The Nikkei appears poised to continue its broader corrective trend [Video]

![The Nikkei appears poised to continue its broader corrective trend [Video]](https://editorial.fxsstatic.com/images/i/Equity-Index_NIKKEI-2_XtraLarge.jpg)

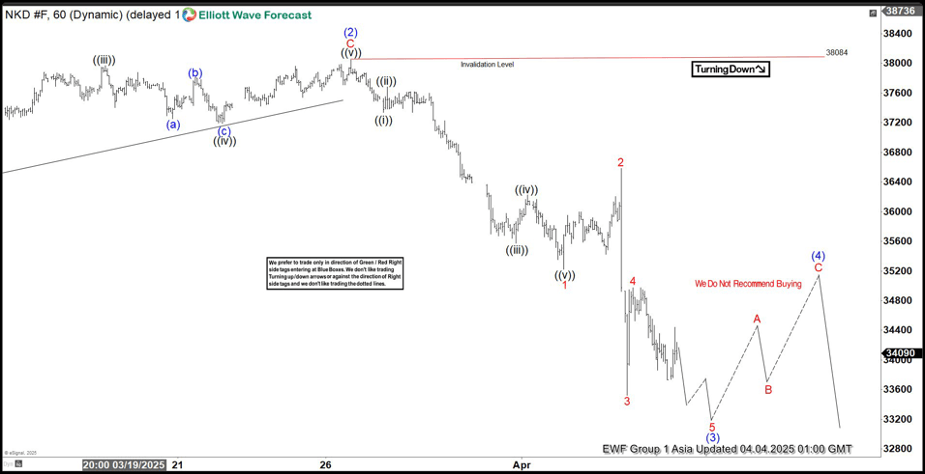

The Nikkei (NKD) has been trending lower since its peak on July 8, 2024. We indicate this decline follows a “double three” Elliott Wave pattern, characterized by a series of distinct movements. After reaching that high, the index fell to 30,720, rebounded to 40,675, and is now progressing downward in a zigzag formation as the internal within “wave y.” The index dropped to 36,275, rose to 38,029 with intermediate fluctuations, and has since resumed its downward trajectory.

This ongoing move lower has already reached 33,525, followed by a recovery to 34,975. We anticipate the index will extend further downward to complete this phase. Afterwards, a temporary rally is expected to provide a correction before the next decline resumes. We anticipate the index will extend further downward to complete this phase. Afterwards, a temporary rally is expected to provide a correction before the next decline resumes.

In the near term, as long as the high of 38,029 remains intact, any upward movements are likely to be limited, setting the stage for additional downside. Investors should monitor these developments closely as the Nikkei continues to navigate this pattern

Nikkei 60 minute Elliott Wave chart

Nikkei Elliott Wave [Video]

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com