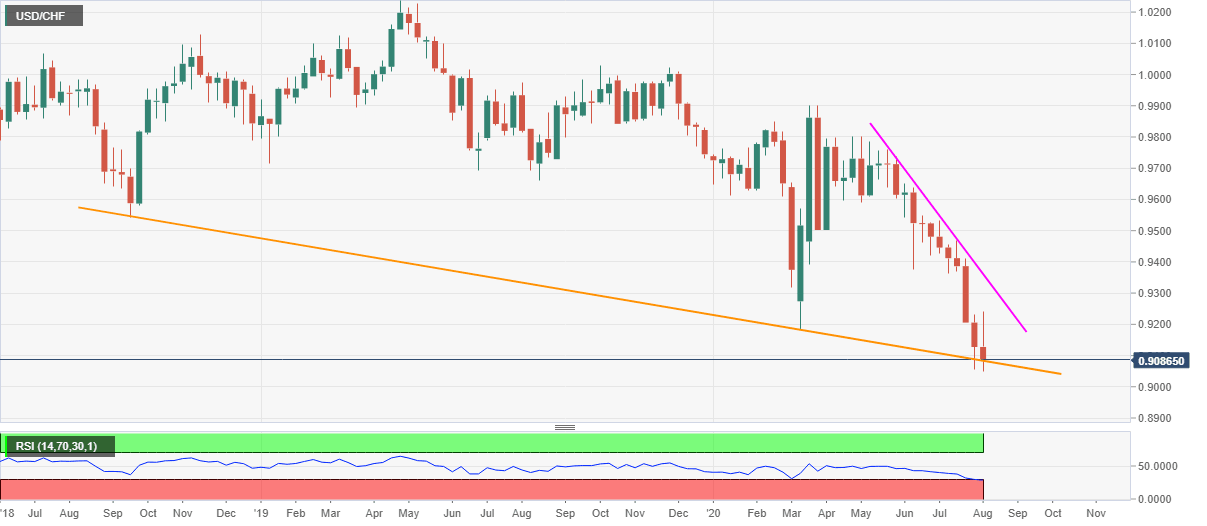

USD/CHF Price Analysis: 23-month-old support line keeps buyers hopeful

- USD/CHF attacks upper end of the 0.9075/88 trading range.

- Oversold RSI, a falling trend line from September 2018 favor the bulls.

- June 2014 top can offer immediate support, pullback will have to cross 0.9250 to convince buyers.

USD/CHF keeps the short-term trading range between 0.9075 and 0.9088, currently around 0.9087, during the major part of Thursday’s Asian session. The quote slumped to the early-2015 bottom the previous day. However, longer-term falling trend line joins oversold RSI conditions to challenge the bears.

Considering the pair’s failures to slip beneath the recent lows of 0.9050, while repeating the last week's bounce, buyers should be watchful of any upside clearance of 0.9100. The same could recall 0.9155 back to the chart. However, Monday’s peak near 0.9245, followed by 0.9250 round-figures could challenge the bulls afterward.

In a case where the pair manages to stay strong past-0.9250, odds of its run-up to the early-July lows near 0.9360 can’t be ruled out.

Meanwhile, any further downside past-0.9050 will have to break 0.9000 psychological magnet to mark the bears’ strength. Though, June 2014 high near 0.9035 can act as immediate support.

USD/CHF weekly chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.