US Dollar Index looks well supported near 99.00

- DXY has once again tested the 99.00 support on Thursday.

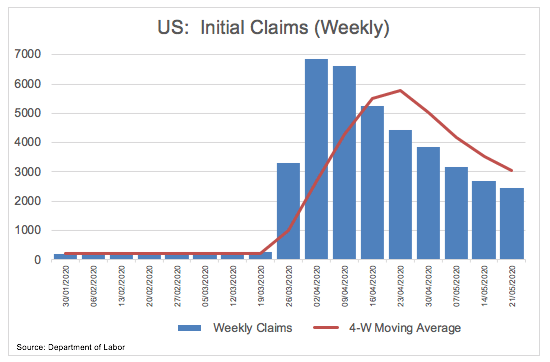

- Initial Claims rose by around 2.4 million during last week.

- The Philly Fed Index rebounded to -43.1 in May.

The US Dollar Index (DXY), which gauges the greenback vs. a bundle of its main rivals, is alternating gains with losses around the 99.20 region on Thursday.

US Dollar Index unfazed post-data

The index stayed apathetic following another surge in weekly Claims, this time by around 2.4 million citizens, taking Americans under insurance benefits to more than 25 million.

Additional data saw the Philly Fed manufacturing gauge improving a tad to -43.1 for the current month and Markit’s preliminary manufacturing and services PMIs coming in at 39.8 and 36.9, respectively. Furthermore, Existing Home Sales came in at 4.33 million units, or a drop of nearly 18%.

In the meantime, focus remains on the gradual re-opening of the economy against the backdrop of alternating risk appetite trends and somewhat improving data releases from record drops.

What to look for around USD

The greenback has started the week on a negative fashion, falling below the 100.00 mark on Monday on the back of the resumption of the risk-on sentiment in the global markets. In the meantime, the dollar remains vigilant on the US-China trade front and the gradual return to some sort of normality in the US economy. On the constructive stance around the buck, it remains the safe haven of choice among investors, helped by its status of global reserve currency and store of value. The dollar also derived extra support after Fed’s Jerome Powell recently ruled out negative rates.

US Dollar Index relevant levels

At the moment, the index is gaining 0.06% at 99.23 and a break above 100.56 (monthly high May 14) would open the door to 100.93 (weekly/monthly high Apr.6) and finally 101.34 (monthly high Apr.10 2017). On the other hand, the next support emerges at 99.00 (weekly low May 20) followed by 98.91 (100-day SMA) and then 98.47 (200-day SMA).

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.