USD/CHF shifts negative and drops toward 0.9260 on soft USD

- USD/CHF retraced earlier gains after printing a daily high of 0.9316.

- Upbeat US economic data is bad for the greenback as the US Dollar weakens.

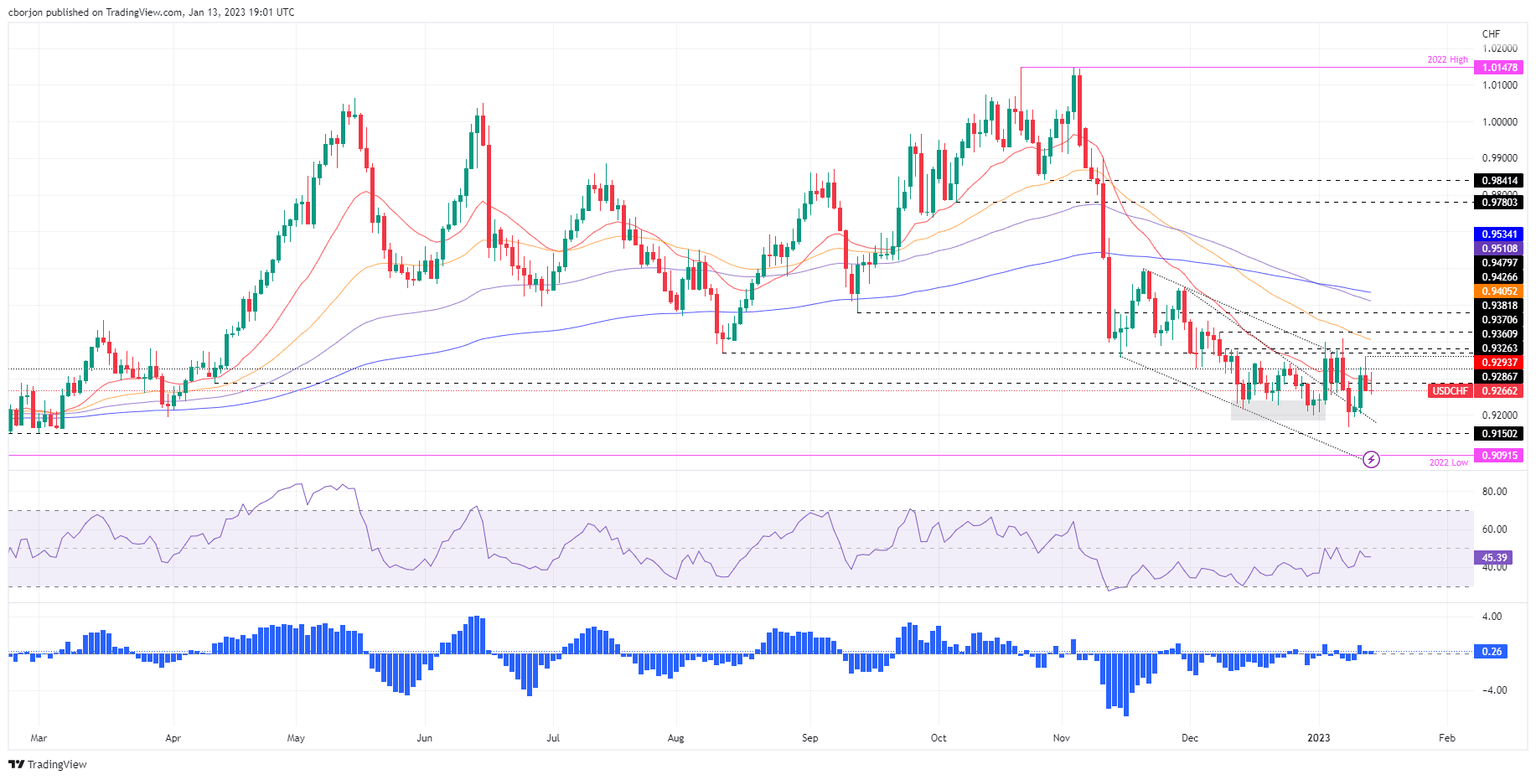

- USD/CHF Price Analysis: A break / daily close below 0.9300 would expose the pair to further selling pressure.

The USD/CHF is trading below its opening price, though it failed to crack the 20-day Exponential Moving Average (EMA) and missed to hold to 0.9300, albeit upbeat US data crossed newswires. Therefore, the USD/CHF is exchanging hands at 0.9265 at the time of writing.

Wall Street has resumed its uptrend after a brief hiccup that witnessed the S&P 500 and the Nasdaq turning red. Thursday’s release of softer inflation in the United States (US) spurred hopes for a less aggressive US Federal Reserve (Fed); hence the US Dollar (USD) weakened. A University of Michigan (UoM) survey showed that consumer sentiment improved, as it exceeded estimates of 60.5, hitting 64.6. In the same poll, inflation expectations for one year were revised to 4% from 4.4% in December, while for a five-year horizon, inflation is foreseen to hit 3% from 2.9% in the previous month.

In the meantime, the US Dollar Index (DXY), which measures the buck’s performance against a basket of six rivals, erases its earlier gains, down 0.04%, at 102.201.

During the session, the USD/CHF cleared the 20-day EMA at 0.9293 and cleared the 0.9300 mark. Nevertheless, as the greenback weakened, the major retreated those gains and is tumbling to fresh two-day lows around 0.9255.

USD/CHF Price Analysis: Technical outlook

From a technical perspective, the USD/CHF would likely continue its downtrend, though it’s fair to say that if not for the US CPI report missing estimates, the USD/CHF had momentum, and it could have tested the 50-day EMA at 0.9405. Aside from this, oscillators like the Relative Strength Index (RSI) and the Rate of Change (RoC) suggest that sellers remain in charge. Therefore, the USD/CHF key support levels would be 0.9200, followed by the current week’s low of 0.9167, ahead of the 2022 low of 0.9091.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.