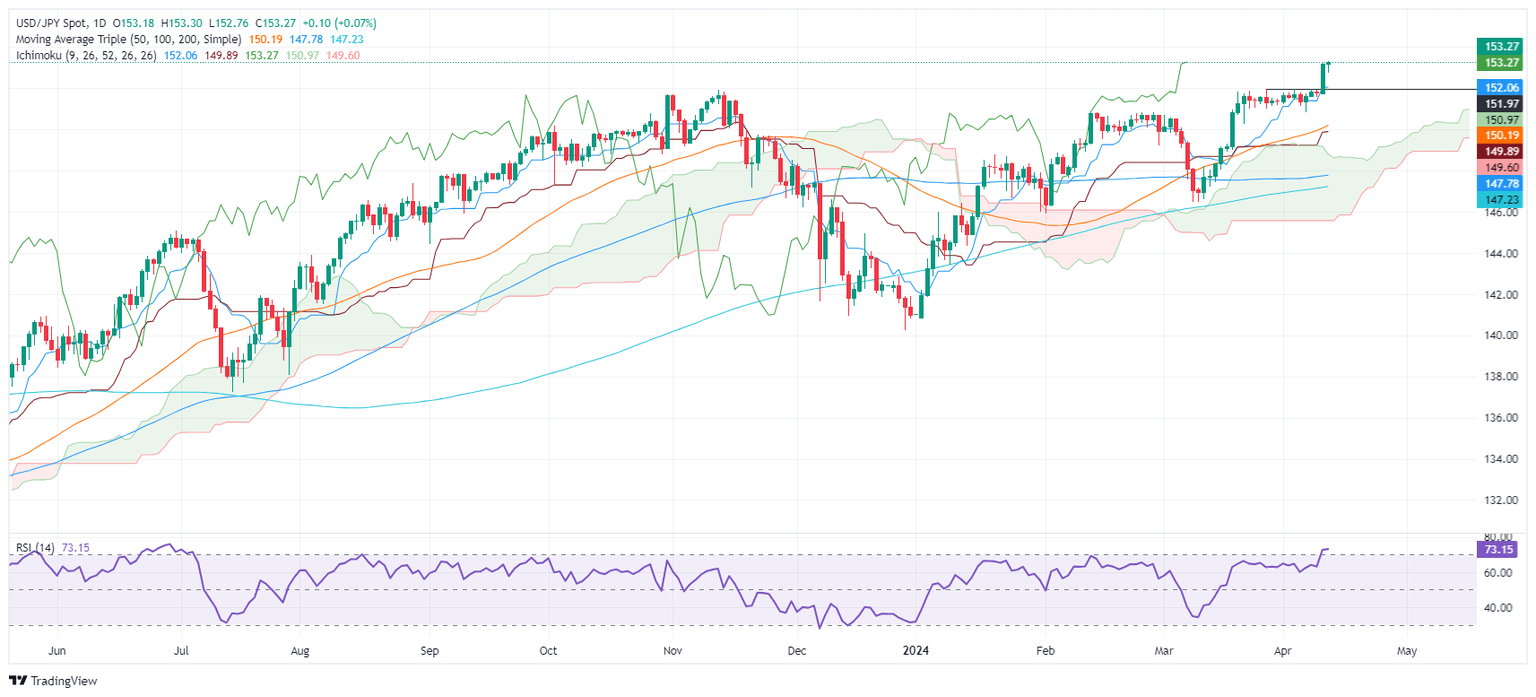

USD/JPY Price Analysis: Technical outlook

Given the fact the USD/JPY has broken the 153.00 barrier, the next resistance level would be the June 1990 monthly high at 155.78, followed by the April 1990 pivot high at 160.32. On the other hand, the risks of intervention could tumble the pair toward the next key support levels. Firstly, the Tenkan-Sen at 152.05, followed by the Senkou Span A at 150.97, the Kijun-Sen at 149.89, closely followed by the Senkou Span B at 149.59.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.