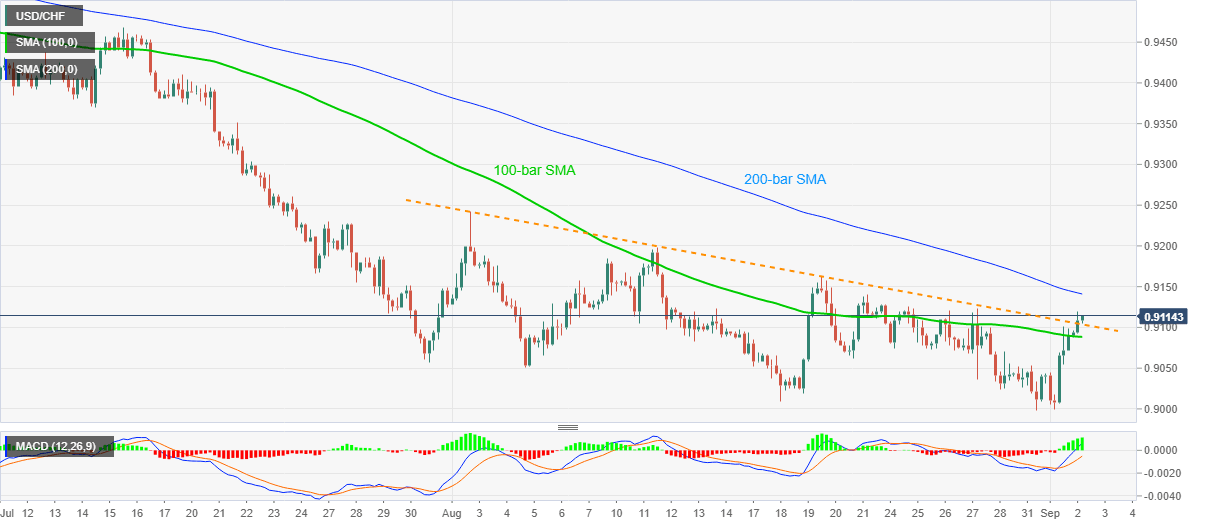

USD/CHF Price Analysis: Pierces 0.9100 after breaking monthly falling trend line

- USD/CHF attack one-week high following upside clearance of a descending trend line from August 03.

- Bullish MACD directs the quote towards 200-bar SMA.

- Sellers may wait for re-entry once the pair slips below 100-SMA.

USD/CHF picks up bids near 0.9110, up 0.21% on a day, during the pre-European session on Wednesday. The pair recently broke a one-month-old resistance line, now support, amid bullish MACD.

As a result, the buyers are attacking a 200-bar SMA level of 0.9145 before targeting the August 20 peak surrounding 0.9160.

However, the pair bears are not going to go back unless the bulls conquer August month high around 0.9240/45.

On the flip side, the pair’s weakness below the previous resistance line, at 0.9100 now, will be challenged by a 100-bar SMA level of 0.9088.

It should, however, be noted that the extended fall below 0.9088 might not hesitate to aim for the yearly bottom close to 0.9000.

USD/CHF four-hour chart

Trend: Further recovery expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.