US Pres. Trump to hold China news conference on Friday, risk-off themes will be in play

The US President Donald Trump will hold a news conference on China this Friday. This will likely include the president's opinions on COVID-19 and China's handling of it, trade relations, currency wars and the US administration's political response to China’s parliament approving a decision to go forward with national security legislation for Hong Kong. This was a move that has triggered widespread concern about democratic freedoms.

So far, we know that the US has already announced that it has cancelled visas for Chinese students with ties to military schools and that it has stripped Hong Kong of its special treaty status, certifying it as no longer autonomous.

Market implications

The ramifications for financial markets could be enormous. We have already seen the value of the CNY weaken vs. the USD which will likely raise concerns that China could be weaponising its currency to support external trade.

FX markets will be keeping a close eye on these developments and AUD, JPY, HKD, USD and CNH markets will all be responding in kind. Equities could also take a hammering, (S&P 500 losing 30 points on the announcement and DJIA has now fallen into negative territory for the day).

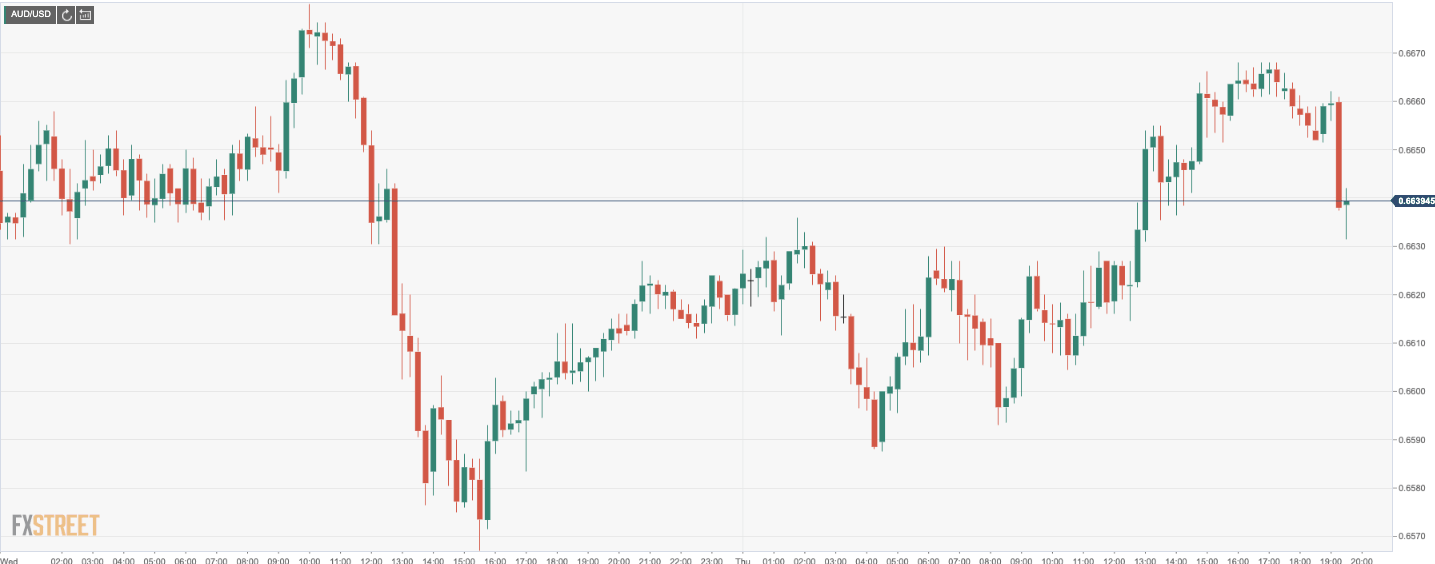

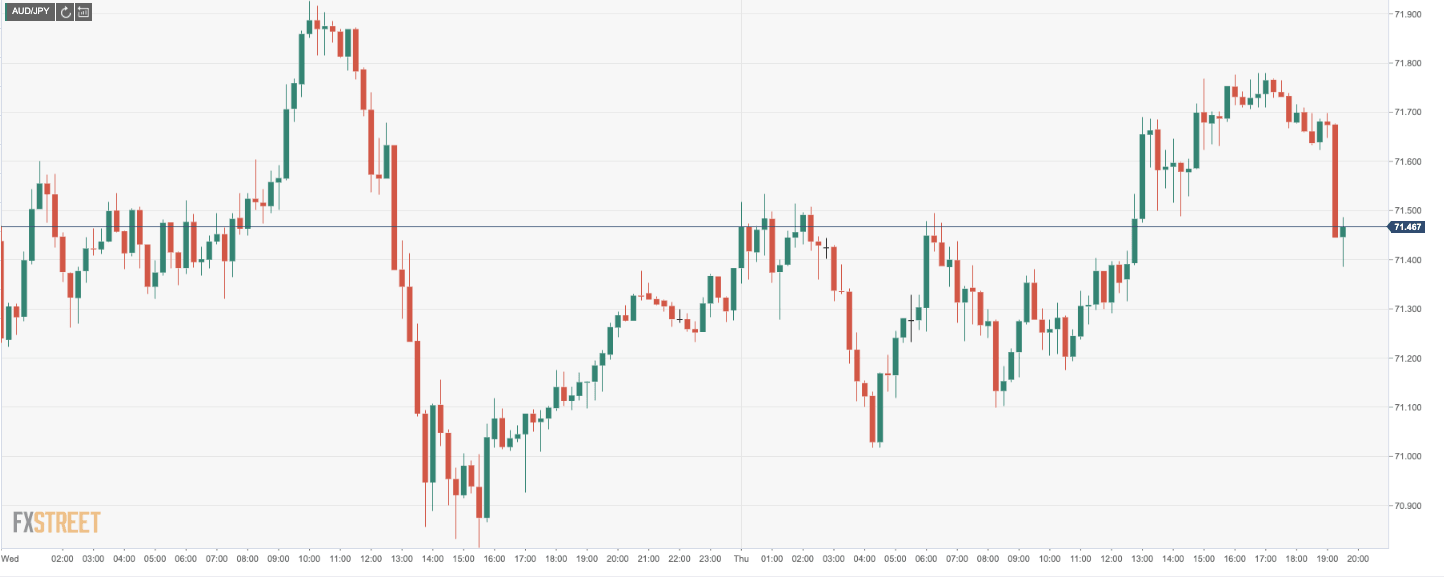

AUD/USD and AUD/JPY are already falling in anticipation as well:

AUD/USD 15 mins chart

AUD/JPY 15 mins charts

This is a theme that has been brewing since the start of this week. More on all of this in the following notes from earlier this week:

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.