TESLA ($TSLA) impulsive rally favors upside [Video]

![TESLA ($TSLA) impulsive rally favors upside [Video]](https://editorial.fxstreet.com/images/Markets/Equities/display-panel-of-daily-stock-market-59908972_XtraLarge.jpg)

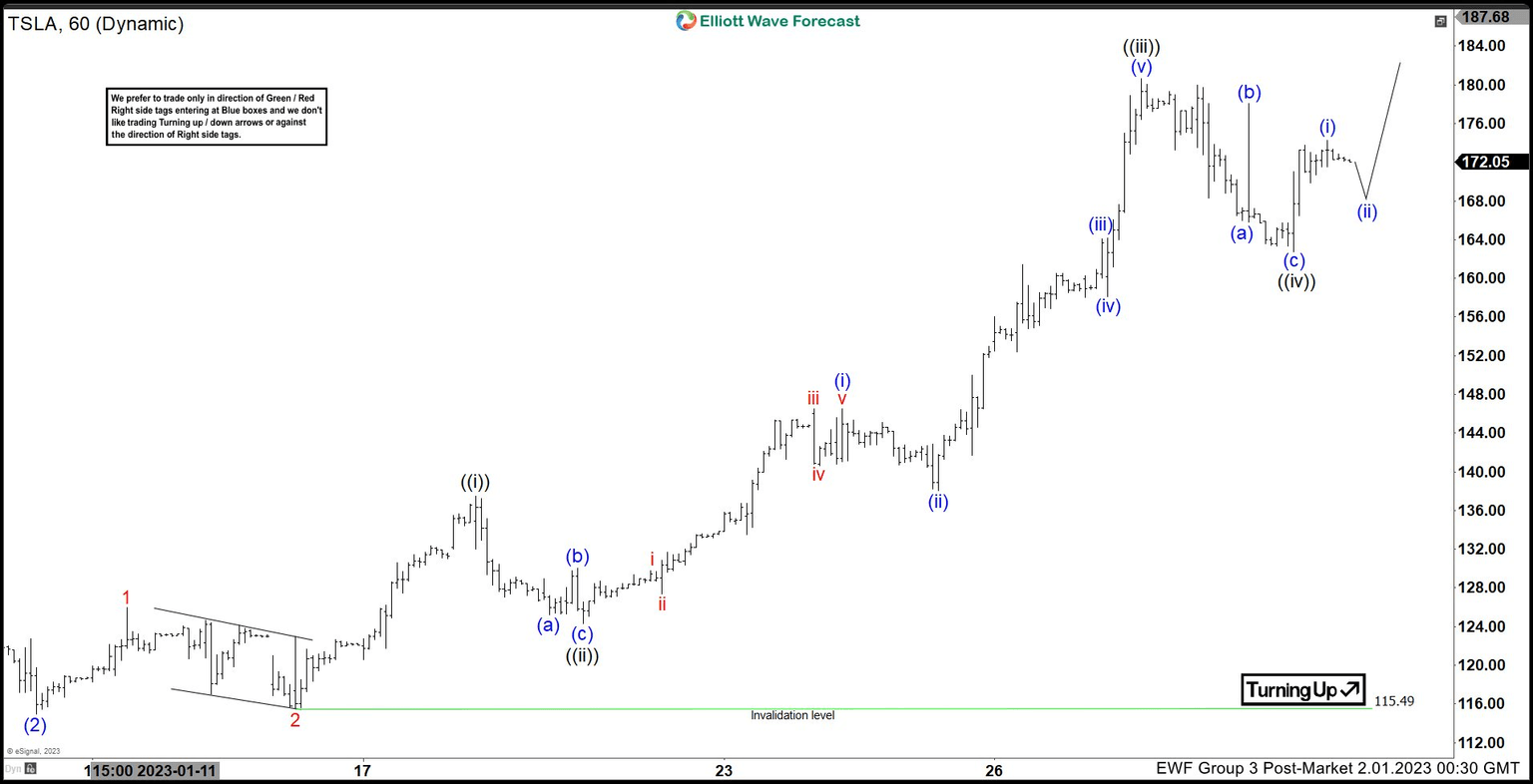

TESLA (TSLA) showing short term Elliott wave impulsive sequence started from 1/06/2023 low. It should remain supported in 3, 7 or 11 swings and extend higher. Short term, it placed ((iv)) correction at 162.78 low against 1/19/2023 low and favors upside in ((v)) of 3 of (3). It proposed ended weekly correction at 101.20 low at weekly blue box area and favors higher or at least can see larger 3 swing larger bounce. It placed (1) at 123.52 high and (2) at 114.92 low. Above there, it favors higher in extended wave (3) and expect further strength to continue. Within (3), it placed 1 at 125.95 high and 2 at 115.64 low. Currently, it favors higher in extended wave 3 of (3) and expect one more leg higher in ((v)) to finish wave 3.

In wave 3, it favored ended ((i)) at 137.50 high and ((ii)) at 124.31 low as 0.618 Fibonacci retracement against ((i)). Above there, it extends higher in wave ((iii)), which ended at 180.68 high as 2.618 Fibonacci extension of wave ((i)). It proposed ended ((iv)) at 162.78 low in 3 swing pullback. It placed (a) at 166 low, (b) at 178.05 high and finally ended (c) of ((iv)) at 162.78 low. While above there, it favors higher in ((v)) to finish wave 3 of (3). It placed (i) of ((v)) at 174.30 high and expect short term pullback in (ii), which should remain above ((iv)) low to resume upside in (iii) of ((v)). It confirms the sequence above ((iii)) high. Short term, it should be remains supported in 3, 7 or 11 swings to see further upside.

TSLA 1-hour Elliott Wave chart

TSLA Elliott Wave video

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com