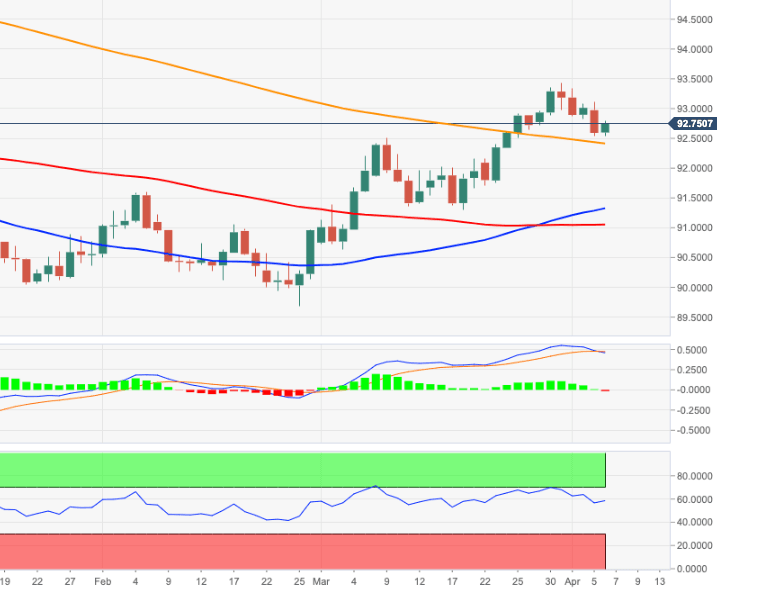

US Dollar Index Price Analysis: Decent support aligns at the 200-day SMA

- The recent weakness in DXY met contention near 92.40.

- A breach of this area could trigger further losses near-term.

Monday’s downtick in the dollar halted just ahead of the critical 200-day SMA in the 92.40 region.

While above this area, the near-term outlook for DXY is expected to remain constructive and allow for extra gains.

On the opposite side, a convincing return to the area below the 200-day SMA should negate the ongoing near-term positive stance and open the door to fresh weakness to, initially, 91.30 (March 18).

DXY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.