USD/CAD Price Analysis: On the bids above 1.3320/25 resistance confluence

- USD/CAD stays on the front foot after clearing the key upside barrier.

- September high is on the bulls’ radar, mid-October tops add filter during the pullback.

- Bullish MACD, sustained break of crucial resistance favor buyers.

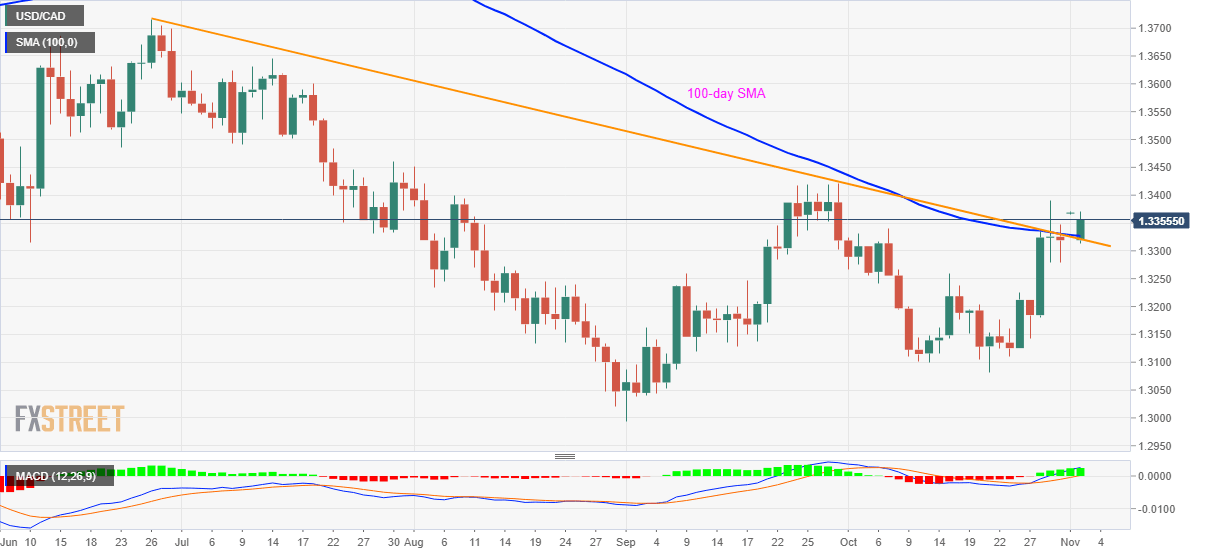

USD/CAD rises to 1.3365, an intraday high of 1.3370 during Monday’s Asian session. The loonie pair recently crossed a confluence of 100-day SMA and a falling trend line from June 26 amid the bullish MACD.

As a result, the bulls are targeting September month’s high of 1.3420 while also concentrating on the October peak close to 1.3390 and the 1.3400 threshold as immediate upside barriers.

If the bullish MACD favors USD/CAD buyers to clear 1.3420 resistance, the late-July high of 1.3459 and the June 23 low surrounding 1.3485 can return to the charts.

On the contrary, a daily closing below 1.3320/25 technical joint can revisit the October 15 high of 1.3259.

However, USD/CAD bears are less likely to get confirmation until the quote stays above October month’s trough near 1.3080.

USD/CAD daily chart

Trend: Bullish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.