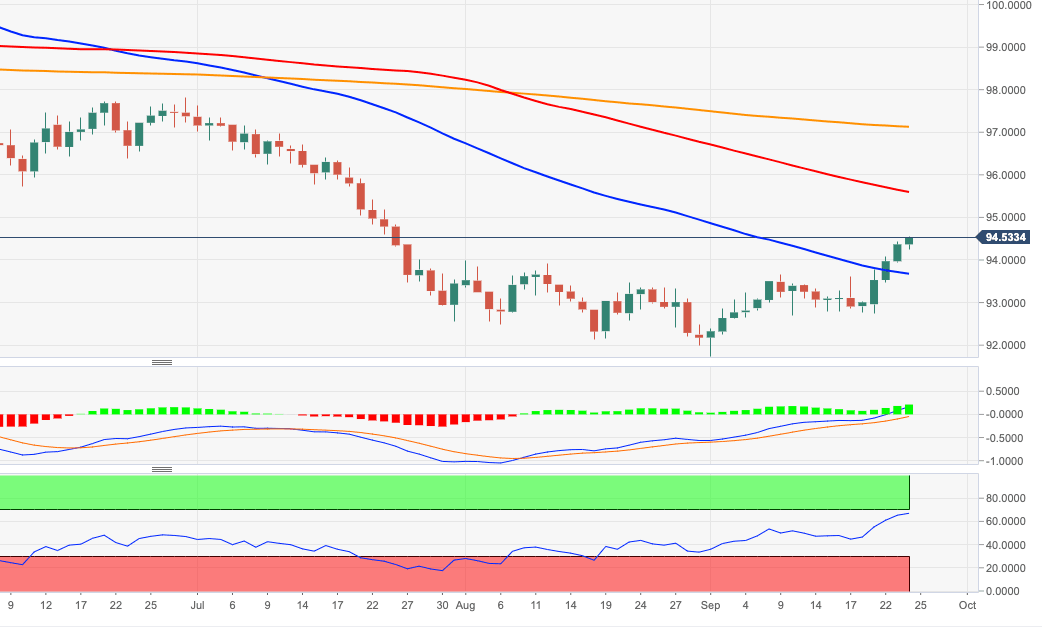

US Dollar Index Price Analysis: Rally faces interim hurdle around 94.80

- DXY looks to consolidate above the 94.00 yardstick on Thursday.

- Next on the upside emerges the resistance line near 94.80.

The positive note in the dollar stays unabated on Thursday and pushes DXY to fresh 2-month peaks above 94.50 on Thursday.

The continuation of this trend is expected to target the 6-month resistance line in the 94.80 region ahead of other minor hurdles at the 100-day SMA (95.59) and a Fibo level at 96.03.

The bearish view on DXY is seen unchanged while below the 200-day SMA, today at 97.12.

DXY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.