- Vaccine optimism following Moderna’s update this morning has boosted CAD, sending USD/CAD below 1.3100.

- Having rejected its 21DMA last week and broken to the downside of a rising wedge structure, USD/CAD eyes a run at 1.3000.

In the late European session morning, USD/CAD slumped below the 1.3100 level and now trades with losses of around 30 pips on the day or down a little over 0.2%.

CAD derives risk-driven boost, tracks higher crude

Risk assets, including CAD, received another vaccine driven boost on Monday morning, almost exactly one week following Pfizer and BioNtech positive vaccine announcement last Monday. Moderna released the results of their Phase 3 Covid-19 vaccine trail, and their vaccine might be even better than Pfizer/BioNtech’s. Firstly, it has a slightly higher efficacy rate at 94.5% (Pfizer/BioNtech’s vaccine was about 90%) and secondly, it can be stored at refrigerator temperatures (Pfizer/BioNtech’s vaccine must be kept frozen, which presents a key logistic/distributional challenge).

Admittedly, this latest boost to risk appetite has been much more modest; as noted by various analysts and market commentators following Moderna’s Monday announcement, markets are now expecting vaccine makers that use a similar technology to Pfizer and BioNtech (like Moderna) to yield similar results. The fact that Pfizer/BioNtech's vaccine was able to achieve 90% efficacy with their vaccine was a big surprise one week ago. The fact that Moderna’s vaccine has 94.5% efficacy is great news, but less of a surprise.

Nonetheless, financial markets have again cheered; the S&P 500 currently trades with gains in excess of slightly less than 1% and the index is back above 3600 and the Dow hit all-time highs, while US yields have again moved higher and the yield curve steepened. Over in Europe, the Stoxx 600 closed higher by around 1.3%. Meanwhile, crude oil prices, although off earlier highs, continue to trade with solid gains on the day (WTI +2.8%), driven higher not just by the vaccine news but also by the prospect of a three-month extension of current OPEC+ output cuts (indicated by sources following Monday’s meeting of the OPEC+ Joint Technical Committee, which proceeds the actual OPEC+ meeting later in the month).

FX markets are also feeling the positive vibes, with risk-sensitive currencies leading the way, while traditional havens (JPY, CHF, USD), as well as GBP (due to more news of Brexit deadlock) and EUR (amid jawboning against the EUR from ECB’s de Cos) are the laggards.

CAD has thus traded as a function of broader risk appetite and crude oil prices on Monday, rather than on its own domestic drivers. Canadian Manufacturing Sales at 13:30GMT came in bang in line with expectations at 1.5% MoM. Thus, CAD price action looks set to continue to be determined by global risk dynamics and crude prices, at least up until tomorrow’s Canadian Consumer Price Inflation data for October as 13:30GMT, which ought to be interesting, at least from the Bank of Canada's perspective.

USD/CAD in bearish wedge structure, eyes further downside

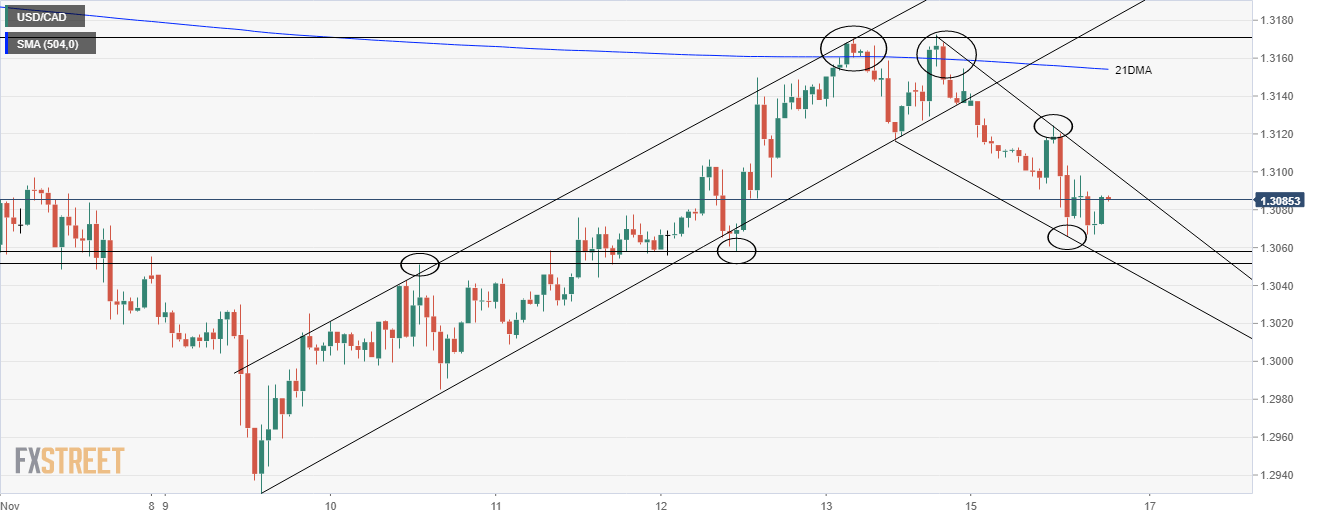

Having broken to the south of an upwards trend channel at the re-open of trade this week, USD/CAD has continued to the south, taking out the 1.3100 level. For now, the pair has been unable to push much lower than the 1.3070 level but is arguably now in a short-term bearish wedge structure (see the one hour chart). As such, the bears will be eying an imminent test of the next support area around 1.3050 (10 November high, 12 November low).

Below that, there is very little by way of notable levels of support keeping the pair away from a test of the psychological 1.3000 level, and below that the 10 November low at 1.2985 and then the 9 November low at 1.2930. A break below November’s low point would take USD/CAD back to its lowest levels in over two years.

Conversely, to the upside, there is the 1.3100 level, which has been capping the price action since before the start of Monday’s US session. A break above that and to the upside of the short-term bearish wedge structure that prices are currently bound within would open up a test of Monday’s early European session highs at just above 1.3120.

Further to the upside sits USD/CAD’s 21-day moving average (DMA) at 1.3152, which proved solid resistance at the back end of last week. Above this, the 50DMA resides at 1.3204.

USD/CAD hourly chart

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.