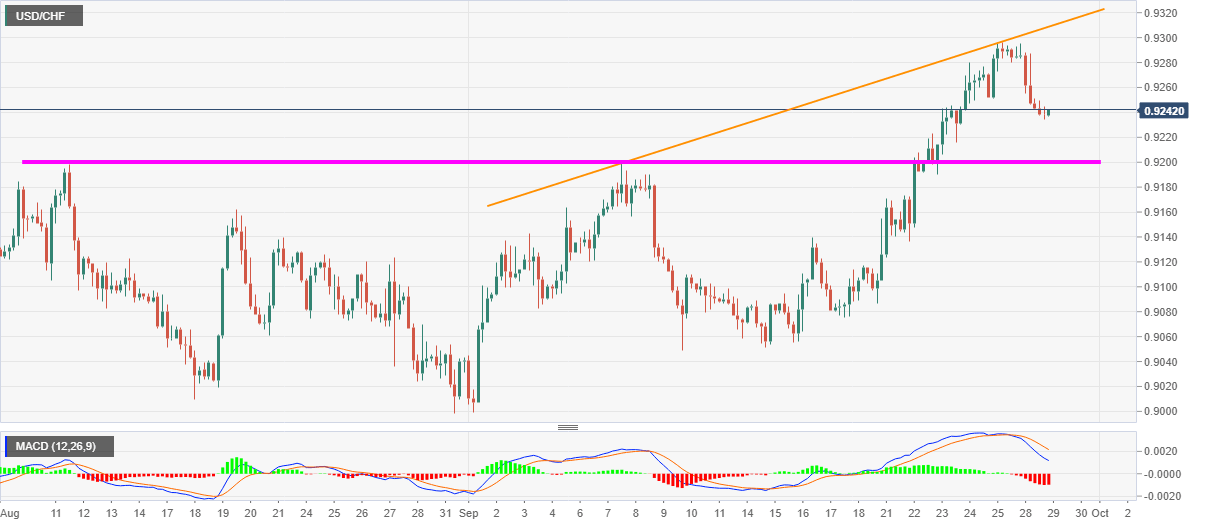

USD/CHF Price Analysis: On its way down to 0.9200

- USD/CHF extends Monday’s downbeat performance to probe the three-day lows.

- Bearish MACD favors sellers targeting seven-week-old horizontal support.

- Ascending trend line from September 08 can question the bulls beyond the monthly top.

USD/CHF seesaws around intraday low, currently down 0.05% on a day near 0.9240, while heading into Tuesday’s European session. The pair took a U-turn from over two months’ high on Friday and fell since then.

With the recent declines taking clues from the MACD histogram, the quote is likely to weaken further towards an area comprising highs marked since August 12, close to 0.9200.

If at all the bears refrain from stepping back from 0.9200, August 20 top near 0.9160 and September 17 peak close to 0.9140 may get the market attention.

Meanwhile, 0.9250 and 0.9280 can offer immediate resistance to the pair ahead of fueling it to the monthly peak of 0.9296.

Though, a three-week-old rising trend line, at 0.9310 now, can question the USD/CHF bulls beyond the 0.9300 mark.

USD/CHF four-hour chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.