USD/CHF Price Analysis: Pullbacks from weekly highs, as a triple-top emerges in the H4

- USD/CHF retraces from weekly highs and dives below the 0.9800 figure due to a risk-on impulse.

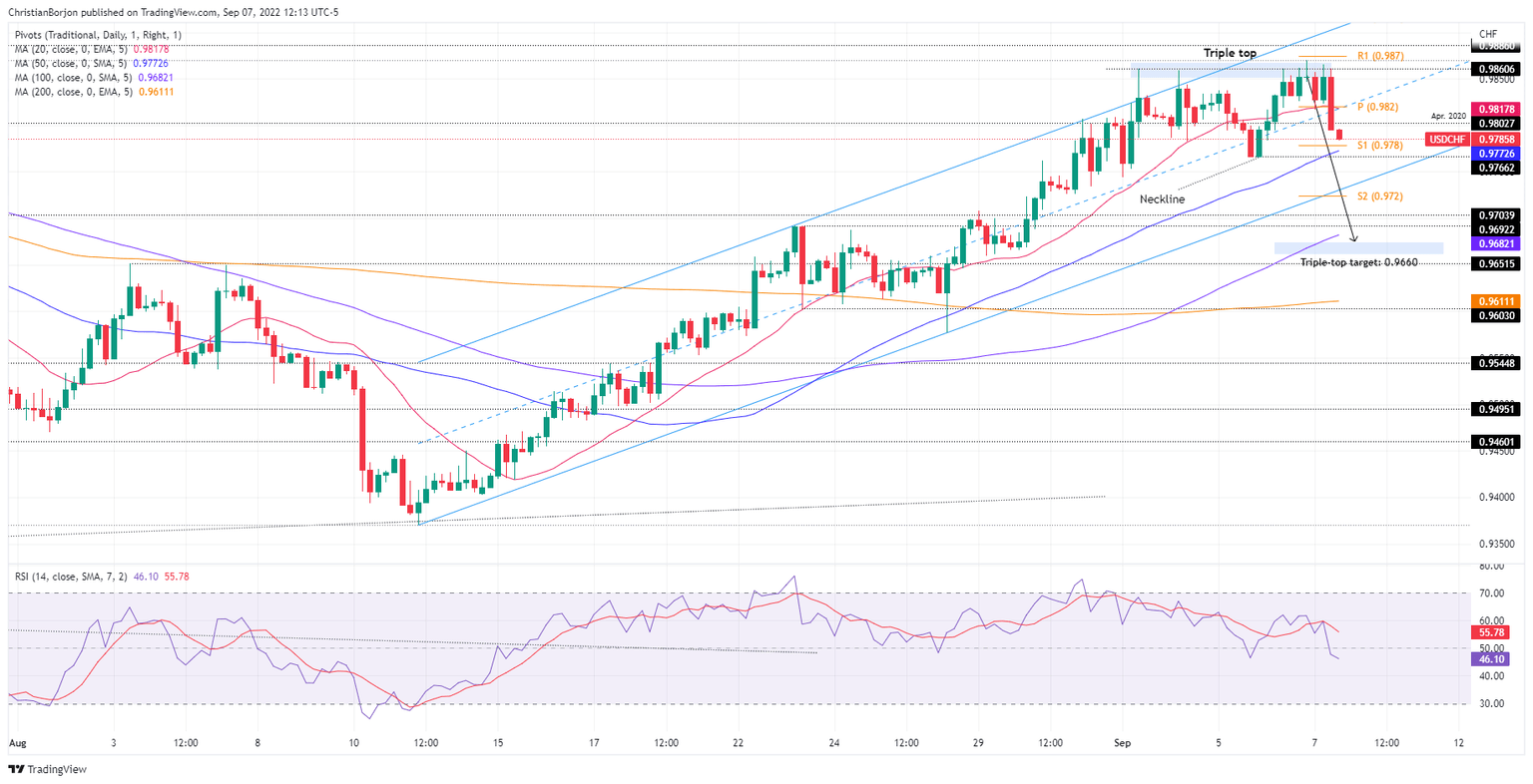

- A triple-top chart pattern in the 4-hour chart keeps the USD/CHF under some selling pressure, targeting a fall to 0.9660.

USD/CHF slides from weekly highs reached at around 0.9869 on Wednesday, despite risk appetite improving, which usually benefits riskier assets during the day. The USD/CHF is trading at 0.9783, below its opening price, by 0.51%.

USD/CHF Price Analysis: Technical outlook

The USD/CHF is pulling back after reaching a solid weekly high at around 0.9869, set during the overlap of the Asian/European session, courtesy of market sentiment shifting sour. Nevertheless, as the North American session progressed, investors’ mood improved, as seen by US equities trading in the green.

In the USD/CHF case, the Swiss Franc strength dragged prices lower, so far clearing on its way south the 0.9800 figure.

Short term, the USD/CHF four-hour chart, illustrates a formation of a triple-top chart pattern, and so far, the major is retreating from weekly high levels, approaching the “neckline” around the 0.9766 area. A decisive breach of the latter could send the major tumbling towards the triple-top measured target at 0.9660, but first, it will need to overcome some hurdles on its way south.

The USD/CHF first support would be the bottom-trend line of an ascending channel drawn since August 11, around 0.9720, followed by the 0.9700 figure, followed by the 100-EMA at 0.9680.

USD/CHF Key Technical Levels

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.