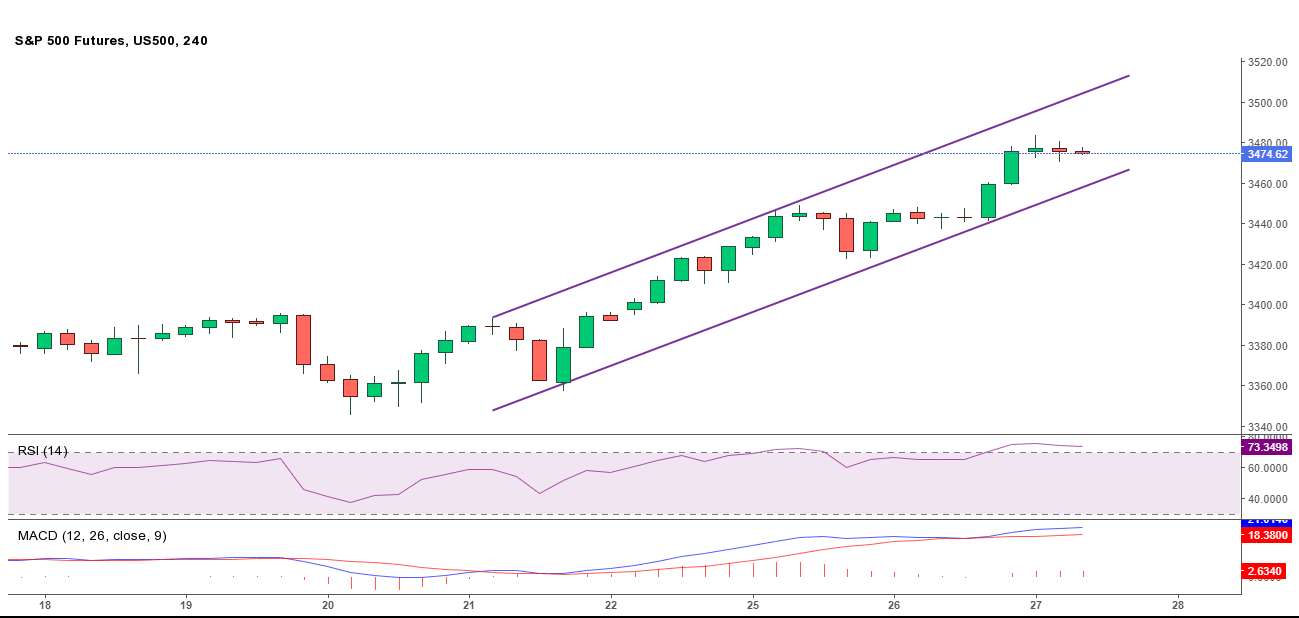

S&P 500 Futures Price Analysis: All eyes on weekly ascending channel

- S&P 500 Futures stay pressured near the all-time high flashed the previous day.

- Overbought RSI conditions suggest further declines, bullish chart pattern challenge the sellers.

- The 3,500 threshold appears on the bulls’ radars.

S&P500 Futures print mild losses of 0.15% while declining to 3,474 before the European traders arrive for Thursday’s move. The risk barometer refreshed the record high to 3,483.38 on Wednesday but overbought RSI triggered the quote’s pullback afterward. Also challenging the gauge’s further upside is the market’s cautious sentiment ahead of the key speeches from the Jackson Hole Symposium.

As a result, the sellers eye support line of an upward sloping trend channel from August 21, at 3,458 as an immediate target, a break of which will highlight Tuesday’s top near 3,448.

During the bears’ dominance past-3,448, the 3,400 psychological magnet and August 19 peak near 3,395 could return to the chart.

Meanwhile, bulls will have to refresh the latest high near 3,483 to retake the controls. In doing so, 3,500 round-figures may become their favorite.

However, the resistance line of the aforementioned channel, close to 3,505, will be a tough nut to break for the optimists.

S&P 500 Futures four-hour chart

Trend: Bullish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.