US dollar sinks below bearish 10/20 EMA crossover, CPI aftermath

- There are bearish bets on the US dollar as market prices out Fed reaction to CPI.

- Bond market figure inflationary transitory only.

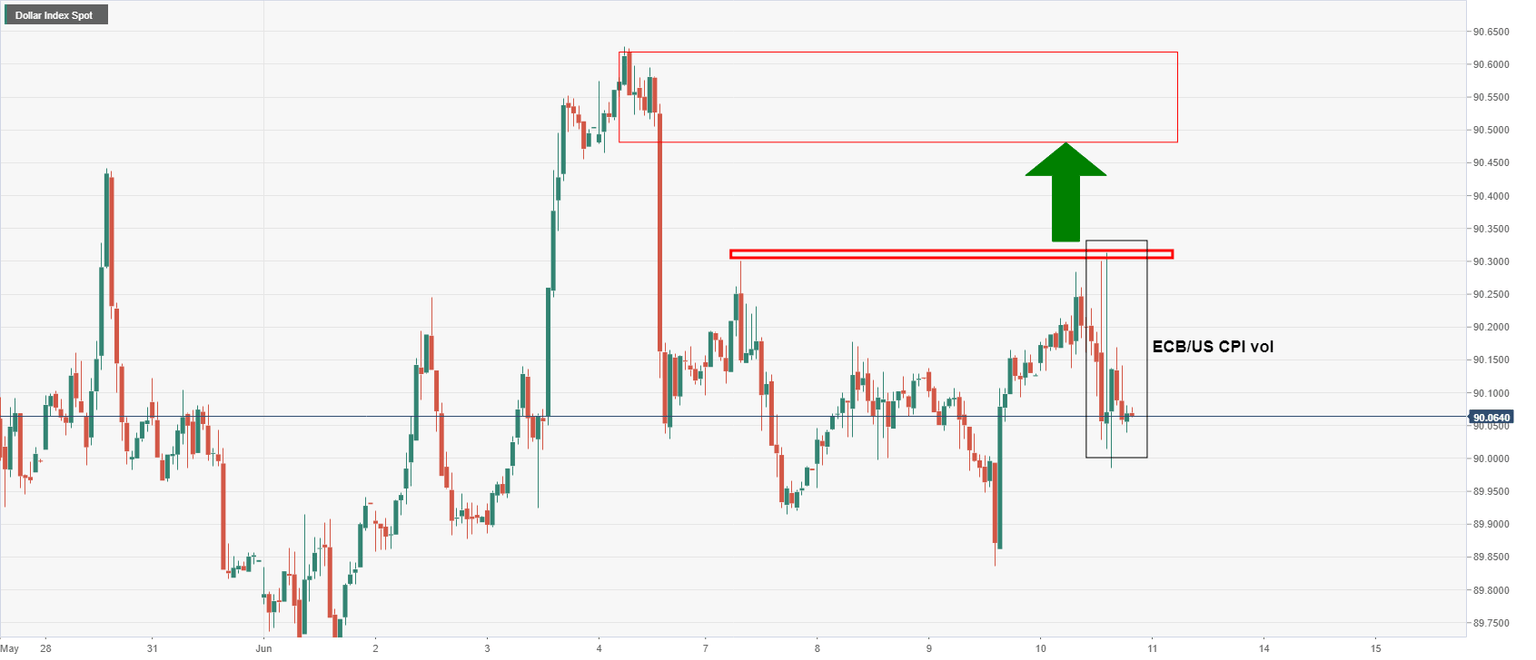

The greenback switched from bullish pre-US Consumer Price Index data, edging higher for a third straight day the highest level since Monday at around 90.30, to bearish post the event.

The CPI rose 0.6%, with core up 0.7%, stronger than expected. Also, the US CPI rose 5.0% YoY which was the largest annual gain in more than a decade

However, the outcome was not entirely a surprise given the potential changes as the economy re-opens.

''All in all, strong core data again, but the strength can probably still be viewed as "transitory" to a large extent, due to post-COVID reopening as well as fallout from the semiconductor shortage,'' analysts at TD Securities said.

''We don't think this report materially changes the Fed's thinking as much of the strength remains confined to reopening-related sectors.''

''... it would take a string of strong CPI reports later this year for the Fed to get concerned about an earlier overshoot.''

US treasury yields were falling for the 3rd consecutive day on Thursday, despite stronger than expected CPI as the bond market prices out the Fed.

The data was arguably in line with the Fed’s ‘transitory’ judgement.

The 2-year government bond yields fell to 0.15%, while 10-year bond yields rose to 1.53% before tumbling down to 1.43%.

Meanwhile, forex volatility is at its lowest since the turn of 2020:

DXY hourly chart

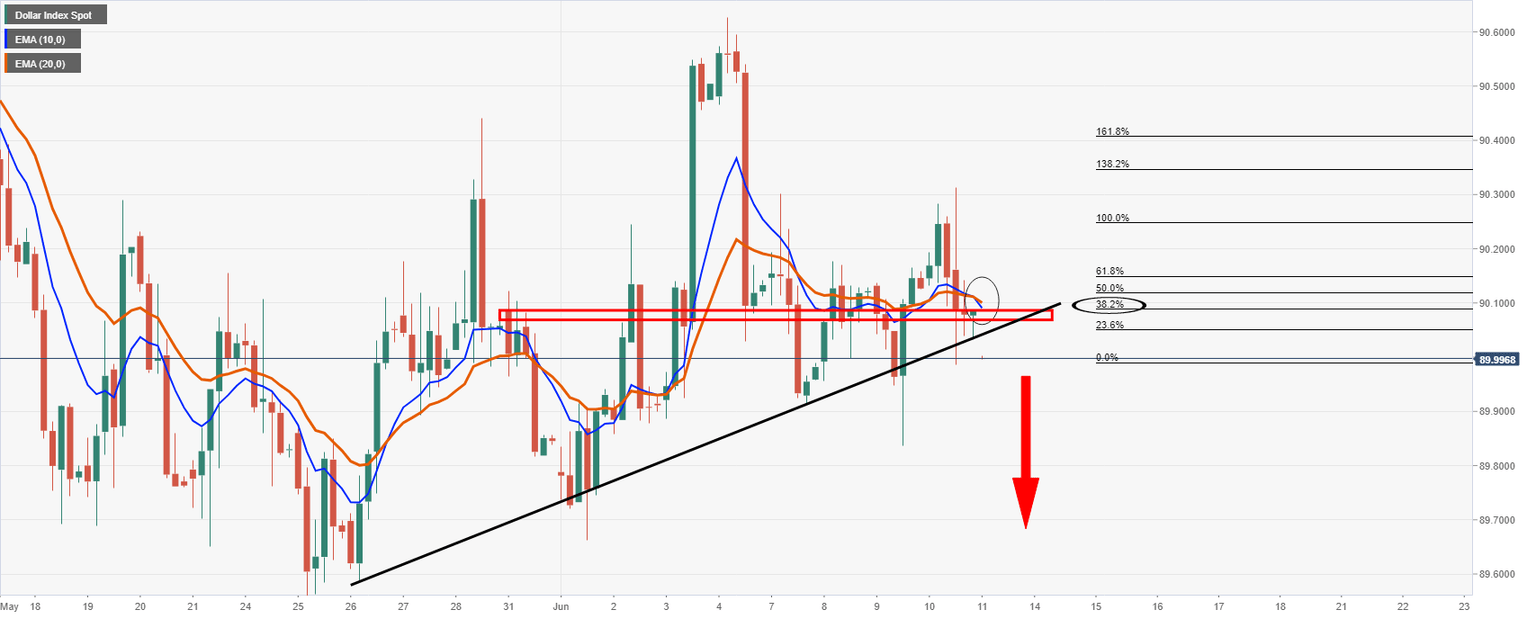

The Fed is in focus for next week and the dollar keeps sliding, now trading below a significantly bearish development on the 4-hour time frame:

The Fed is in no hurry to exit, at least according to the bond market performance today.

On the other hand, analysts at TD Securities argue that the tone will probably be slightly less dovish than in April.

''We expect the chair to say that the committee has started discussing a progress-dependent tapering plan while also emphasizing that action will require much more progress,'' the analysts argued.

''A less dovish Fed tone next week would help to stabilize the USD in the very short run,'' the analysts forecasted.

''Of course, it may not reverse all of Q2's weakness, but positioning has turned short once again, real rates might be bottoming, and global growth shows signs of pausing. All signs to expect some USD stability as we enter the summer months.''

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.

-637589449181097612.jpeg&w=1536&q=95)