USD/INR Price News: Indian rupee drops inside key SMA envelope ahead of US inflation data

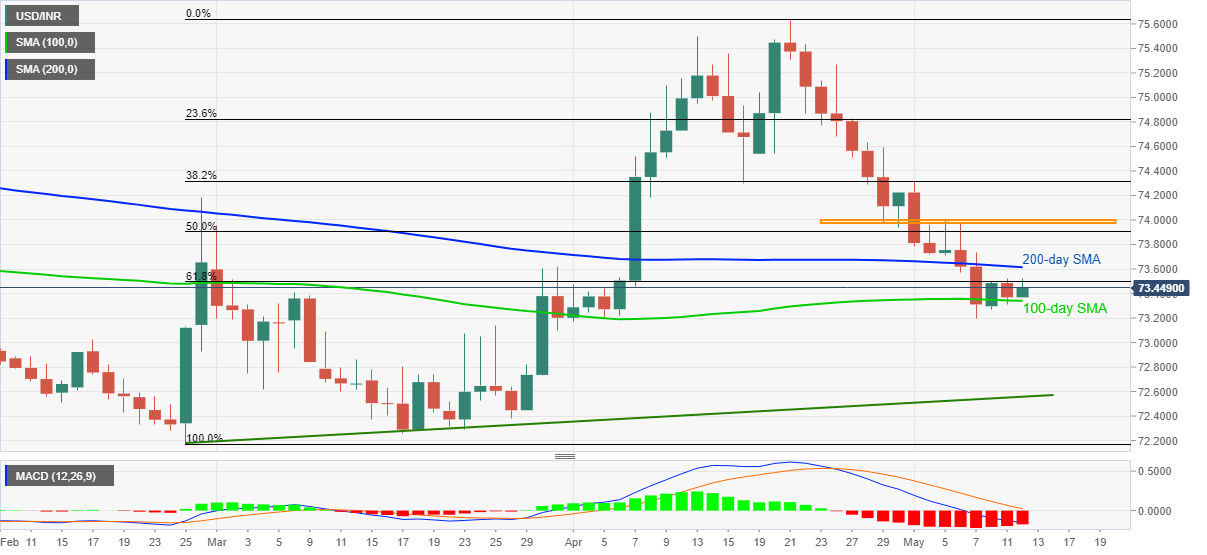

- USD/INR stays firm as buyers attack 61.8% Fibonacci retracement level.

- Bearish MACD, sustained trading below key SMA favor sellers.

- Bulls need to refresh monthly top for conviction.

- USD/INR edges higher around 73.46, up 0.11% on a day, amid the initial Indian trading session on Wednesday. In doing so, the Indian rupee (INR) pair remains confined between 200-day and 100-day SMA as buyers battle 61.8% Fibonacci retracement of February-April upside amid bearish MACD.

A clear break of the 73.50 immediate hurdle could escalate recovery moves toward a 200-day SMA level of 73.61. However, any further upside requires a sustained run-up beyond the 74.00 threshold, comprising the monthly high, to convince markets of the bullish momentum.

Following that, the mid-April low near 74..30, the 75.00 round-figure may entertain the USD/INR buyers ahead of the 75.30 and the yearly peak surrounding 75.65.

Meanwhile, a daily closing below the 100-day SMA level of 73.34, which is more likely due to the downbeat MACD and the pair’s failures to recover, will not hesitate to recall the 73.00 level to the chart.

It should be noted that USD/INR weakness below 73.00 may target an ascending support line from February 25, near 72.55 by the press time.

Above all, risk-off mood ahead of the US Consumer Price Index (CPI) for April becomes important and can keep USD/INR buyers hopeful.

Read: US Consumer Price Index April Preview: The two base effects of inflation

USD/INR daily chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.