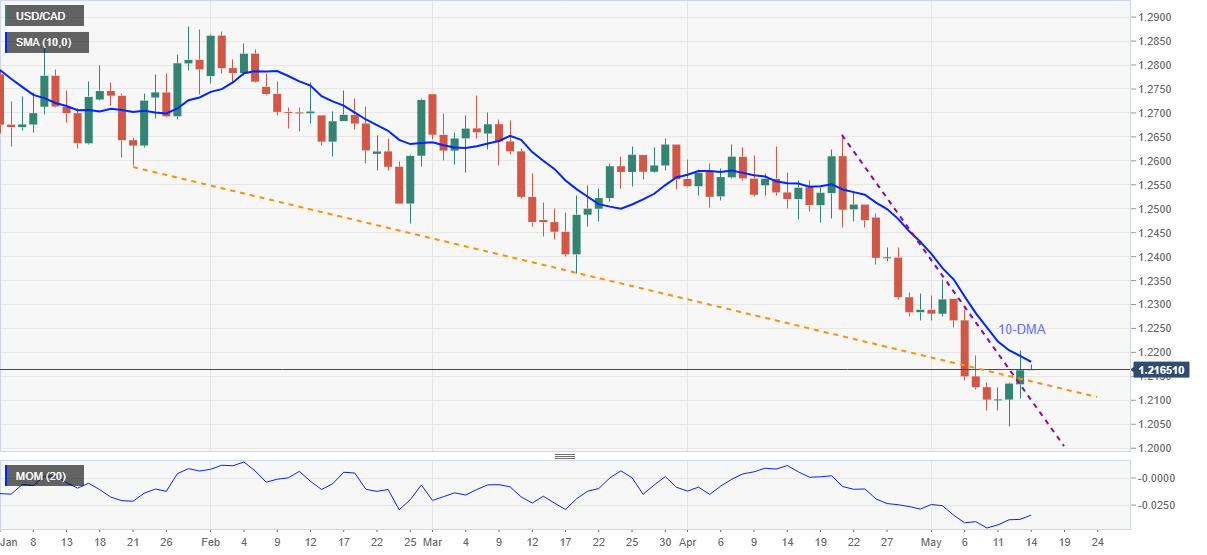

USD/CAD Price Analysis: Bulls battle 10-DMA above nearby key hurdles

- USD/CAD wavers inside a choppy range after crossing crucial previous supports.

- Momentum recovery joins the trend line breakout to keep buyers hopeful.

- Fresh selling may wait for a clear break below 1.2000 threshold.

USD/CAD eases from the immediate trading range’s resistance line, around 1.2165, during the early Friday. The Loonie pair crossed two key ex-support lines, from late January and April respectively, the previous day.

Given the daily closing beyond the key hurdles, now supports, taking clues from Momentum uptick, USD/CAD bulls are likely to overcome the adjacent Simple Moving Average (DMA), around 1.2180.

The DMA break is likely to extend the recovery moves towards 1.2270 and the monthly top near 1.2350 before highlighting March’s low of 1.2365 as the key resistance.

Alternatively, 1.2140 and 1.2100 can test the pair’s fresh downside. However, USD/CAD bears are less likely to be convinced unless witnessing a clear break below the 1.2000 round-figure as multiple levels can entertain sellers around 1.2065 and 1.2050.

Overall, USD/CAD is up for a corrective pullback but the bearish trend remains intact.

USD/CAD daily chart

Trend: Further recovery expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.