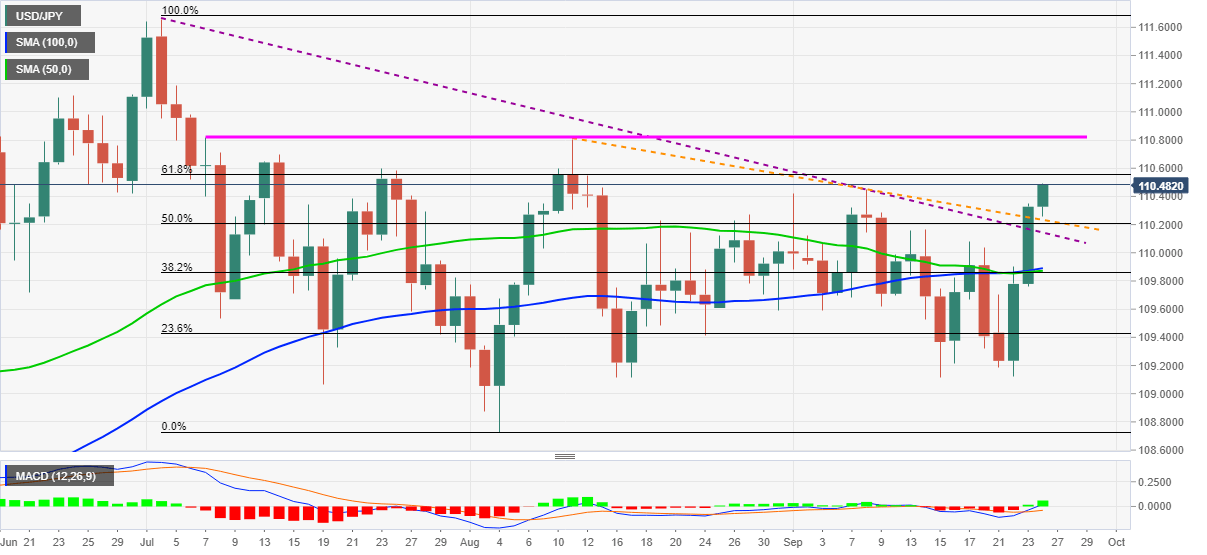

USD/JPY Price Analysis: Refreshes monthly top, 110.80 in focus

- USD/JPY takes the bids to renew multi-day top, prints three-day uptrend.

- Sustained break of the key moving averages, trend lines favor bulls.

- 11-week-old horizontal area guards immediate upside, 109.10 adds to supports.

USD/JPY extends three-day uptrend to renew the monthly high near 110.50, up 0.14% intraday as European traders brace for Friday’s task.

The yen pair crossed a convergence of the 50-day and 100-day SMA the previous day before closing beyond downward sloping resistance lines, now supports, stretched from July and August.

Given the bullish MACD signals joining the upside break of important resistance-turned-support, USD/JPY is ready for further advances towards the 61.8% Fibonacci retracement of July-August declines, near 110.55.

However, the pair’s rise past 110.55 will be challenged by a short-term horizontal line near 110.80, a break of which will direct the bulls towards July’s top of 111.65.

Meanwhile, pullback moves may first retest the descending trend line from August, surrounding 110.23, before revisiting the previous resistance line from July near 110.14.

Also important is the convergence of the stated moving averages and 38.2% Fibonacci retracement around 109.90.

In a case where USD/JPY bears keep controls below 109.90 multiple lows near 109.10 will challenge the further downside.

USD/JPY: Daily chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.