US Dollar Index looks apathetic around 92.00 post-data

- DXY keeps the trade around the 92.00 mark so far.

- US flash GDP expected to expand 33.1% during Q3.

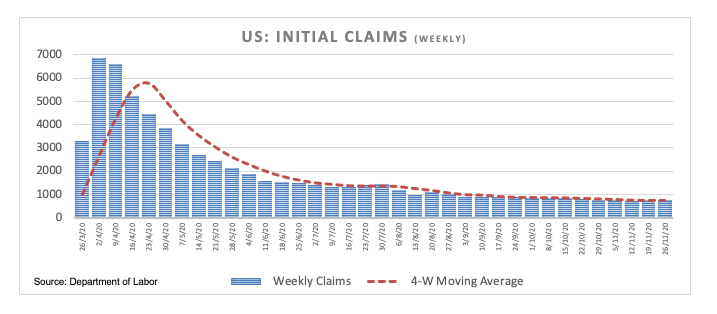

- US Initial Claims missed estimates and rose by 778K WoW.

The US Dollar Index (DXY), which gauges the buck vs. a bundle of its main rivals, keeps the offered stance well and sound around the 92.00 yardstick on Wednesday.

US Dollar Index could revisit the 2020 lows near 91.70

The index stays depressed in the 92.00 neighbourhood - area coincident with the 8-month support line – following the slew of data releases in the US calendar and the prevailing market bias towards the riskier assets.

The dollar barely reacted after weekly Initial Claims rose by 778K, missing consensus, and the flash Q3 GDP showed the economy is seen expanding 33.1%, matching the previous reading.

Additional results saw Durable Goods Orders expanding 1.3% inter-month in September and the advanced Good Trade Balance showing a $80.29B deficit in October.

Further releases will include the final November U-Mich index, Personal Income/Spending, New Home Sales and inflation tracked by the PCE.

What to look for around USD

DXY remains on the defensive and does not rule out a visit to the 2020 lows near 91.70 in the short-term horizon. The better mood in the risk-complex was bolstered further by a clearer US political scenario in combination with auspicious vaccine news and better growth prospects. Furthermore, hopes of extra fiscal stimulus have re-emerged and along with the “lower for longer” stance from the Federal Reserve is seen keeping the buck under extra pressure for the time being.

US Dollar Index relevant levels

At the moment, the index is retreating 0.14% at 92.10 and faces the next support at 91.94 (monthly low Nov.25) followed by 91.74 (2020 low Sep.1) and then 89.22 (monthly low Apr. 2018). On the other hand, a breakout of 93.20 (weekly high Nov.11) would open the door to 93.48 (100-day SMA) and finally 94.30 (monthly high Nov.4).

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.