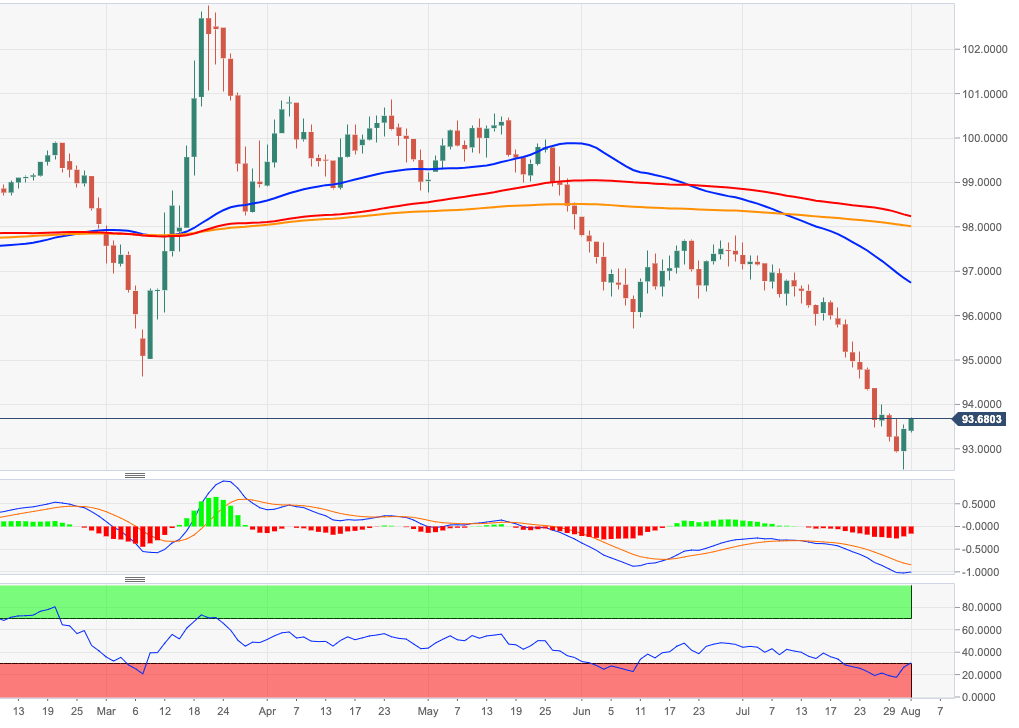

US Dollar Index Price Analysis: Recovery targets 94.00 and beyond

- DXY is extending the rebound from recent lows in the mid-92.00s.

- The area above the 94.00 barrier emerges as the next hurdle.

DXY’s bounce of +2-year lows near 92.50 (Friday) has already reclaimed levels well above 93.00 the figure at the beginning of the week.

In fact, further north comes in the 94.00 hurdle ahead of the Fibo level (of the 2017-2018 drop) at 94.20, where the recovery is expected to struggle.

The ongoing rebound is seen as corrective only and the negative outlook on the dollar is forecasted to remain unchanged while below the 200-day SMA, today at 98.00.

DXY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.