- USD/CAD extends decline in tandem with the US dollar.

- The bulls defending the critical support near 1.2715, for now.

- Focus shifts to the Canadian data and Treasury Sec. nominee Yellen.

USD/CAD extends the pullback from five-day tops into Tuesday, although the bears appear to take a breather following a steady decline from 1.2760.

The spot fell in tandem with the US dollar, as the return of risk-on flows weighed on the safe-haven demand for the greenback. Markets cheer calls for higher fiscal stimulus under Biden’s presidency after Treasury Secretary Nominee Janet Yellen urged Congress to do more to fight the pandemic recession.

On Monday, USD/CAD rallied hard and tested the 1.2800 level after the Canadian dollar was hit by the reports that Biden is expected to cancel the controversial Keystone XL Pipeline on his first day in office.

The pipeline is projected to carry oil nearly 1,200 miles (1,900km) from the Canadian province of Alberta down to Nebraska, to join an existing pipeline.

Markets now await the Canadian Manufacturing Sales data and Yellen’s inaugural speech as the Treasury Secretary due later in the NA session today for fresh trading directives.

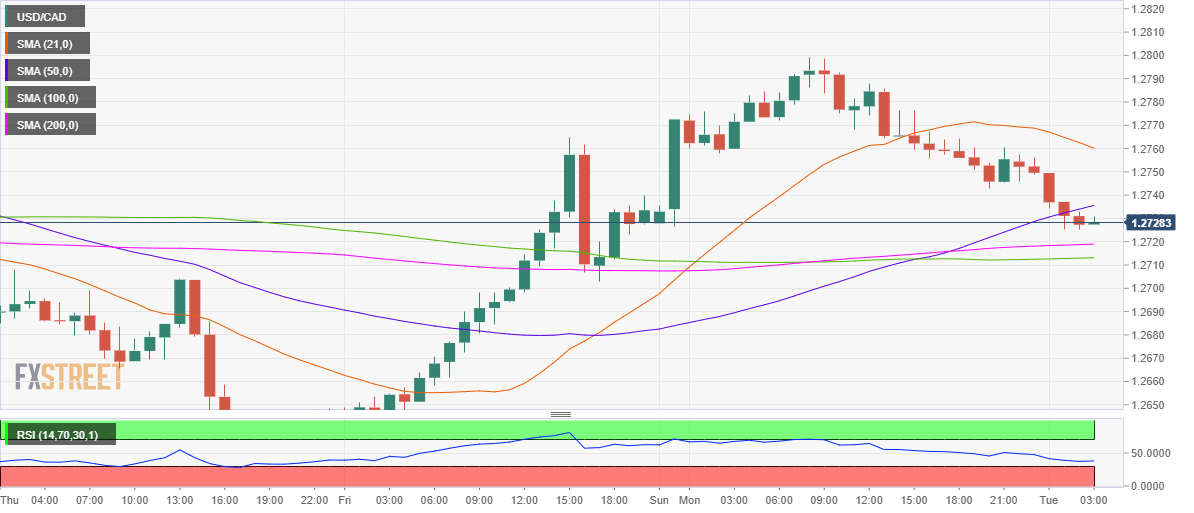

From a near-term technical perspective, the price has stalled its decline above the critical support near 1.2715, which is the confluence of the 200-hourly moving average (HMA) and 100-HMA.

The Relative Strength Index (RSI) has also taken a U-turn from lower levels, suggesting a brief bounce.

The bullish 50-HMA support now resistance at 1.2736 will be tested on the road to recovery. A break above the latter could expose the bearish 21-HMA barrier at 1.2760.

To the downside, a breach of the 1.2715 support could call for a test of the 1.2700 psychological level. The next relevant support is aligned at the January 13 low of 1.2680.

USD/CAD: Hourly chart

USD/CAD: Additional levels

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

USD/JPY pops and drops on BoJ's expected hold

USD/JPY reverses a knee-jerk spike to 142.80 and returns to the red below 142.50 after the Bank of Japan announced on Friday that it maintained the short-term rate target in the range of 0.15%-0.25%. The decision aligned with the market expectations. Governor Ueda's presser eyed.

AUD/USD bears attack 0.6800 amid PBOC's status-quo, cautious mood

AUD/USD attacks 0.6800 in Friday's Asian trading, extending its gradual retreat after the PBOC unexpectedly left mortgage lending rates unchanged in September. A cautious market mood also adds to the weight on the Aussie. Fedspeak eyed.

Gold consolidates near record high, bullish potential seems intact

Gold price regained positive traction on Thursday and rallied back closer to the all-time peak touched the previous day in reaction to the Federal Reserve's decision to start the policy easing cycle with an oversized rate cut.

Ethereum rallies over 6% following decision to split Pectra upgrade into two phases

In its Consensus Layer Call on Thursday, Ethereum developers decided to split the upcoming Pectra upgrade into two batches. The decision follows concerns about potential risks in shipping the previously approved series of Ethereum improvement proposals.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.