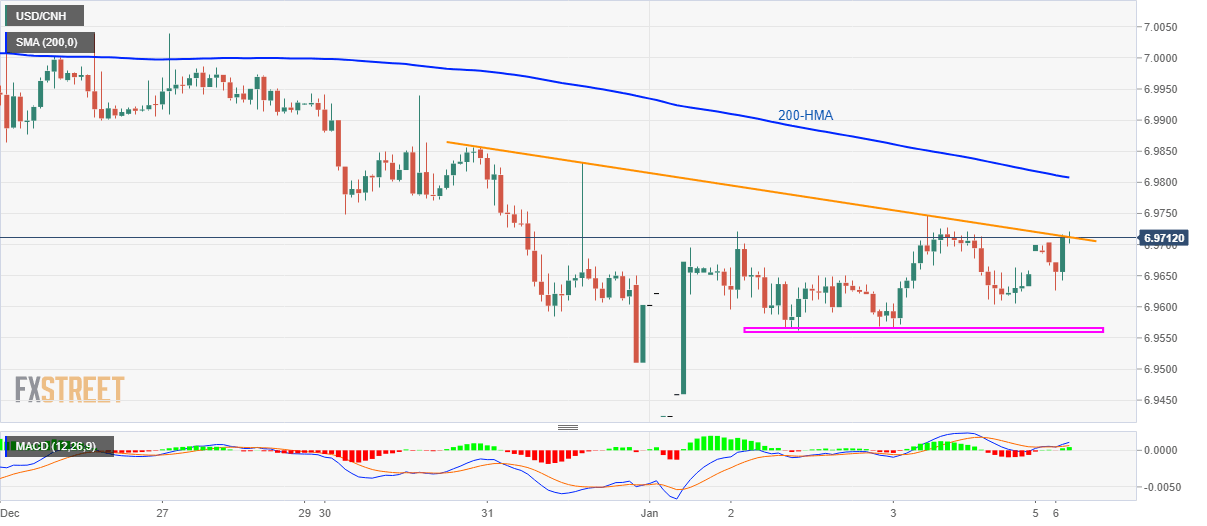

USD/CNH Technical Analysis: Pierces weekly resistance trendline after China data

- USD/CNH rises after China’s downbeat Caixin Services PMI.

- A sustained break will escalate recovery to 200-HMA.

- Lows marked on Thursday/Friday seem to limit immediate declines.

USD/CNH breaks the immediate falling trend line while taking the bids to 6.9720 during early Monday.

The pair recently got a boost after China’s December month Caixin Services PMI slipped below 53.5 prior reading to 52.5.

With this, prices are now heading towards the 200-Hour Simple Moving Average (HMA) level of 6.9810. However, 6.9900/05 area comprising multiple lows marked around Christmas 2019 could challenge buyers afterward.

If at all the Bulls dominate past-6.9905, 7.000 mark will become their favorite.

On the contrary, 6.9565/6 horizontal region can restrict immediate declines ahead of the monthly low surrounding 6.9425.

USD/CNH hourly chart

Trend: Bullish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.