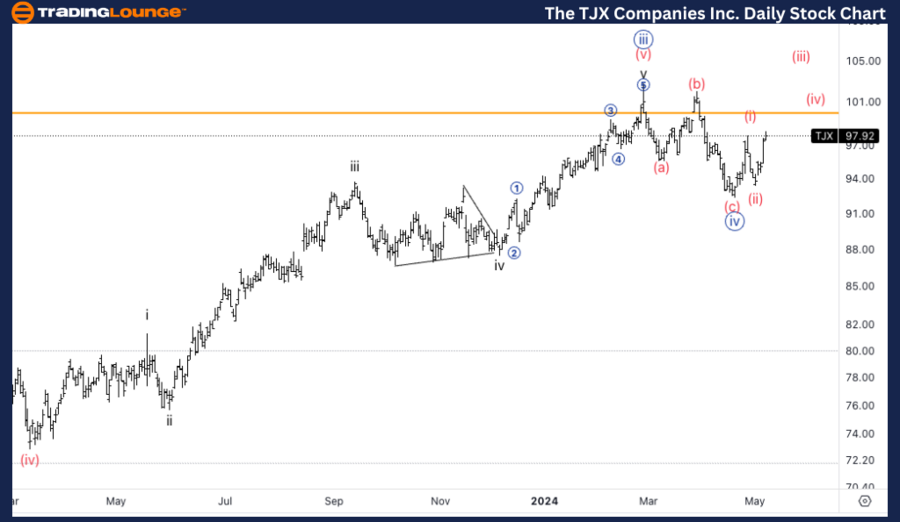

TJX Elliott Wave Analysis Trading Lounge Daily Chart,

The TJX Companies Inc., (TJX) Daily Chart

TJX Elliott Wave technical analysis

Function: Trend.

Mode: Impulsive.

Structure: Motive.

Position: Minute wave {v}.

Direction: Upside in Minute {v}.

Details: Looking for a bottom in wave {iv} in place to then continue higher. Equality of {v} vs. {i} stands at 108$.

Our detailed Elliott Wave analysis for The TJX Companies Inc. (TJX) as of May 7, 2024, offers insightful perspectives on potential movements for both daily and 4-hour trading charts. This analysis aims to assist traders and investors in identifying strategic positions in line with the predicted trends in TJX's stock prices.

TJX Elliott Wave Technical Analysis – Daily chart

On the daily chart, TJX is currently exhibiting an impulsive, motive wave pattern, specifically within Minute wave {v}. This wave is crucial as it suggests a continued upward momentum following the establishment of a bottom in wave {iv}. The target for equality between wave {v} and wave {i} is projected at $108, indicating significant upside potential.

TJX Elliott Wave Analysis Trading Lounge 4Hr Chart

The TJX Companies Inc., (TJX) 4Hr Chart

TJX Elliott Wave technical analysis

Function: Trend.

Mode: Impulsive.

Structure: Motive.

Position: Wave (i) of {v}.

Direction: Upside in wave (iii).

Details: Looking for a CTLP on 100$, we need to break (b) to then start thinking about longs.

TJX Elliott Wave technical analysis – Four hour chart

Zooming into the 4-hour chart, TJX is progressing through Wave (i) of Minute {v}. The focus is on the upcoming wave (iii), which is known for its typically strong upward drive. A critical price point to monitor is the $100 level, where a conclusive break above the (b) wave high will validate bullish sentiments and open the door for positioning long trades.

Technical analyst: Alessio Barretta.

TJX Elliott Wave technical analysis [Video]

As with any investment opportunity there is a risk of making losses on investments that Trading Lounge expresses opinions on.

Historical results are no guarantee of future returns. Some investments are inherently riskier than others. At worst, you could lose your entire investment. TradingLounge™ uses a range of technical analysis tools, software and basic fundamental analysis as well as economic forecasts aimed at minimizing the potential for loss.

The advice we provide through our TradingLounge™ websites and our TradingLounge™ Membership has been prepared without considering your objectives, financial situation or needs. Reliance on such advice, information or data is at your own risk. The decision to trade and the method of trading is for you alone to decide. This information is of a general nature only, so you should, before acting upon any of the information or advice provided by us, consider the appropriateness of the advice considering your own objectives, financial situation or needs. Therefore, you should consult your financial advisor or accountant to determine whether trading in securities and derivatives products is appropriate for you considering your financial circumstances.

Recommended content

Editors’ Picks

EUR/USD extends slide below 1.0700 on stronger USD, EU political angst

EUR/USD stays under bearish pressure and trades at its lowest level since early May below 1.0700. Unabated US Dollar demand amid risk aversion and looming EU political uncertainty exert downside pressure on the pair heading into the weekend.

GBP/USD slumps to multi-week lows below 1.2700

GBP/USD extends its decline on Friday and trades at its lowest level in nearly a month below 1.2700. In the absence of high-tier data releases, the US Dollar continues to benefit from souring market mood, forcing the pair to stretch lower in the second half of the day.

Gold clings to recovery gains at around $2,330

Following Thursday's pullback, Gold holds its ground on Friday and trades in positive territory near $2,330. The benchmark 10-year US Treasury bond yield edges lower toward 4.2%, helping XAU/USD push higher ahead of the weekend.

Monero price poised for a downward correction

Monero price has encountered resistance at a critical level. The technical outlook suggests a potential short-term correction as momentum indicators signal a bearish divergence.

Week ahead – RBA, SNB and BoE next to decide, CPI and PMI data also on tap

It will be another central-bank-heavy week with the RBA, SNB and BoE. Retail sales will be the highlight in the United States. Plenty of other data also on the way, including flash PMIs and UK CPI.