USD/CHF drops beneath the 0.9400 mark after Fed decision on mixed sentiment

- The USD/CHF is losing 0.29% in the North American session.

- Geopolitics and central bank tightening conditions keep the mood fluctuating.

- USD/CHF Price Forecast: Remains upwards, but a break under 0.9373 would exert downward pressure in the pair.

The USD/CHF continues sliding for the second consecutive trading day after a hawkish Federal Reserve increased rates by 25 bps and expects to hike for the remainder of the year, meaning six more increases are yet to come. At the time of writing, the USD/CHF is trading at 0.9377.

Geopolitics and tightening monetary policy conditions keep markets whipsawing

Mixed market sentiment clouds the financial markets, as European and US equity indices fluctuate in the green/red, courtesy of Russia’s invasion of Ukraine and central bank tightening monetary conditions.

Discussions between Russia and Ukraine continue, though they were qualified as challenging by Ukraine’s President Zelensky, while one of his aids and Defense Minister said that there is nothing to satisfy us in negotiations with Russia. On the Russian side, the Foreign Minister Lavrov says discussions persist, and the Kremlin added that their delegation is putting “colossal energy” into Ukraine peace talks.

Aside from this, on Wednesday, the US Federal Reserve began its tightening cycle, increasing rates 25 basis points, and the so-called dot-plot, a projection of the Federal Fund Rates (FFR), foresees six more hikes in the rest of 2022. Furthermore, Fed members revealed that the US economy would grow by 2.8%, a 1% drop compared to December projections. Fed’s favorite gauge of inflation, the core Personal Consumption Expenditure (PCE), is estimated to peak around 4.1%.

Earlier in the North American session, the US docket featured Initial Jobless Claims for the week ending on March 12, which came at 214K, lower than the 220K expected, while Industrial Production for February showed some strength, rose by 7.5%y/y higher than the 3.6% previous reading.

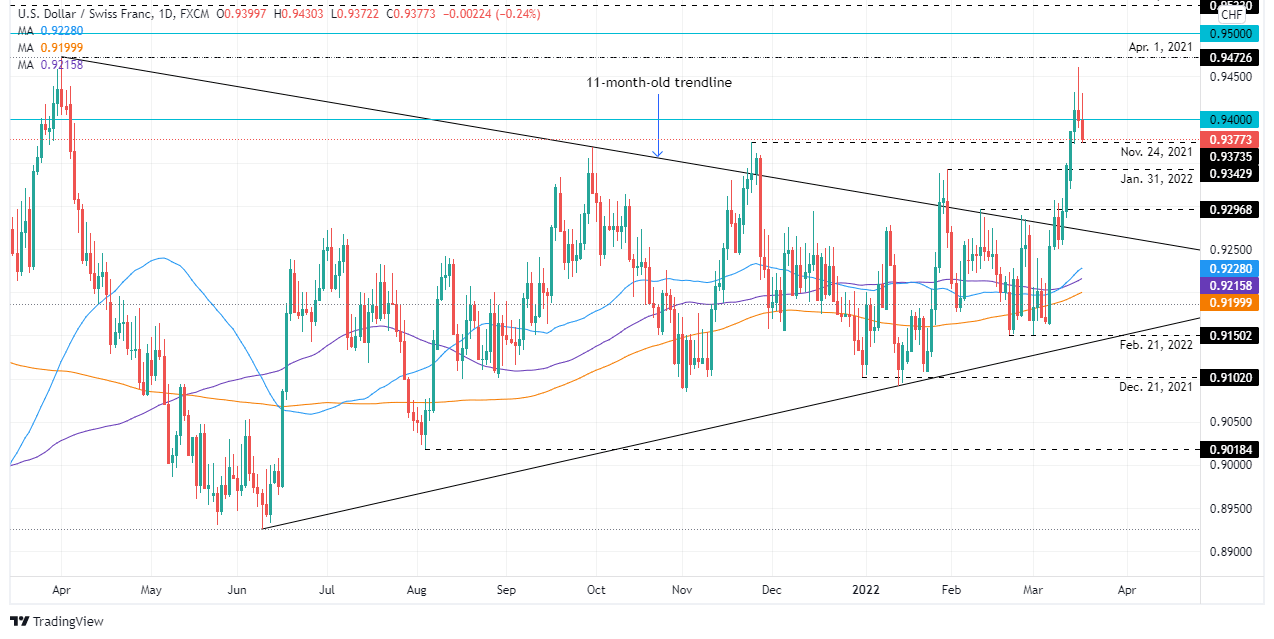

USD/CHF Price Forecast: Technical outlook

Overnight, the USD/CHF seesawed around the 0.9400-20 area after the US central bank hiked rates

The USD/CHF bias is upwards, but downside risks persist unless USD/CHF bulls hold the exchange rate above the November 24, 2021, high at 0.9373, previous resistance-turned-support. In that event, the 0.9400 would be the first resistance, followed by March 15 high at 0.9431. Once cleared, the next stop would be April 1, 2021, high at 0.9472, exposing the 0.9500 mark once cleared.

On the flip side, the USD/CHF first support would be 0.9373, followed by January 31 resistance-turned-support at 0.9343 and the 0.9300 psychological level.

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.