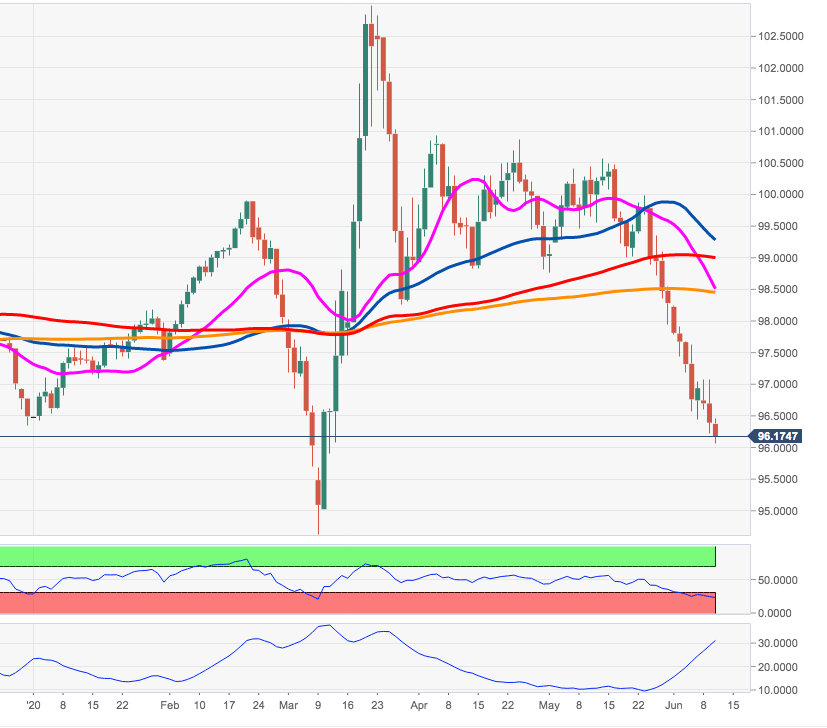

- DXY has resumed the downside and returns to 3-month lows.

- Further south now emerges the Fibo retracement at 96.03.

The selling mood around DXY looks anything but abated on Wednesday.

The index is now facing rising odds for a test of the 96.00 neighbourhood, where sits a Fibo retracement (of the 2017-2018 drop).

As long as the upside remains capped by the 2019-2020 line (near 97.00) and the 200-day SMA (at 98.44), further downside remains well on the cards for the dollar.

DXY daily chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD pares gains to near 1.0850, focus shifts to US ISM PMI

EUR/USD is paring back gains to trade near 1.0850 in the European morning on Monday. Softer US monthly Core PCE inflation data and hotter-than-expected Eurozone HICP inflation data help the pair to stay afloat amid a better market mood. US ISM PMI holds the key.

GBP/USD consolidates around mid-1.2700s, downside seems cushioned amid softer USD

The GBP/USD pair kicks off the new week on a subdued note and oscillates in a narrow band, around mid-1.2700s during the Asian session. The downside, meanwhile, remains cushioned in the wake of a modest US Dollar weakness, weighed down by signs of easing inflationary pressures in the United States.

Gold focuses on daily close below $2,330 and US ISM PMI

Gold price is licking its wounds while trading close to over two-week lows of $2,321, setting off the week on cautious footing. Gold price fails to find inspiration from broadly softer US Dollar and negative US Treasury bond yields.

Week ahead: Altcoins likely to bounce due to short-term bullish wave Premium

Last week was a bummer with Bitcoin price consolidation, and altcoins movements showed confusion in their directional bias. Some altcoins saw bullish, impulsive moves, but most trended sideways or slid lower.

Bumper week of event risk ahead

Featuring two central bank updates – the Bank of Canada and the European Central Bank – a slew of job numbers out of the US and Aussie GDP growth data, the first full week of June is poised to be eventful.