USD/CHF Price Forecast: First breakout target met

- USD/CHF rises up and achieves the first price target for range breakout.

- The pair is now pulling back and RSI is threatening to exit overbought increasing bearish pressure.

- USD/CHF is in a solid uptrend so should continue higher to next target after the correction.

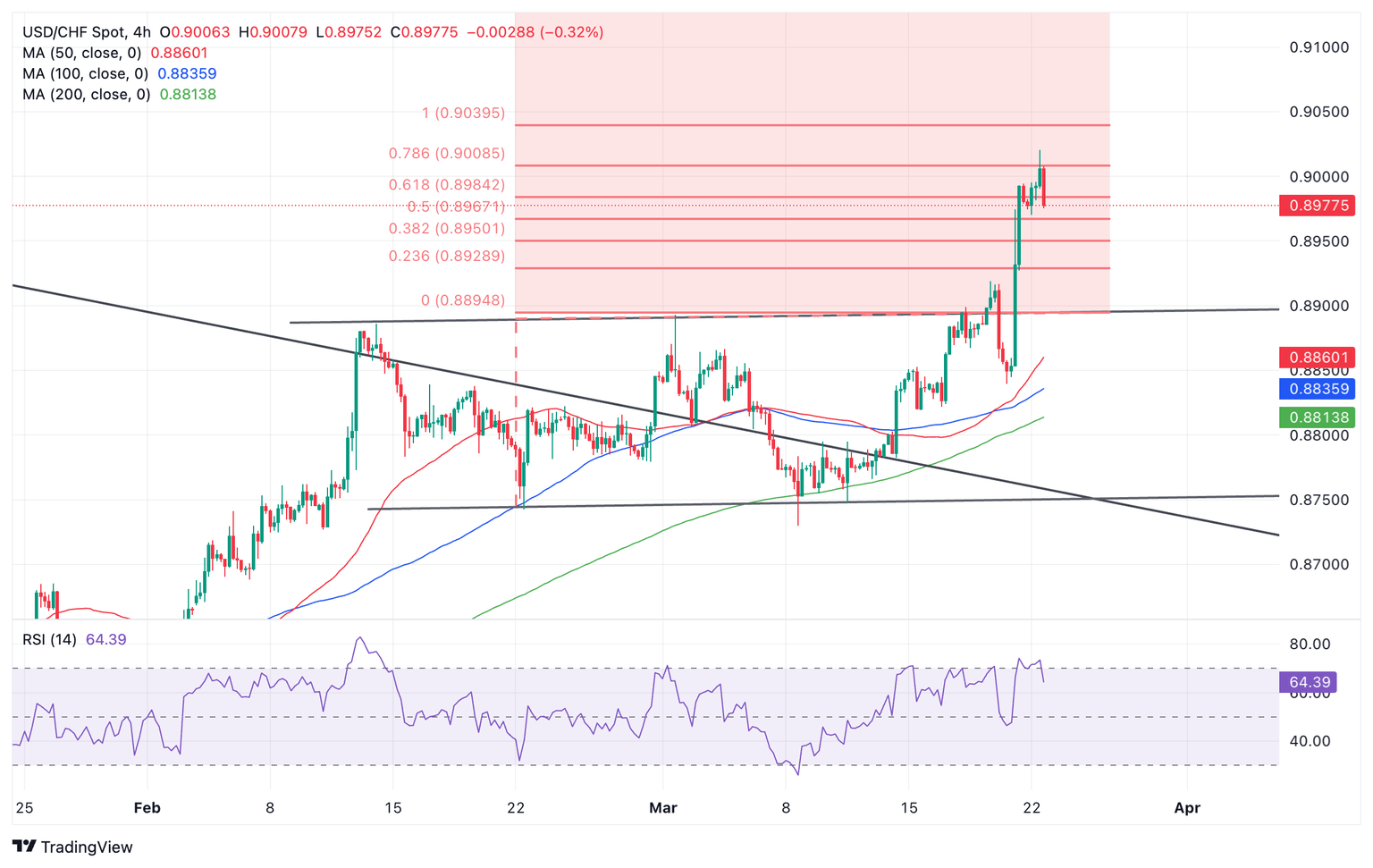

The USD/CHF is trading in the upper 0.8900s after breaking out of the top of a range it had been yo-yoing in since Valentine’s Day, and rallying higher.

The pair has now risen up and met the conservative target for the breakout at 0.8984 and is pulling back.

The technical method for establishing targets from range breakouts is by taking the 0.618 Fibonacci of the height of the range and extending it from the breakout point higher.

US Dollar versus Swiss Franc: 4-hour chart

The next target is at 0.9052, the full height (1.000 ratio) of the range extrapolated higher.

There is likely to be a correction before the next target is achieved, however, given the Relative Strength Index (RSI) is threatening to exit overbought territory on the current bar. Such an exit would provide a sell signal and reinforce the view that a correction is evolving.

If the current 4-hour period ends bearishly the exit from overbought will be confirmed. This would increase the chances of a continuation of the pullback, potentially to a target at the midpoint of the breakout rally, situated at 0.8930.

Beyond that, the pair is overall seen continuing the short-term uptrend that formed prior to the range.

It would take a break back below 0.8729 to suggest a short-term trend reversal and the start of a deeper slide.

The first target for such a move would be the 0.618 Fib. extrapolation of the height of the range at 0.8632, followed by the full extrapolation at 0.8577, which is also close to the 0.8551 January 31 lows, another key support level to the downside.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.