USD Index clings to daily gains near 112.60 post-Payrolls

- The index remains bid around the 112.50 region on Friday.

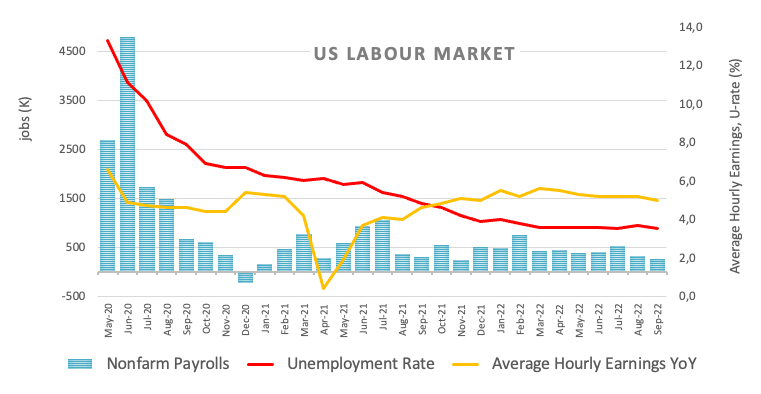

- US Non-farm Payrolls rose by 263K jobs in September.

- The Unemployment Rate surprised markets and dropped to 3.5%.

The greenback, when tracked by the USD Index (DXY), sticks to the positive territory in the mid-112.00s in the wake of the publication of Nonfarm Payrolls for the month of September.

USD Index flirts with weekly highs

The index keeps the positive stance on Friday after the release of the Nonfarm Payrolls showed the US economy added 263K jobs during September, surpassing initial estimates for a gain of 250K jobs.

Further data saw the Unemployment Rate retreat to 3.5% (from 3.7%) and the key Average Hourly Earnings – a proxy for inflation via wages – rise 0.3% MoM and 5.0% from a year earlier. Additionally, the Participation Rate, receded a tad to 62.3% (from 62.4).

Next on tap in the US docket comes the speech by NY Fed J.Williams, Wholesale Inventories and Consumer Credit Change.

What to look for around USD

The index gathers extra pace and revisits the 112.50 zone following another healthy print from the Nonfarm Payrolls.

The firmer conviction of the Federal Reserve to keep hiking rates until inflation looks well under control regardless of a likely slowdown in the economic activity and some loss of momentum in the labour market continues to prop up the underlying positive tone in the index.

Looking at the more macro scenario, the greenback also appears bolstered by the Fed’s divergence vs. most of its G10 peers in combination with bouts of geopolitical effervescence and occasional re-emergence of risk aversion.

Key events in the US this week: Nonfarm Payrolls, Unemployment Rate, Consumer Credit Change, Wholesale Inventories (Friday).

Eminent issues on the back boiler: Hard/soft/softish? landing of the US economy. Prospects for further rate hikes by the Federal Reserve vs. speculation of a recession in the next months. Geopolitical effervescence vs. Russia and China. US-China persistent trade conflict.

USD Index relevant levels

Now, the index is gaining 0.27% at 112.56 and faces the next hurdle at 114.76 (2022 high September 28) seconded by 115.00 (round level) and then 115.32 (May 2002 high). On the flip side, a breach of 110.05 (weekly low October 4) would open the door to 109.35 (weekly low September 20) and finally 107.68 (monthly low September 13).

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.