Silver Price Analysis: XAG/USD seems vulnerable near 38.2% Fibo., lowest since April

- Silver consolidates the overnight slide to its lowest level since early April.

- The setup favours bearish traders and supports prospects for further losses.

- Any attempted recovery is likely to remain capped near the $24.25-30 area.

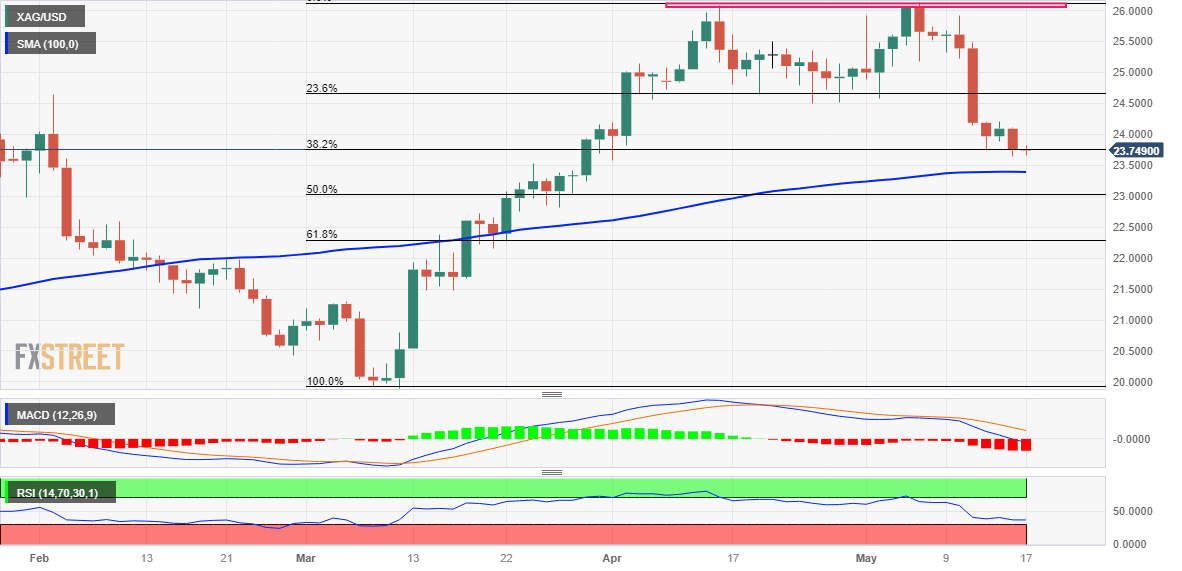

Silver enters a bearish consolidation phase on Wednesday and oscillates in a narrow trading band around the $23.70-$23.75 area, just above its lowest level since April 3 touched the previous day.

From a technical perspective, the aforementioned area represents the 38.2% Fibonacci retracement level of the March-May rise. Some follow-through selling will expose the 100-day Simple Moving Average (SMA), currently pegged around the $23.40-$23.35 region, below which the XAG/USD could slide towards 50% Fibo. level, around the $23.00 round-figure mark.

Some follow-through selling below the latter will be seen as a fresh trigger for bearish traders and set the stage for an extension of the recent sharp pullback from over a one-year top touched earlier this month. The XAG/USD might then accelerate the fall towards the $22.65-$22.60 intermediate support before dropping to the $22.30-$22.25 zone, or the 61.8% Fibo. level.

Meanwhile, oscillators on the daily chart are holding deep in the negative territory and are still far from being in the oversold zone. Hence, any attempted recovery back above the $24.00 mark is more likely to attract fresh sellers and remain capped near the $24.25-$24.30 supply zone. That said, some follow-through buying might prompt an aggressive short-covering rally.

The XAG/USD might then surpass the 23.6% Fibo. level, around the $24.60 zone, aim to reclaim the $25.00 psychological mark. The momentum could get extended further towards the $25.30-$25.40 supply zone en route to the $26.00 round figure and the YTD peak, around the $26.10-$26.15 region.

Silver daily chart

Key levels to watch

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.