USD/CHF Price Analysis: Trims Monday’s losses but remains range-bound within the 0.9300-70s area

- The USD/CHF cuts some of Monday’s losses amidst a mixed market sentiment.

- Falling US Treasury yields weigh on the greenback, which losses against most currencies except the Swiss franc.

- USD/CHF Price Forecast: Range-bound within 0.9300-70 amid the lack of a fresh impulse.

The USD/CHF advances for the second consecutive day and is about to trim Monday’s losses amid a mixed market mood as portrayed by European and US equities fluctuating between gainers and losers as global bond yields fall. In the FX space, safe-haven peers remain the laggards, while the greenback remains defensive against most peers but the Swiss franc. At the time of writing, the USD/CHF is trading at 0.9333.

Meanwhile, US Treasury yields remain downward pressured, with the 10-year benchmark note down from 2.788% highs to 2.672%, a headwind for the greenback, as the US Dollar Index, a gauge of the buck’s value vs. six currencies, edges down 0.25%, sitting at 100.069.

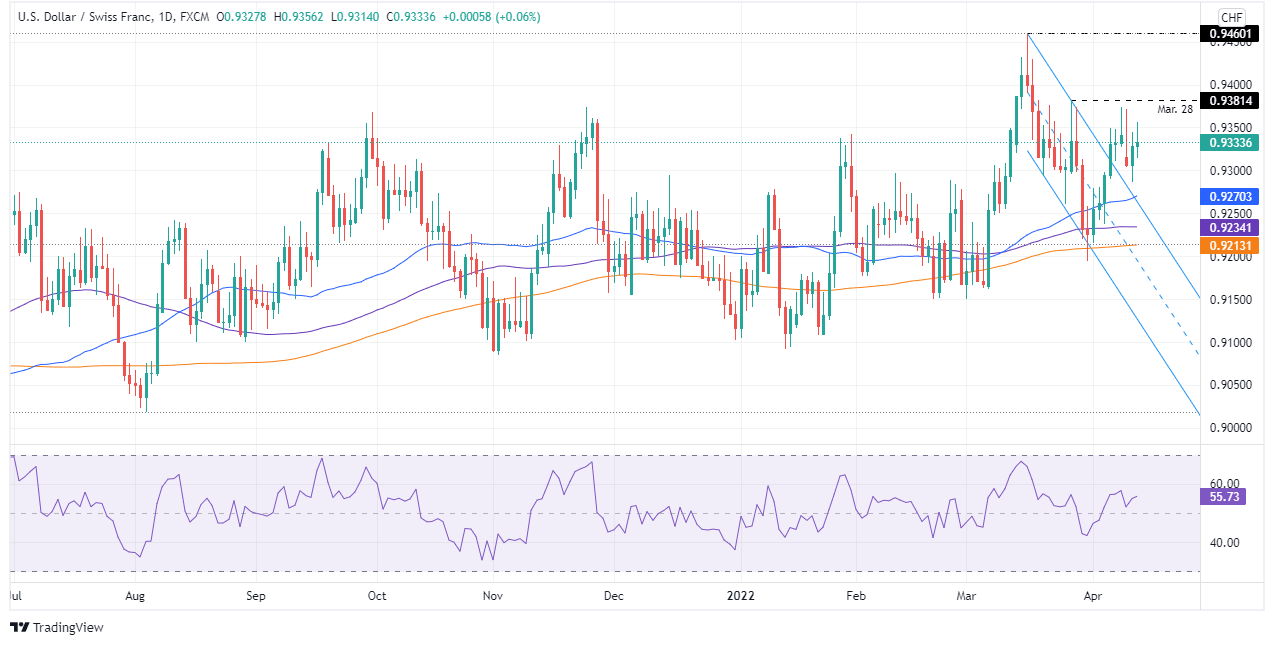

USD/CHF Price Forecast: Technical outlook

Overnight, the USD/CHF was subdued In the Asian Pacific session, but in the European one, it edged up above the R1 daily pivot, lying at 0.9353, forming a tweezer-top candlestick chart pattern, which dragged the USD/CHF down towards the 100-hour simple moving average (SMA) at 0.9332.

Meanwhile, the USD/CHF daily chart depicts the pair as upward biased, but it has remained consolidated in the 0.9300-70 area since April 6, amidst the lack of a catalyst.

Upwards, the USD/CHF’s first resistance would be the March 28 daily high at 0.9381. A breach of the latter would expose the psychological 0.9400 level, followed by the YTD high at 0.9460. On the downside, the USD/CHF first support would be 0.9300. A decisive break would expose the 50-day moving average (DMA) at 0.9270, followed by the 100-DMA at 0.9234 and the 200-DMA at 0.9213.

Technical levels to watch

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.