USD/JPY ends the North American day better bid ahead of full markets returning

- USD/JPY bulls are moving in hard on a critical level of resistance.

- The week ahead will be a busy one with full markets returning and eager for volatility around critical events.

Monday marked the final day of the holiday season for all markets. The rest of the week will be supercharged on both volumes returning and high stake calendar events which could make for a wild ride. USD/JPY is going to be a major focus on forex given its ascent through 115.

At the time of writing, USD/JPY rallied from a low of 114.94 to a high of 115.36, extending the holiday drift to the upside. The moves in USD/JPY has dovetailed with the rally in stocks. The performance of global equities will be key at this juncture and more of the same could see the pair overcome 115.52, the high of November.

Bonds maintain a corrective tone after long end yields surged in late December and the Federal Open Market Committee minutes and Nonfarm Payrolls will be key this week in that respect.

''Following the FOMC's decision to double the pace of QE tapering and the projection of a significantly more hawkish dot plot, the focus will now turn to the elements that led to the evolution of views among policymakers (including on "maximum employment") after the November meeting,'' analysts at TD Securities said.

As for the main event of the week, the analysts explained that ''the late-December COVID surge likely came too late to prevent a pickup in US payrolls after the gain in November (210k) appeared to be held down by an overly aggressive seasonal factor.''

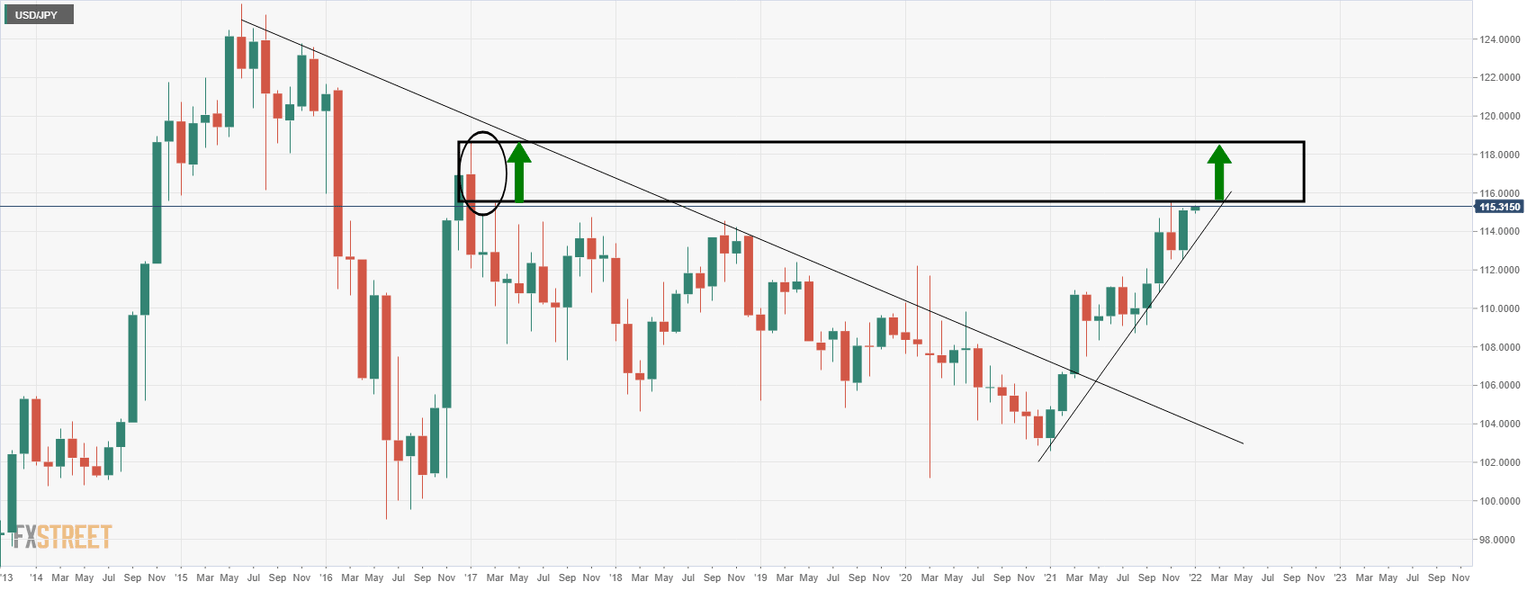

USD/JPY technical analysis

USD/JPY is attempting to break into a key area on the monthly chart. If it breaches the 116 figure, then there are real prospects of mitigation between here and 118.60 for the first quarter of the year.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.