US Elections: A decisive Democratic victory to hit the USD – Nordea

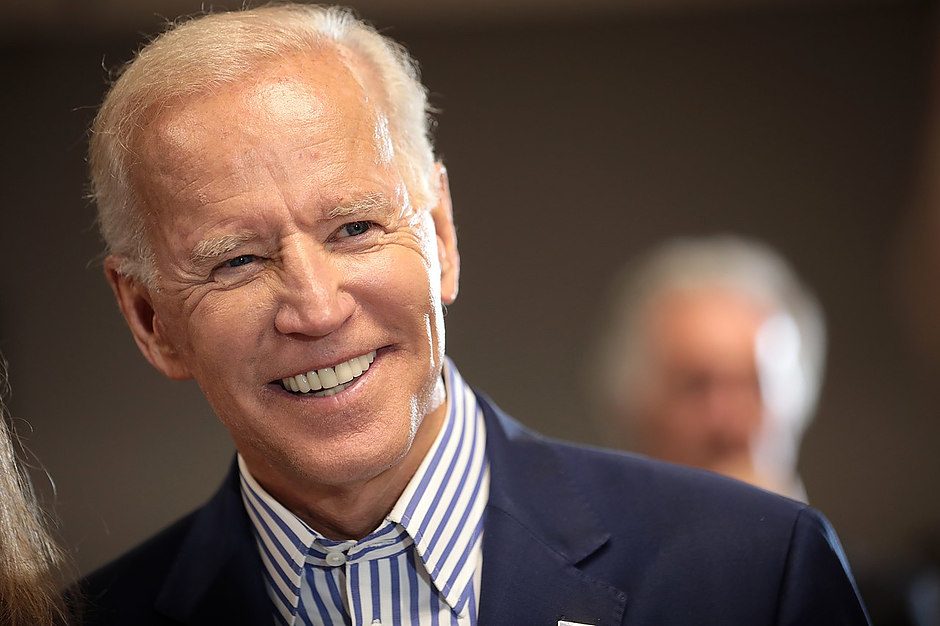

The stakes are high and the result is far from clear in the US November elections. A Biden victory would drive EUR/USD higher, while his tax plans could cause some concerns amidst equity investors. On the other hand, a second term for Trump would be full of uncertainties, strategists at Nordea report.

Key quotes

“We think the race is much closer than the polls imply, and even if a Biden victory is the most likely outcome, such a scenario is far from a given. If Biden wins and the Democrats also take control of the Senate (the House is very likely to remain in Democratic hands in any case), we could expect to see European assets outperforming US ones and a higher EUR/USD.”

“The tax hike aspects of Biden’s agenda could put some pressure on equity markets. Even if the tax hikes are mainly targeted towards higher-income taxpayers, his plans would include higher corporate, dividend and capital gains taxes, which could scare equity investors to some extent. In the short run, however, sizable fiscal stimulus could offset such concerns.”

“A Trump victory coupled with a Republican-led Congress remains a viable scenario as well (around 30% probability). Trump would favour more tax cuts, deregulation and a more limited stimulus package. The Democratic House would probably block most of his plans, though Trump could push through some more deregulation using his presidential powers. Trump could quickly become frustrated by the inability to forward his domestic agenda, and could concentrate on trade policies instead. The trade war could escalate and his unpredictability could dent risk appetite longer out. Global trade policy would become even more uncertain, supporting the USD. EUR/USD would drop, especially if tariffs on European cars would return on his agenda.”

Author

FXStreet Team

FXStreet