SNB Maechler: Will continue to raise rates if see inflation projections above target

The Swiss National Bank will continue to raise rates if see inflation projections above target, SNB governing board member Andrea Maechler said on Thursday.

The battle against inflation has not been won despite a dip in Swiss inflation to 3.0% in October from 3.3% in September, Maechler told Swiss business newspaper L'Agefi said last week.

In its latest inflation forecast, the SNB expects inflation to decline to 2% by the third quarter of 2023, the top end of its price stability goal which it defines as inflation of 0-2%.

Key notes

- Inflation started with shocks but it's no longer shock-driven and has the risk of being more persistent.

- Will continue to raise rates if see inflation projections above target.

- Important we maintain our focus on achieving price stability.

- We are willing to intervene in the FX market by buying or selling as necessary, but not yet ready to reduce our balance sheet.

USDCHF update

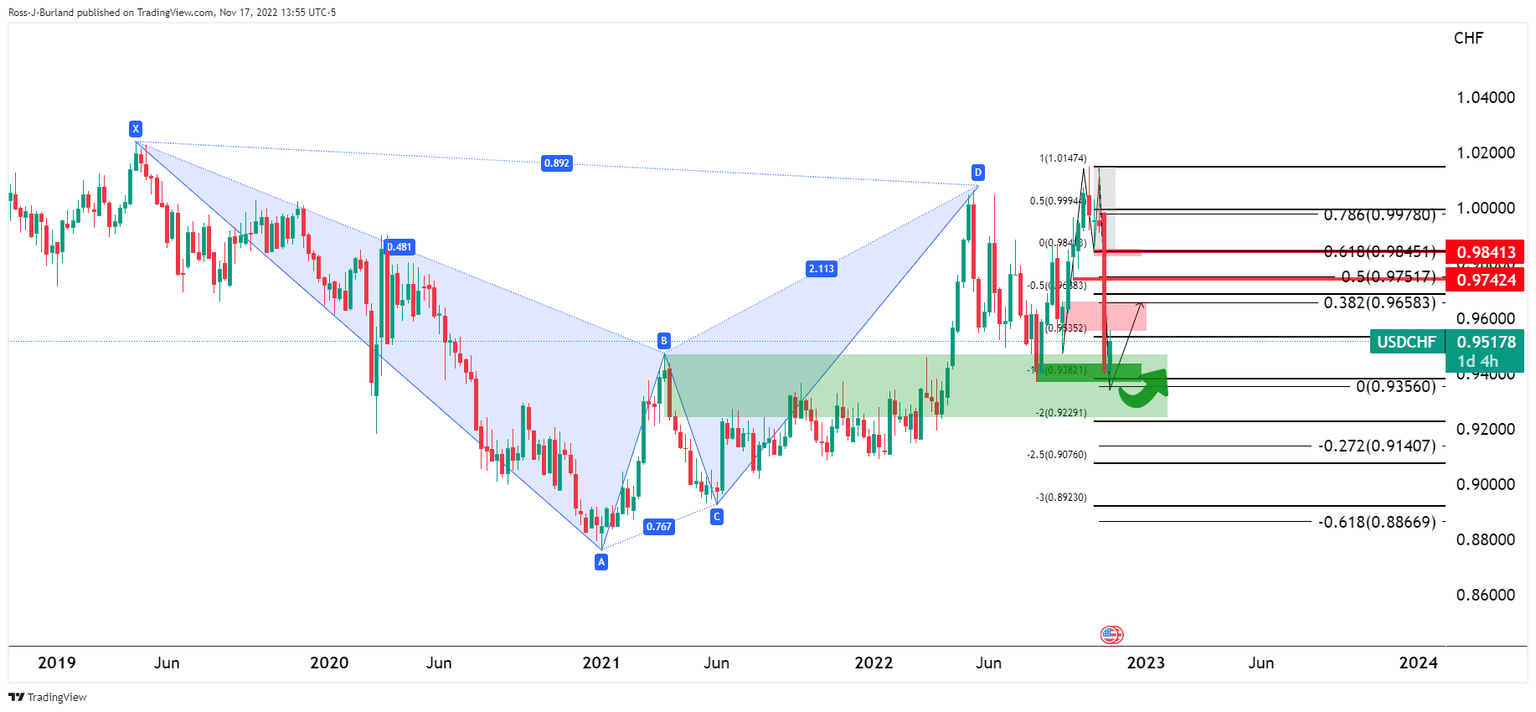

The price is correcting the prior bearish impulse after a 150% expansion of the prior consolidative tops from the harmonic patterns neckline support area on the weekly chart.

On the hourly chart, the bulls have broken structure and eye a correction to test the trendline resistance with eyes on 0.9580, 0.9650 / 0.9700.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.