- NASDAQ: SNDL has dropped by 15% in early trade on Tuesday.

- Sundial Growers Inc is a retail favourite but risk-off across most assets hurting.

- SNDL has been on a strong run in 2021 so profit-taking understandable.

Update February 25: Sundial Growers Inc (NASDAQ: SNDL) shares have closed Wednesday's session with a rise of 15% to $1.45. While US ten-year Treasury yields have also risen to 1.45% – making stocks theoretically less attractive – there is room for more rises. Shares of the Calgary-based cannabis firm are set to extend their gains and move up some 11.72% to $1.61 according to Thursday's premarket data. Jerome Powell, Chairman of the Federal Reserve, has dismissed inflation concerns and seems keen to continue printing dollars and keeping rates low. That is music to investors' ears.

Too much of a good thing – a firm that raises capital is a double-edged sword. On the one hand, the new cash may support an expansion and allow the firm to weather any storms. On the other hand, the need to raise money is also considered a sign of weakness – and dilutes those holding the bag.

Sundial Growers Inc (NASDAQ: SNDL) is suffering from its announcement of selling 98 warrants to purchase common shares at low prices – $0.80 to $1.10, below the current level. Another round of warrant selling is set to be exercised at $1.50, above current prices.

The most recent exercise is worth some $89.1 million while the new move could rake in some $147.5. As mentioned, investors are focusing on the low price rather than the extra cash.

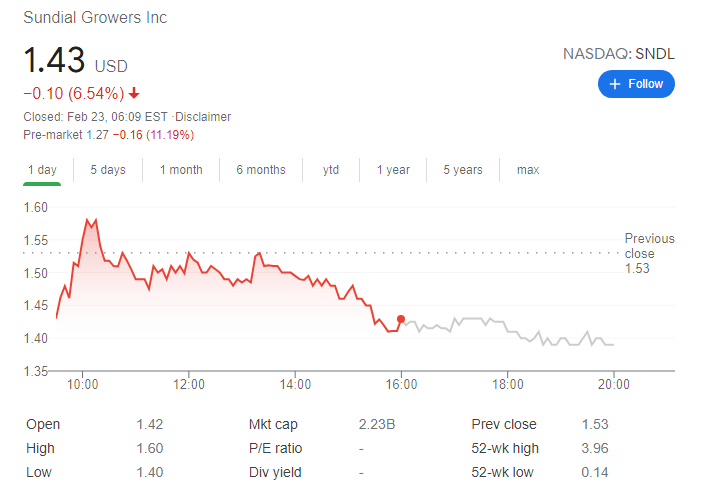

SNDL Stock Price

NASDAQ: SNDL has been on a losing streak since hitting a high of $3.96 and closing near $3 during last week. On Monday's equity of the Calgary-based company fell to $1.43, beyond the second warrant issuance exercise price.

According to Tuesday's premarket data, another fall is on the cards, by some 11% to $1.27. Significant support awaits at $1.04 low, which was the lowest close this month. Resistance awaits at $1.50.

SNDL Stock Forecast

Sundial Growers is a cannabis company and prospects for the sector are brightening – full Democratic control in Washington allows the left-leaning party to work toward legalization – or at least decriminalization of marijuana. Moreover, upbeat economic forecast and upcoming stimulus checks could also flow toward weed consumption.

On the other hand, the vast American market is still plagued by the underground selling of cannabis and is prone to legal issues in many states.

A new area for Sundial to expand into is edibles via its acquisition of Indiva . The fellow Canadian company would allow for more growth in the growing subcategory. Moreover, it also allows shows that SNDL investors now see that the newly raised cash is going into growth.

Previous updates

Update February 23: Shares in Sundial Growers (SNDL) suffered early Tuesday as the broader stock market began taking risk off the table as Federal Reserve Chair Powel spoke in Washington. Inflation concerns have been to the fore of traders minds this week and any stocks with decent 2021 gains have suffered from profit-taking. This would appear to be the case with Sundial, which opened the year at $0.48 and rallied as high as $3.96, as no other news appears to be in evidence.

Update, February 24: Sundial Growers Inc (NASDAQ: SNDL) has been on the rise, surging some 10% to $1.39 on Wednesday. Optimism about a return to normal – thanks to regulatory progress in approving Johnson and Johnson's vaccine – is boosting sentiment. Moreover, progress in approving fiscal stimulus will likely free the Biden administration to move forward with other issues, such as further loosening marijuana rules.

The author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.