USD/JPY Price Analysis: Holds above 150.00 ahead of the weekend

- USD/JPY advances to 150.16, lifted by US inflation figures and positive consumer outlook.

- Fed's Bostic and Daly call for a cautious stance on rate cuts, advocating patience.

- Technical outlook suggests bullish potential for USD/JPY, eyeing targets beyond 151.00 with key supports in focus.

The USD/JPY is set to finish the day and the week positively, with the major clinging above the 150.00 figure, posting daily gains of 0.16%, exchanging hands at 150.16.

Fundamentally speaking, Friday’s data suggests inflation in the United States (US) is stickier than expected, as shown by the latest Producer Price Index (PPI) report, with the headline and underlying PPI exceeding the consensus and the previous month’s reading. Despite this, the latest Consumer Sentiment report, showed Americans remain optimistic about the economic outlook, despite upward revising inflation expectations for one year.

Given this backdrop, Federal Reserve officials Bostic and Daly acknowledged the progress on inflation but remained cautious about providing a timetable for interest rate cuts. Both suggested that patience is required before the Fed begins its easing cycle.

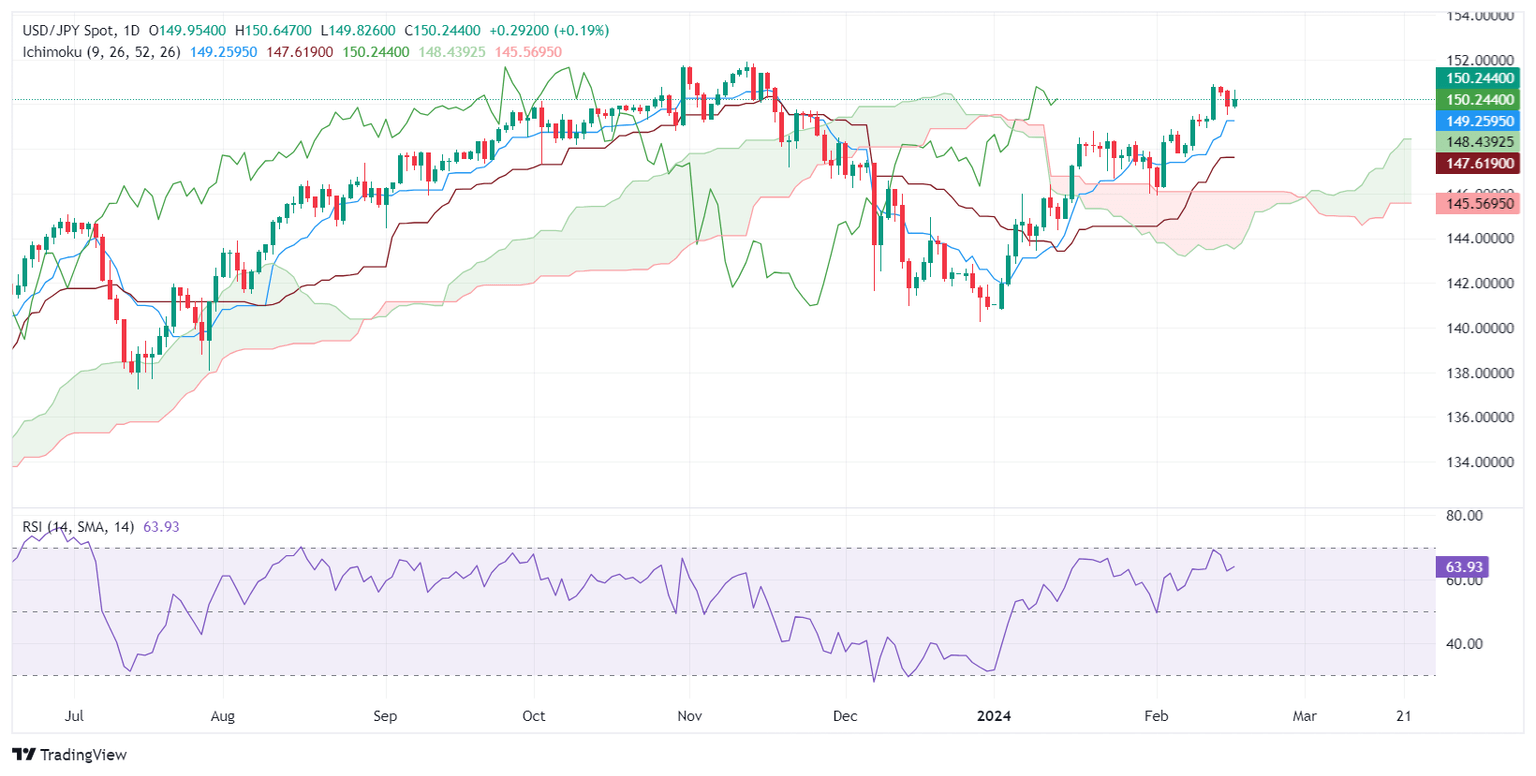

From a technical standpoint, the USD/JPY is neutral to upward biased after peaking at around the 150.00-150-88 area following the release of US inflation figures. For a bullish continuation, buyers must lift the exchange rate above 151.00, followed by the November 13 high at 151.91, before challenging 152.00.

Conversely, if USD/JPY drops below 150.00, the first support would be the Tenkan-Sen at 149.25. The next support would be the Senkou Span A at 148.43, followed by the 148.00 figure. Downside risks emerge at the Kijun-Sen level at 147.62.

USD/JPY Price Action – Daily Chart

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.