SOS Stock News and Forecast: Prices registered direct offering at $5, shares suffer

- SOS announced a registered direct offering.

- Company to raise $125 million.

- The new crypto mining entrant is offering shares and warrants at $5.

Update 2 March 30: SOS shares remain steady if one can call a drop of 18% steady! Well, steady versus pre-market, being virtually unchanged in the opening half hour versus their pre-market drop of 18%. Despite Bitcoin climbing over 2% shares in SOS remain under pressure following the announcement of its share and warrant offering.

Update: SOS announced the pricing of its registered direct offering to raise $125 million. The raise will be done by way of a sale of 25 million American Depository Shares (ADS) and warrants at $5 each. The purchase price for one ADS and one corresponding warrant will be $5. The warrant will be exercisable at issuance and have a five-year expiration. The offering is expected to close on April 1. SOS says the proceeds will be used for working capital, general corporate purposes and to develop its cryptocurrency cloud, mining and security business, as well as its insurance business.

SOS shares are currently trading at $4.59, down 18% in Tuesday's pre-market.

Stay up to speed with hot stocks' news!

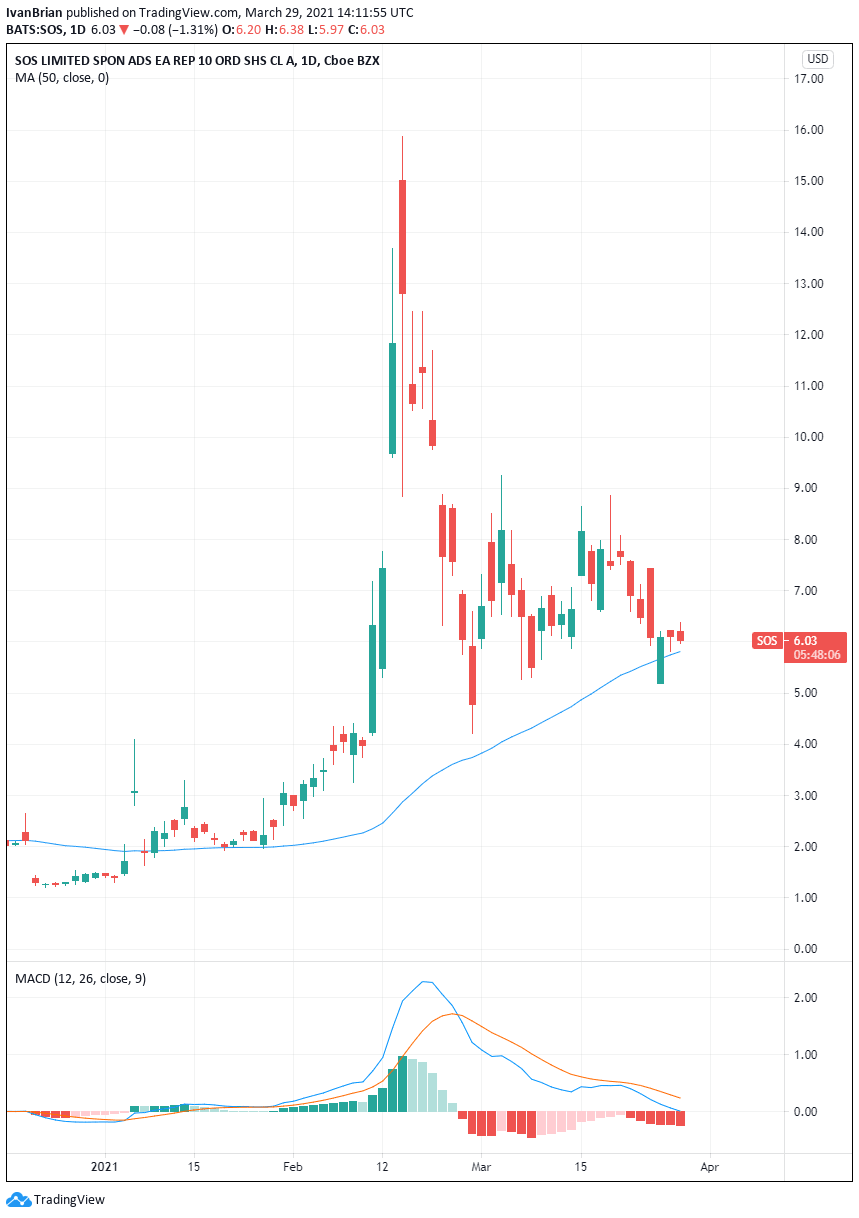

SOS shares are trading lower on Monday following the company announcing a joint venture deal. Immediately post-announcement, SOS shares traded up to $6.38, but have since fallen back below $6. SOS Information Technology, a subsidiary of SOS, plans to enter into a joint venture with Qingdao Ronghe Finance. The joint venture will be called SOS Ronghe Digital Technology, with the new company receiving its business license on March 27.

SOS is a Chinese company involved in providing cloud-based emergency services to businesses and individuals. SOS provides information security solutions for emergency roadside assistance, emergency healthcare and emergency living assistance. SOS also has an involvement in the cryptocurrency mining business and this has captured obvious retail enthusiasm.

SOS stock news

SOS has been on the radar of retail traders in 2021 after the company entered the cryptocurrency mining space. The sector has seen much investor enthusiasm in line with the rising price of Bitcoin and other cryptocurrencies.

Feb 11 saw the bullish fever really take hold as SOS jumped nearly 60%. This was likely on the back of an announcement made by SOS on February 9 that it had received 5,000 mining rigs for cryptocurrency.

SOS Chairman Yandai Wang commented, "We have secured supply of crypto mining equipment that is expected to generate sufficient crypto hash power to allow us to promptly capture the rising cryptocurrency price.”

Later in February, SOS was the subject of two bearish articles by Culper Research and Hindenberg Research. SOS rebutted these arguments, and subsequently, Scorpio VC issued a bullish research piece.

All this contrasting information ensured volatility remained elevated in SOS shares. SOS fell from nearly $16 to $4.21 in a few days in mid-February before then rallying back to $9.25 a few sessions later. Clearly not one for the faint hearted!

Recent developments have seen SOS announce it has installed a second batch of crypto mining machines and gave an outlook that it expected to mine at least 41 bitcoins and 909 etherum in Q1 2021.

On March 29, SOS announced a joint venture with Qingdao Ronghe Finance. The new company will have registered capital of $9.2 million, with SOS contributing 51% and Ronghe the other 49%. The aim of the joint venture is to establish a supercomputing centre.

Shares in SOS have struggled to hold early gains and have just slid back under $6 on Monday, currently down 2%.

The author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Errors and omissions excepted.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.