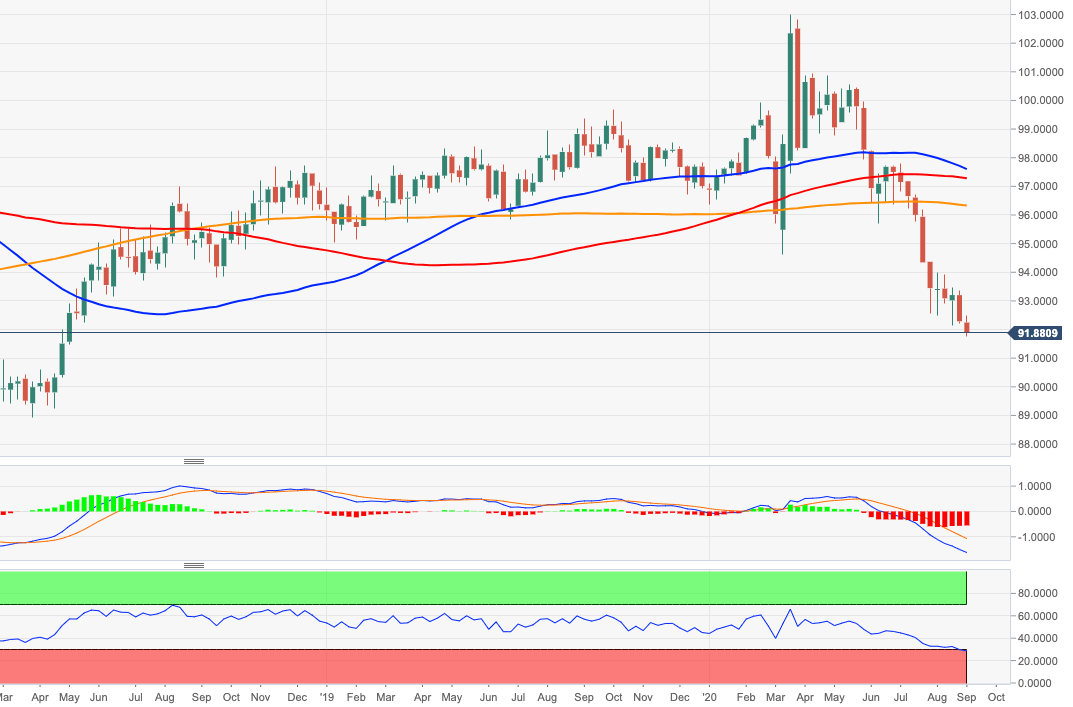

US Dollar Index Price Analysis: Extra losses remain on the table

- DXY is adding to Friday’s sell off below the 92.00 yardstick.

- While USD-bears remain well in control, a deeper pullback stays on the cards.

DXY dropped to levels last seen in April 2018 in the 91.80/75 band, opening the door for the continuation of the downtrend in the short/medium-term horizon.

That said, further losses are likely under the current bearish context, leaving the index ripe for a move further south of recent lows at 91.75. Against this, the next support of note emerges at the April 2018 low at 89.23 ahead of the March 2018 low at 88.94.

The offered stance in the dollar is expected to remain unchanged while below the 200-day SMA, today at 97.48.

DXY weekly chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.