Silver Price Forecast: XAG/USD remains sideways near $27.60 as investors reassess Fed rate cut bets

- Silver price consolidates around $27.60 as traders reprice Fed rate cut hopes.

- Sticky US inflation will feed expectations for Fed delaying rate cuts.

- Investors see the Fed keeping interest rates steady next week.

Silver price (XAG/USD) remains stuck in a tight range around $27.60 in Friday’s American session. Traders reassess expectations for the Federal Reserve (Fed) rate cuts as the United States core Personal Consumption Expenditure Price Index (PCE) for March remain higher than the consensus.

The annual underlying inflation data rose by 2.7% from the estimates of 2.6% but decelerated from the prior reading of 2.8%. On a month-on-month basis, price pressures grew in line with expectations and the prior reading of 0.3%. Price pressures remaining higher fuel expectations for Federal Reserve (Fed) maintaining a hawkish monetary policy framework.

The scenario is favorable for the US Dollar and bond yields but weighs on non-yielding assets, such as Silver. The US Dollar Index (DXY) rebounds from 105.40 amid expectations that the Fed will keep interest rates higher for a longer period. The Fed sees rate cuts appropriate only when they get evidence that inflation will return to the desired rate of 2%. 10-year US Treasury yields are down 1.15% to 4.65%.

Meanwhile, investors shift focus to the Fed’s interest rate decision, which will be announced on May 1. The Fed is anticipated to keep interest rates unchanged in the range of 5.25%-5.50%. Though the Fed is expected to maintain the status quo, investors will focus on guidance on interest rates.

Silver technical analysis

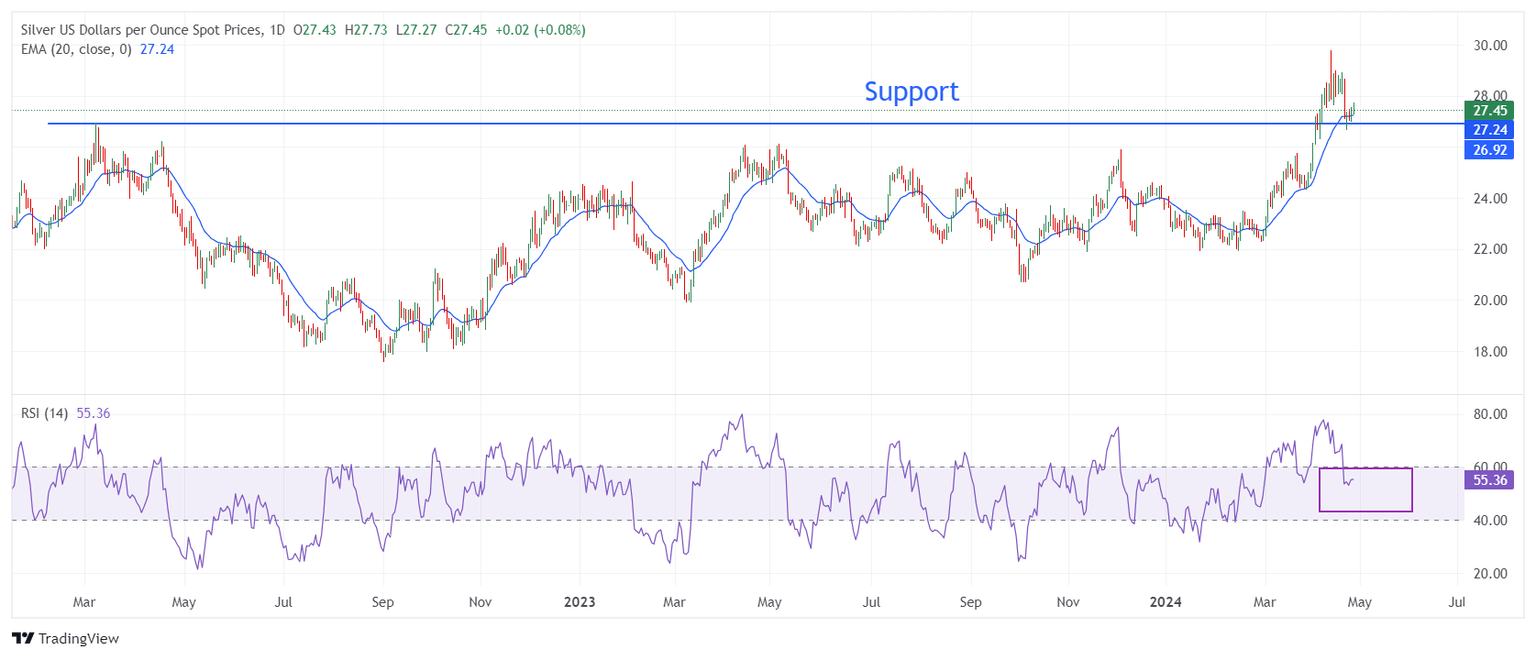

Silver price corrects to near March 2022 high near $27.00 after failing to extend upside above the crucial resistance of $30.00. The near-term appeal for Silver seems uncertain as it struggles to sustain near the 20-day Exponential Moving Average (EMA), which trades around $27.20.

The 14-period Relative Strength Index (RSI) shifts into the 40.00-60.00 range from the bullish range of 60.00-80.00, suggesting that the bullish momentum has faded for now.

Silver daily chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.