US Dollar off to a supportive start of the week with a small tick higher

- The US Dollar trades mildly up as the possible escalation in the Middle East conflict drives flows towards the Greenback.

- Fed speakers are starting to align with market expectations for gradual to no rate cuts this year.

- The US Dollar Index rally could pick up steam if Donald Trump leads further in the polls.

The US Dollar (USD) is a little bit in favor this Monday as three main factors provide some support for the Greenback. The first one is geopolitics, with Israel’s Prime Minister Benjamin Netanyahu vowing to step up retaliations after an Iranian drone struck near his private residence over the weekend. The second driver is coming from the Federal Reserve (Fed) after a few of its officials called for a gradual approach to reduce interest rates (or even no rate cuts) in order to retain control of inflation. Finally, the third driver is the upcoming US presidential election on November 5 with a small lead on the betting websites for former US President Donald Trump, which supports a stronger US Dollar.

The US calendar is very light in terms of economic data on Monday. Besides the US Treasury set to issue some more debt into the markets, four Fed members will speak. Markets will want to look for further confirmation from the Fed on the rate cut projections for the meetings in November and December after Atlanta Fed President Raphael Bostic said last week that the Fed should refrain from cutting.

Daily digest market movers: Some fuel for the US Dollar

- Federal Reserve Bank of Dallas President Lorie Logan is set to speak at 12:55 GMT. Logan participates in a conversation at the 2024 SIFMA (Securities Industry and Financial Markets Association) Annual Meeting.

- At 17:00 GMT, Federal Reserve Bank of Minneapolis President Neel Kashkari participates in a town hall event hosted by the Chippewa Falls Chamber of Commerce in Chippewa Falls, Wisconsin.

- At 21:05 GMT, Federal Reserve Bank of Kansas City President Jeffrey Schmid delivers remarks about the US economic and monetary policy outlook at an event organized by the Chartered Financial Analyst Society in Kansas City.

- Federal Reserve Bank of San Francisco President Mary Daly is set to participate in a moderated Q&A session with the Wall Street Journal's Nick Timiraos at the 2024 WSJ Tech Live at 22:40 GMT.

- Equities are taking a taling a turn for the worse with US futures turning negative on the day.

- The CME Fed rate expectation for the meeting on November 7 shows a 92.3% probability of a 25 basis points (bps) rate cut, while the remaining 7.7% is pricing in no rate cut. Chances for a 50 bps rate cut have been fully priced out.

- The US 10-year benchmark rate is trading at 4.15% after having flirted with a break below 4% on Wednesday.

US Dollar Index Technical Analysis: Last week just the tip of the ice berg

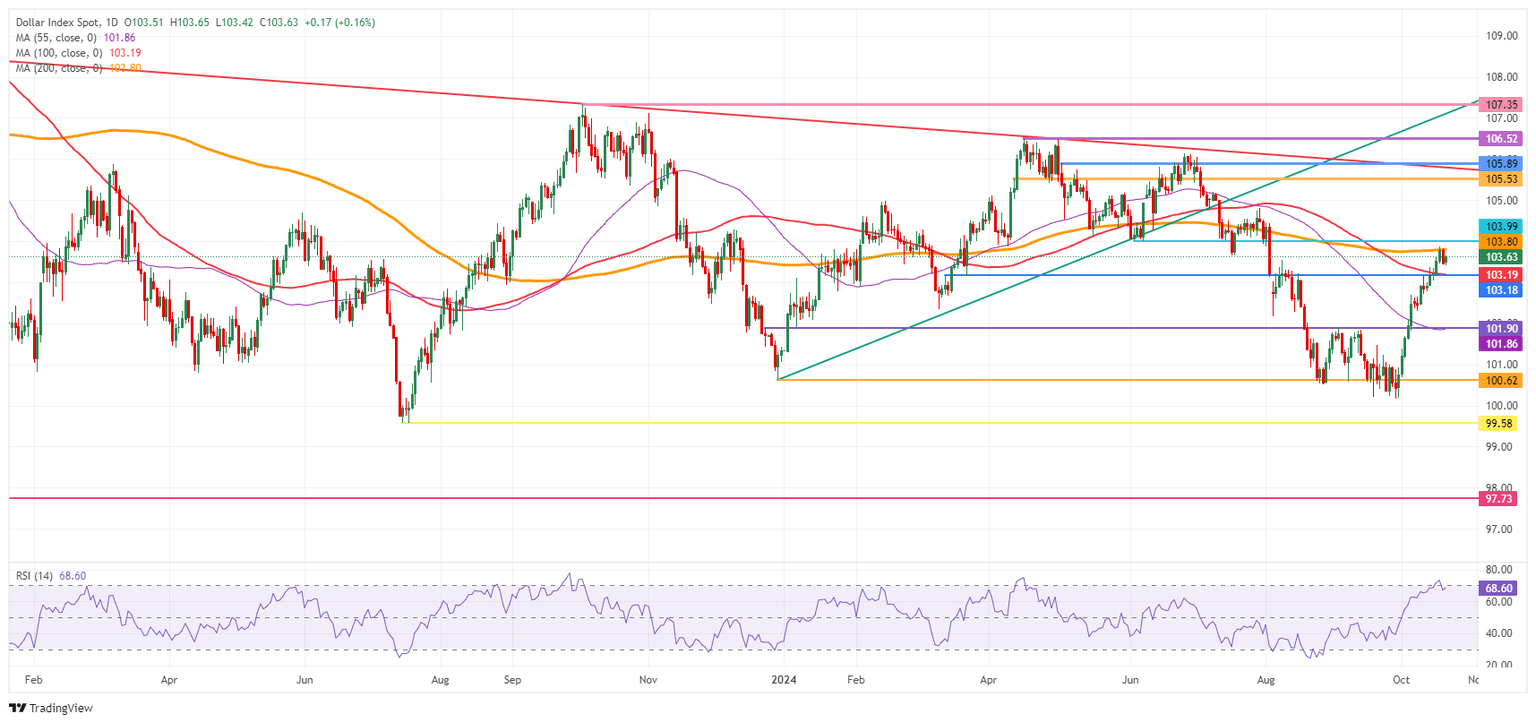

The US Dollar Index (DXY) holds strong near last week’s peak. Expectations of a gradual approach to interest rate cuts by the Fed would support a stronger US Dollar. More upside could take place should former President Donald Trump take a further lead in the polls or gain a swing state majority, or should geopolitical tensions in the Middle East swirl further out of control.

A firm resistance ahead is 103.80, which aligns with the 200-day SMA. Above that, there is a small gap before hitting the pivotal level at 103.99 (the June 4 low) and the 104.00 big figure. Should geopolitical tensions increase or Trump further lead in the polls, a rapid swing up to the 105.00 round level and 105.53 (the April 11 high) could be on the cards.

On the downside, the 100-day SMA at 103.19 and the pivotal level at 103.18 (the March 12 high) are now acting as support and should prevent the DXY from falling lower. With the Relative Strength Index in overbought territory, a test on this level looks granted. Further down, the 55-day SMA at 101.86 and the pivotal level at 101.90 (the December 22, 2023, high) should avoid further downside moves.

US Dollar Index: Daily Chart

Inflation FAQs

Inflation measures the rise in the price of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core inflation excludes more volatile elements such as food and fuel which can fluctuate because of geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the level targeted by central banks, which are mandated to keep inflation at a manageable level, usually around 2%.

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over a period of time. It is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core CPI is the figure targeted by central banks as it excludes volatile food and fuel inputs. When Core CPI rises above 2% it usually results in higher interest rates and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually results in a stronger currency. The opposite is true when inflation falls.

Although it may seem counter-intuitive, high inflation in a country pushes up the value of its currency and vice versa for lower inflation. This is because the central bank will normally raise interest rates to combat the higher inflation, which attract more global capital inflows from investors looking for a lucrative place to park their money.

Formerly, Gold was the asset investors turned to in times of high inflation because it preserved its value, and whilst investors will often still buy Gold for its safe-haven properties in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will put up interest rates to combat it. Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.