USD/INR strengthens as FIIs continue to pare stake in Indian stock market

- The Indian Rupee slumps to its lowest level near 90.00 against the US Dollar amid continuous foreign outflow from the Indian equity market.

- India’s GDP growth surprisingly remained stronger at 8.2% in the third quarter.

- Investors await the US ISM Manufacturing PMI data for November.

The Indian Rupee (INR) underperforms all its major peers and posts a fresh low against the US Dollar (USD) after a flat opening at the start of the week. The USD/INR pair jumps to near 90.00 as the Indian Rupee struggles to attract bids, with consistent foreign outflows offsetting the impact of robust India’s Q3 Gross Domestic Product (GDP) growth.

Foreign Institutional Investors (FIIs) have turned out to be net sellers in the last five months starting July, dumping stakes in the Indian stock market worth Rs. 1,49,718.16 crore.

Currencies from developing economies are significantly impacted by diminishing confidence of overseas investors in their economy.

On Friday, India’s Ministry of Statistics reported that the economy expanded at a robust pace of 8.2% on an annualized basis in the third quarter of the year, faster than expectations of 7.3% and the prior reading of 7.8%. This was the fastest growth seen in over six quarters.

Market experts have credited the government’s announcements of lower direct and indirect taxes that led to robust consumer spending in the third quarter, and have become mixed over whether the Reserve Bank of India (RBI) will cut its Repo Rate in its upcoming monetary policy announcement on Friday.

Economists at Citi expect the RBI to leave rates unchanged this week, diverging from the consensus call for a 25-basis point rate cut.

The table below shows the percentage change of Indian Rupee (INR) against listed major currencies today. Indian Rupee was the weakest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | INR | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.09% | 0.22% | -0.47% | 0.10% | 0.05% | 0.27% | -0.05% | |

| EUR | 0.09% | 0.32% | -0.33% | 0.19% | 0.15% | 0.36% | 0.05% | |

| GBP | -0.22% | -0.32% | -0.62% | -0.13% | -0.17% | 0.04% | -0.27% | |

| JPY | 0.47% | 0.33% | 0.62% | 0.51% | 0.47% | 0.64% | 0.36% | |

| CAD | -0.10% | -0.19% | 0.13% | -0.51% | -0.05% | 0.17% | -0.15% | |

| AUD | -0.05% | -0.15% | 0.17% | -0.47% | 0.05% | 0.21% | -0.10% | |

| INR | -0.27% | -0.36% | -0.04% | -0.64% | -0.17% | -0.21% | -0.32% | |

| CHF | 0.05% | -0.05% | 0.27% | -0.36% | 0.15% | 0.10% | 0.32% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Indian Rupee from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent INR (base)/USD (quote).

The Fed is expected to cut interest rates next week

- The Indian Rupee remains under pressure against the US Dollar, even as the latter trades cautiously amid firm expectations that the Federal Reserve (Fed) will cut interest rates in its monetary policy announcement on December 10.

- At press time, the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, trades close to near the two-week low around 99.40.

- According to the CME FedWatch tool, the probability of the Fed cutting interest rates by 25 basis points (bps) to 3.50%-3.75% in December is 87.4%.

- Fed’s dovish speculation intensified last week after New York Fed Bank President John Williams supported the need for another interest rate cut in December, citing labour market risks. “I view monetary policy as being modestly restrictive, although somewhat less so than before our recent actions, adding that there is room for a further adjustment in the near term,” Williams said, CNBC reported.

- Meanwhile, rising expectations among investors that White House economic adviser Kevin Hassett could be chosen to replace Chair Jerome Powell have dampened the outlook of the US Dollar and bond yields. Over the weekend, Hassett stated in an interview on Fox News that he would be happy to be chosen as the next Fed chairman.

- The selection of White House economic adviser Hassett would be unfavourable for the US Dollar, assuming that his decisions will be influenced by US President Donald Trump’s economic agenda. "Hassett will be viewed as less independent, which creates some risk to the dollar as well as risks to a steeper Treasury yield curve,” analysts at Facet said.

- In Monday’s session, investors will focus on the US ISM Manufacturing Purchasing Managers’ Index (PMI) data for November, which will be published at 15:00 GMT. The agency is expected to report that the Manufacturing PMI contracted at a faster pace to 48.6 from 48.7 in October.

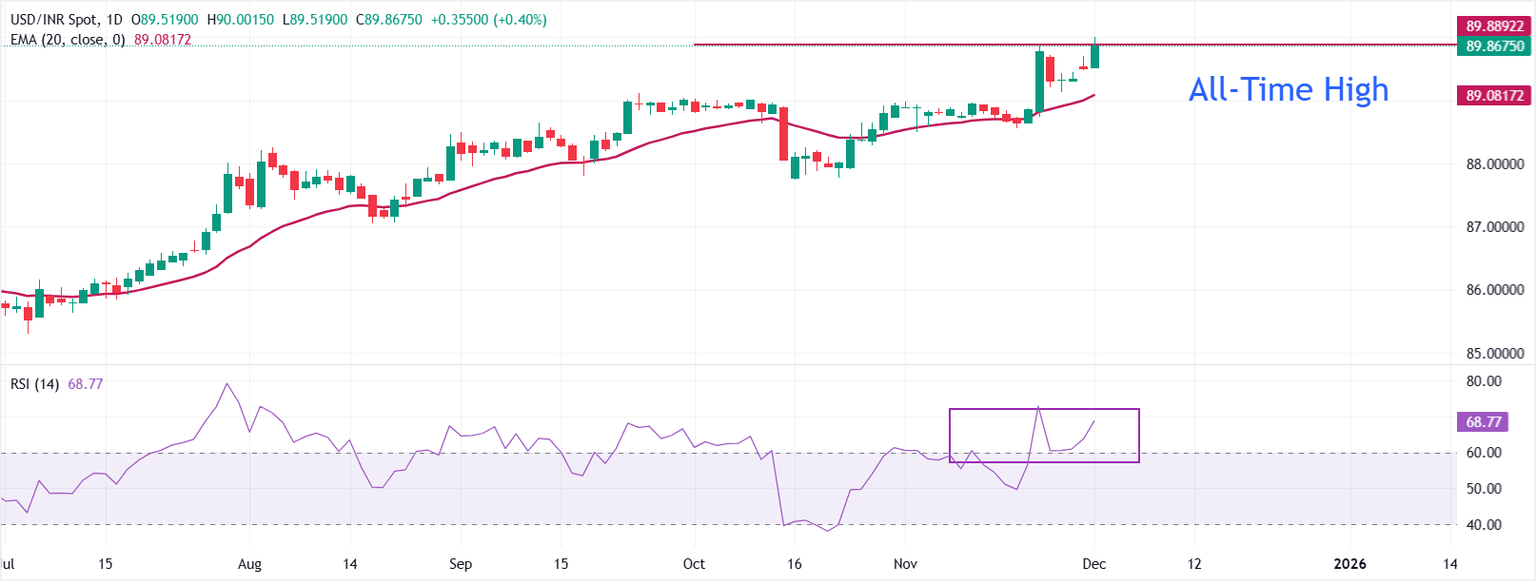

Technical Analysis: USD/INR enters uncharted territory

On Monday, USD/INR posts a fresh all-time high near 90.00. The 20-day Exponential Moving Average (EMA) rises and sits at 89.0823, keeping the pair biased higher as price holds above it. Dips could be contained by this dynamic support. RSI at 68.85, near overbought, underscores firm bullish momentum.

Trend-following conditions remain intact as the pair might enter uncharted territory once it breaks the psychological level of 90.00, a move that could lead the pair towards 91.00. On the downside, odds are healthy that a corrective move could appear, which might push the pair lower towards the November 25 low of 89.14.

(The technical analysis of this story was written with the help of an AI tool)

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.