US dollar holds no bars as it hunts down July highs

- US yields might have put in a double bottom, supporting a strong USD for longer.

- The Fed is expected to taper imminently and US CPI data could be important in this regard.

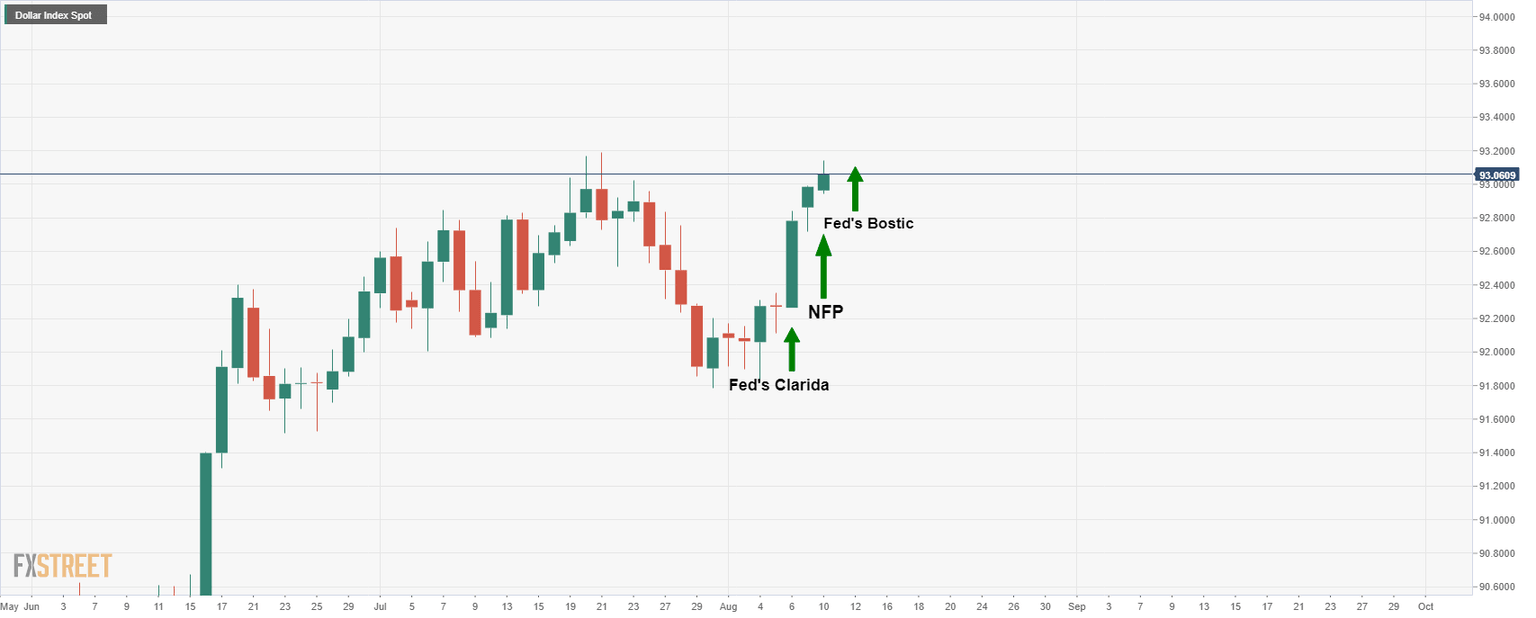

The US dollar index DXY, which measures the greenback against a basket of currencies, was up for a third straight session overnight.

The bulls took the US dollar to trade at the highest level in about three weeks at 93.139, tracking higher highs in long-end US Treasury yields.

The 10-year yield rallied to a fresh recovery high on Tuesday of 1.3490%, up from 1.1270%, weekly lows posted on 4 Aug.

The question now is whether it could turn out to be the 2021 cycle lows, (see below).

In the meanwhile, the US dollar smile theory is playing out:

The combination of economic growth, the Federal Reserve's hawkish bias as well as the risk of covid is playing into the hands of the US dollar bulls no matter which way the currency is approached.

As Friday’s strong jobs report showed, with 943,000 new jobs created in July and above the 870,000 expected, the Fed is now expected to announce its plans for tapering and timings thereof.

In recent sessions, following a series of hawkish statements from Fed officials and combined with the jobs data, we saw the markets react in kind in buying the greenback:

''The set-up was asymmetric, and ultimately the strong jobs number catalyzed substantial liquidations in gold as the yellow metal broke below its bull-market defining trendline from 2019,'' analysts at TD Securities said.

The bar has now been lowered further for an official taper timing announcement from the Fed at the annual Jackson Hole conference of central bankers later this month, 26-28 Aug.

This makes today's US Consumer Price Index data somewhat important, although it could be argued that the jobs data was enough o seal the deal at the Fed.

However, the CPI is due on Wednesday and will be eyed for further clues on how close the Fed are to not only tapering but to hiking interest rates.

Hawkishly, Federal Reserve's Vice-chairman, Richard Clarida, said last week the central bank is likely to hit its economic targets by the end of next year and start raising rates again in 2023.

The vice chairman noted that inflation is tracking to meet and exceed the Fed’s 2% goal.

“Given this outlook and so long as inflation expectations remain well-anchored at the 2% longer-run goal … commencing policy normalization in 2023 would, under these conditions, be entirely consistent with our new flexible average inflation targeting framework,” the policymaker told the Peterson Institute for International Economics in a virtual appearance.

The market consensus for CPI stands at 5.3% YoY.

The outcome could be directional for the US yields which might have just put in a cycle low in the 10-year yield as indicated with a double bottom on the daily chart as follows:

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.